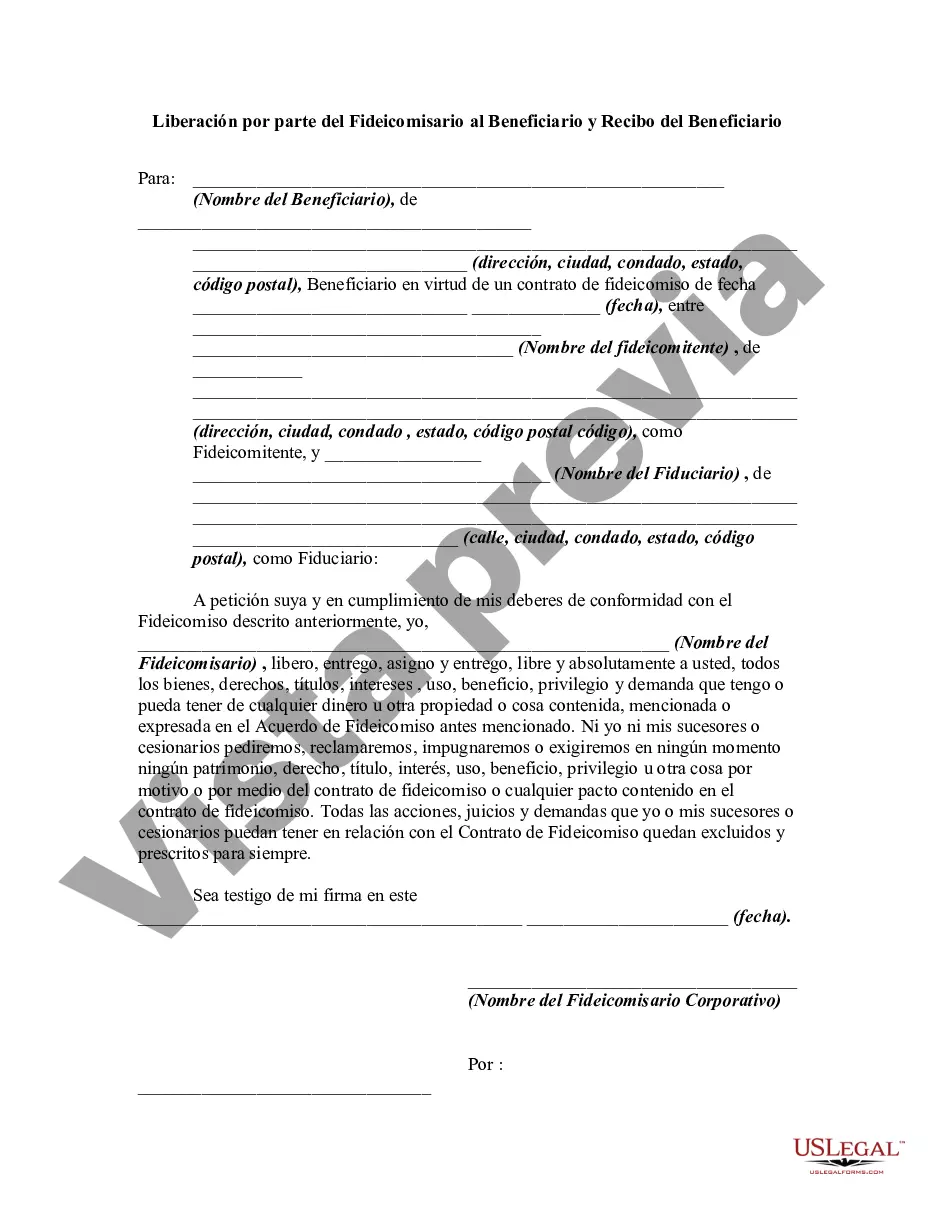

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A "Wisconsin Release by Trustee to Beneficiary and Receipt from Beneficiary" is a legal document that signifies the formal completion of a trust arrangement in the state of Wisconsin. It is essentially a written acknowledgment provided by a trustee to a beneficiary to confirm the trustee's fulfillment of their administration duties and the beneficiary's acceptance of their inheritance or property distribution. This document holds significant importance as it serves as evidence that all trust obligations have been discharged and all assets have been properly transferred. There are various types of Wisconsin Release by Trustee to Beneficiary and Receipt from Beneficiary that may differ based on specific circumstances. Some common variations include: 1. Wisconsin Release by Trustee to Beneficiary and Receipt from Beneficiary for Revocable Living Trust: This type of release and receipt is applicable when the trust being settled is a revocable living trust. In such cases, the trustee will provide a detailed account of all assets held in the trust and how they were distributed to the beneficiaries according to the trust agreement. 2. Wisconsin Release by Trustee to Beneficiary and Receipt from Beneficiary for Testamentary Trust: This variation applies to testamentary trusts. Testamentary trusts are established through a will and become effective upon the testator's death. The trustee, in this case, will validate the distribution of assets named in the will and provide receipts from beneficiaries acknowledging their receipt of the respective bequests. 3. Wisconsin Release by Trustee to Beneficiary and Receipt from Beneficiary for Special Needs Trust: Special Needs Trusts are created to provide for individuals with disabilities without jeopardizing their eligibility for government assistance programs. A Release by Trustee to Beneficiary and Receipt from Beneficiary for this type of trust would ensure that the trustee has successfully met the terms of the trust while simultaneously safeguarding the beneficiary's access to public benefits. Regardless of the specific type, a Wisconsin Release by Trustee to Beneficiary and Receipt from Beneficiary typically includes vital information such as the names and contact details of both the trustee and beneficiary, the trust's designation, the specific assets distributed, dates of distribution, and any conditions or restrictions associated with the distribution. It provides legal confirmation and closure to the trust arrangement, ensuring transparency between the trustee and beneficiary and preventing any potential disputes or misunderstandings in the future. It is crucial to consult with an experienced attorney or legal professional to draft and execute a Wisconsin Release by Trustee to Beneficiary and Receipt from Beneficiary accurately. An attorney can ensure that all legal requirements are met and that the document accurately reflects the intentions of the