An escrow may be terminated according to the escrow agreement when the parties have performed the conditions of the escrow and the escrow agent has delivered the items to the parties entitled to them according to the escrow instructions. An escrow may be prematurely terminated by cancellation after default by one of the parties or by mutual consent. An escrow may also be terminated at the end of a specified period if the parties have not completed it within that time and have not extended the time for performance.

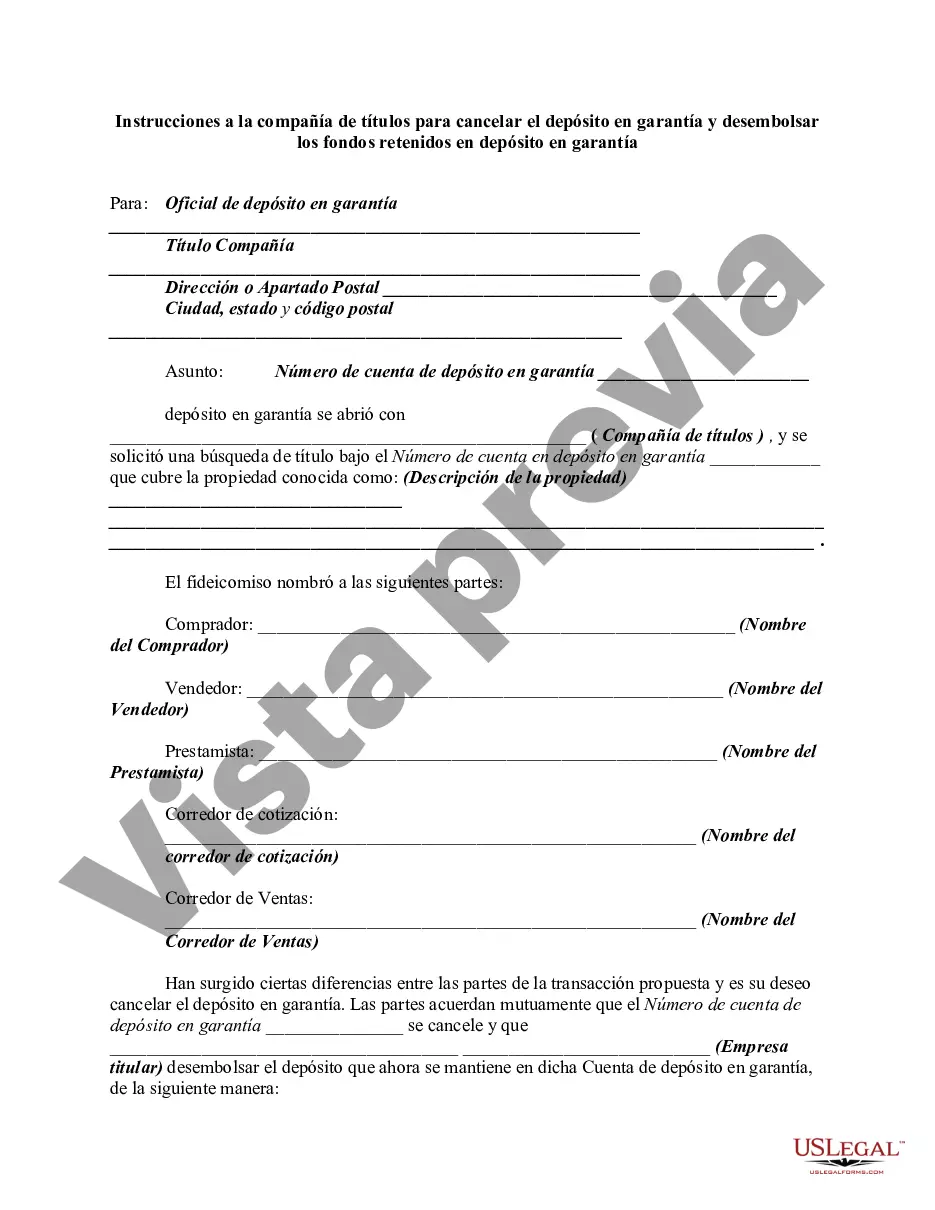

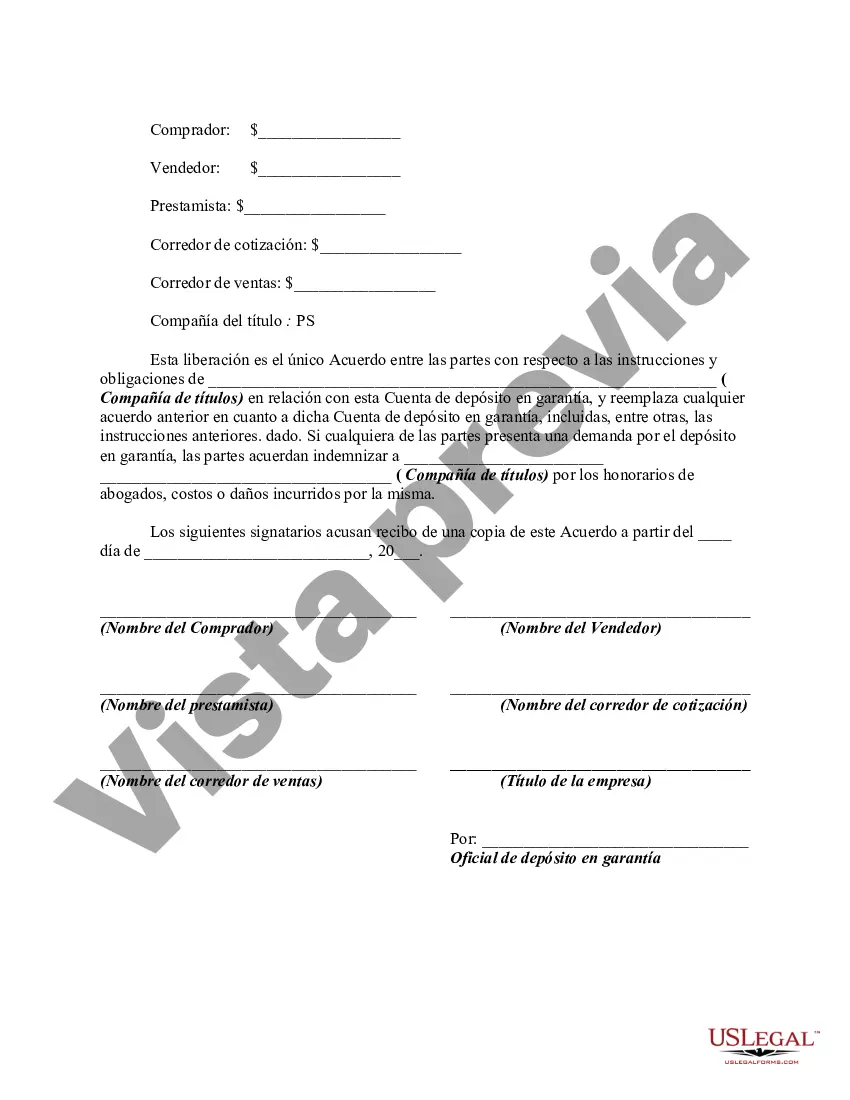

Wisconsin Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow In Wisconsin, when it comes to cancelling escrow and disbursing the funds held in escrow, there are a few different types of instructions that can be provided to the title company. These instructions are generally specific to the nature of the transaction and help ensure a smooth and legally compliant process. Here is a detailed description of what Wisconsin Instructions to Title Company to Cancel Escrow and Disburse the Funds held in Escrow entail: 1. Residential Real Estate Sale: When a residential property in Wisconsin is sold, the buyer may have certain contingencies or conditions in the purchase agreement that, if not satisfied, could result in the cancellation of the transaction. In this case, the buyer's instructions to the title company would outline the specific conditions that were not met, and would request the cancellation of the escrow and disbursement of the funds held in escrow back to the buyer. 