Keywords: Wisconsin triple net lease, commercial real estate, details, types Description: A Wisconsin triple net lease for commercial real estate is a popular type of leasing arrangement in the state. This lease structure is commonly used by landlords and tenants to outline the responsibilities and financial obligations of both parties involved in a commercial real estate transaction. In a triple net lease, the tenant is responsible for paying the base rent along with three additional expenses: property taxes, insurance, and maintenance costs. Under a Wisconsin triple net lease, the tenant assumes a substantial portion of the financial burden associated with the property. This type of lease is commonly favored by landlords as it allows them to shift specific costs and risks to the tenant, resulting in a more stable and predictable income stream. On the other hand, tenants may benefit from having more control over the property and being able to customize it according to their needs. There are different types of Wisconsin triple net leases for commercial real estate, each with its own unique features and terms. Some common variations include: 1. Single-Net Lease: In this type of lease, the tenant is responsible for paying only one additional cost, typically property taxes. The landlord remains responsible for insurance and maintenance expenses. 2. Double-Net Lease: In a double-net lease, the tenant assumes the responsibility for both property taxes and insurance costs. The landlord retains the responsibility for maintenance expenses. 3. Absolute-Net Lease: An absolute-net lease, also known as a bendable net lease, places the maximum financial burden on the tenant. Under this lease, the tenant is responsible for paying all property taxes, insurance costs, and maintenance expenses directly. The landlord is relieved of these financial obligations entirely. It is important for landlords and tenants to carefully review and negotiate the terms of a Wisconsin triple net lease before entering into an agreement. Clarifying responsibilities, specifying cost-sharing arrangements, and considering the potential risks and benefits are crucial steps in ensuring a mutually beneficial and sustainable commercial real estate leasing arrangement.

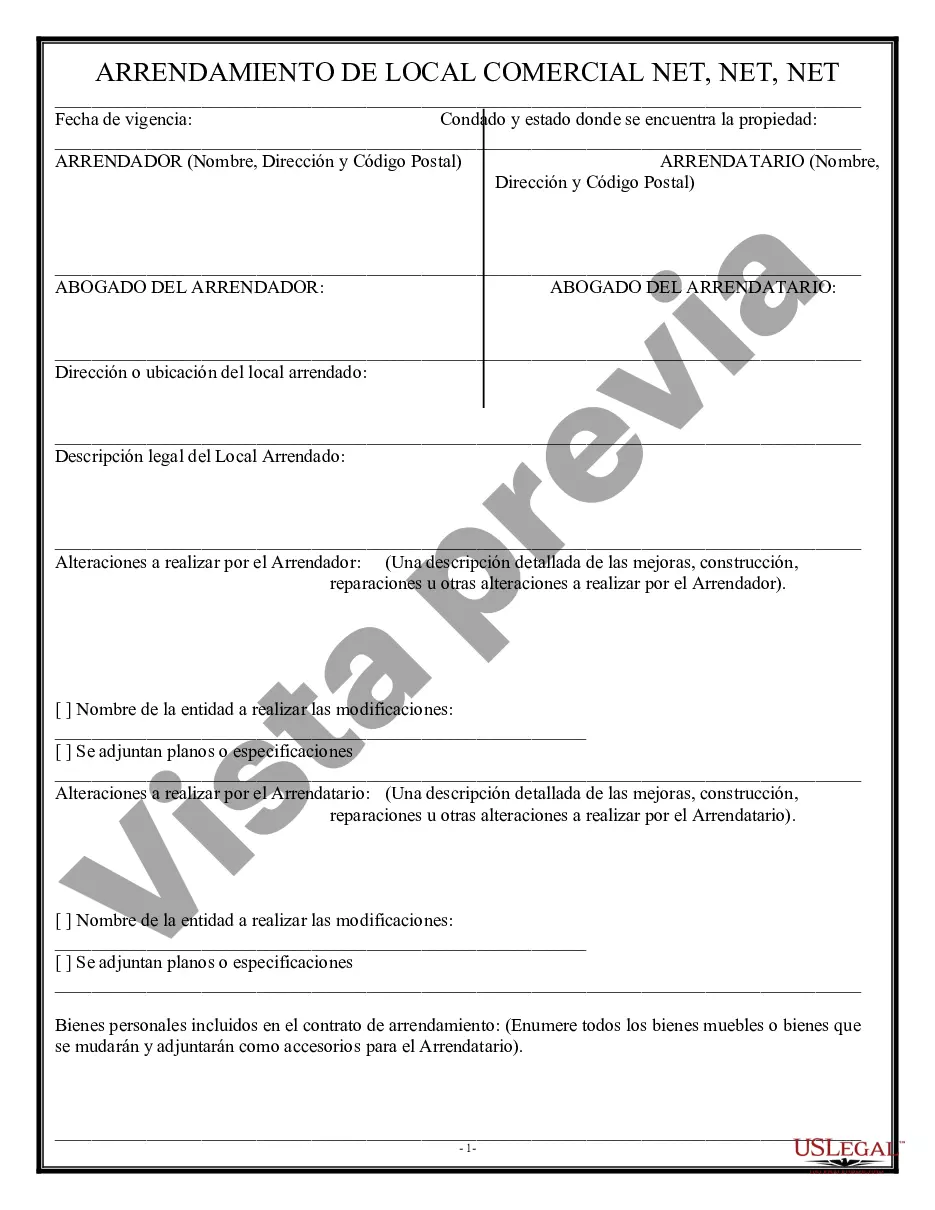

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out Wisconsin Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

Have you been in the place where you need files for either enterprise or individual uses virtually every day time? There are a variety of authorized document templates available on the net, but locating kinds you can rely on isn`t straightforward. US Legal Forms delivers a large number of develop templates, such as the Wisconsin Triple Net Lease for Commercial Real Estate, which are published to fulfill state and federal demands.

Should you be presently knowledgeable about US Legal Forms website and possess your account, just log in. Afterward, it is possible to obtain the Wisconsin Triple Net Lease for Commercial Real Estate design.

If you do not provide an bank account and want to begin to use US Legal Forms, follow these steps:

- Get the develop you will need and make sure it is to the correct area/county.

- Make use of the Review option to analyze the shape.

- Look at the outline to ensure that you have chosen the correct develop.

- In the event the develop isn`t what you are seeking, make use of the Look for discipline to obtain the develop that fits your needs and demands.

- Whenever you get the correct develop, just click Purchase now.

- Choose the costs plan you desire, complete the necessary information to create your bank account, and purchase an order with your PayPal or credit card.

- Decide on a hassle-free paper format and obtain your version.

Locate each of the document templates you may have bought in the My Forms menus. You can aquire a additional version of Wisconsin Triple Net Lease for Commercial Real Estate any time, if possible. Just click the essential develop to obtain or print the document design.

Use US Legal Forms, by far the most substantial variety of authorized types, to conserve some time and steer clear of faults. The assistance delivers skillfully made authorized document templates that can be used for a selection of uses. Produce your account on US Legal Forms and initiate making your lifestyle a little easier.