trust and both parties involved.A "Wisconsin Release by Trustee to Beneficiary and Receipt from Beneficiary" is a legal document that signifies the formal completion of a trust arrangement in the state of Wisconsin. It is essentially a written acknowledgment provided by a trustee to a beneficiary to confirm the trustee's fulfillment of their administration duties and the beneficiary's acceptance of their inheritance or property distribution. This document holds significant importance as it serves as evidence that all trust obligations have been discharged and all assets have been properly transferred. There are various types of Wisconsin Release by Trustee to Beneficiary and Receipt from Beneficiary that may differ based on specific circumstances. Some common variations include: 1. Wisconsin Release by Trustee to Beneficiary and Receipt from Beneficiary for Revocable Living Trust: This type of release and receipt is applicable when the trust being settled is a revocable living trust. In such cases, the trustee will provide a detailed account of all assets held in the trust and how they were distributed to the beneficiaries according to the trust agreement. 2. Wisconsin Release by Trustee to Beneficiary and Receipt from Beneficiary for Testamentary Trust: This variation applies to testamentary trusts. Testamentary trusts are established through a will and become effective upon the testator's death. The trustee, in this case, will validate the distribution of assets named in the will and provide receipts from beneficiaries acknowledging their receipt of the respective bequests. 3. Wisconsin Release by Trustee to Beneficiary and Receipt from Beneficiary for Special Needs Trust: Special Needs Trusts are created to provide for individuals with disabilities without jeopardizing their eligibility for government assistance programs. A Release by Trustee to Beneficiary and Receipt from Beneficiary for this type of trust would ensure that the trustee has successfully met the terms of the trust while simultaneously safeguarding the beneficiary's access to public benefits. Regardless of the specific type, a Wisconsin Release by Trustee to Beneficiary and Receipt from Beneficiary typically includes vital information such as the names and contact details of both the trustee and beneficiary, the trust's designation, the specific assets distributed, dates of distribution, and any conditions or restrictions associated with the distribution. It provides legal confirmation and closure to the trust arrangement, ensuring transparency between the trustee and beneficiary and preventing any potential disputes or misunderstandings in the future. It is crucial to consult with an experienced attorney or legal professional to draft and execute a Wisconsin Release by Trustee to Beneficiary and Receipt from Beneficiary accurately. An attorney can ensure that all legal requirements are met and that the document accurately reflects the intentions of the trust and both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.