2. Commercial Real Estate Purchase: Similar to residential sales, commercial real estate transactions can also encounter contingencies that could lead to the cancellation of escrow. The buyer's instructions in this case would be tailored to the specific terms and conditions outlined in the commercial purchase agreement. It would state the events or situations that have occurred, necessitating the cancellation of escrow, and provide directions for the disbursement of the funds back to the buyer. 3. Refinancing or Loan Payoff: Instructions to title companies for refinancing or loan payoff scenarios can vary depending on the lender and the borrower's preferences. In Wisconsin, when refinancing a mortgage or paying off an existing loan, the homeowner instructs the title company to cancel the escrow and disburse any remaining funds held in escrow to the appropriate parties, such as the previous lender or other creditors. 4. Probate or Estate Settlement: If the property in question is part of a probate or estate settlement, the instructions to the title company would be more complex. In this situation, the instructions would come from the estate's legal representative or executor. The instructions would include details on the court-approved distribution plan and specify how the funds should be disbursed to the heirs or creditors. In any of these scenarios, it is essential to provide precise and thorough instructions to the title company. The instructions should include relevant information such as the parties involved, escrow details, reasons for cancellation, desired disbursement recipients, and any other specifics relevant to the transaction. By providing clear and accurate instructions, all parties involved can ensure a smooth and efficient cancellation of escrow and proper disbursement of funds held in escrow. Keywords: Wisconsin, escrow cancellation, disbursement of funds, title company, residential real estate sale, commercial real estate purchase, refinancing, loan payoff, probate, estate settlement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.