A Wisconsin Revocable Trust for Property, also known as a Living Trust or Inter Vivos Trust, is a legal document used for estate planning purposes in the state of Wisconsin. It allows individuals to transfer their assets into a trust during their lifetime, while retaining control and ownership over those assets. The primary purpose of establishing a Wisconsin Revocable Trust for Property is to avoid probate. Probate is the legal process through which a deceased person's assets are distributed to their heirs, which can be time-consuming, expensive, and subject to public scrutiny. By creating a revocable trust, individuals can ensure that their property is transferred to beneficiaries outside of probate, preserving privacy and reducing administrative costs. One of the key advantages of a Wisconsin Revocable Trust for Property is its flexibility. The trust can be modified or revoked by the granter (person creating the trust) at any time during their lifetime, as long as they have the mental capacity to do so. This allows individuals to adapt their estate plans as circumstances change, such as acquiring new assets or having additional family members. There are several types of Wisconsin Revocable Trusts for Property that cater to specific needs or circumstances. These include: 1. Individual Trusts: This type of trust is created by a single individual and is commonly used when the granter is unmarried, divorced, or wishes to keep their assets separate from their spouse. 2. Spousal Trusts: Designed for married couples, spousal trusts allow assets to transfer between spouses upon the death of one spouse, while still providing the surviving spouse with control and access to the assets. 3. Family Trusts: These trusts are created to benefit multiple family members, including children and grandchildren. Family trusts often incorporate provisions for the management and distribution of assets over multiple generations. 4. Special Needs Trusts: Intended to provide for individuals with disabilities, special needs trusts ensure that assets are managed for the beneficiary's benefit while also preserving their eligibility for government assistance programs. 5. Pour-Over Trusts: These trusts are used in conjunction with a will, transferring any assets not initially funded into the trust during the granter's lifetime and avoiding probate. In summary, a Wisconsin Revocable Trust for Property is a versatile tool that allows individuals to maintain control over their assets while avoiding probate and providing for the smooth transition of those assets to beneficiaries. With various types of trusts available, individuals can tailor their estate plans to suit their specific needs and circumstances.

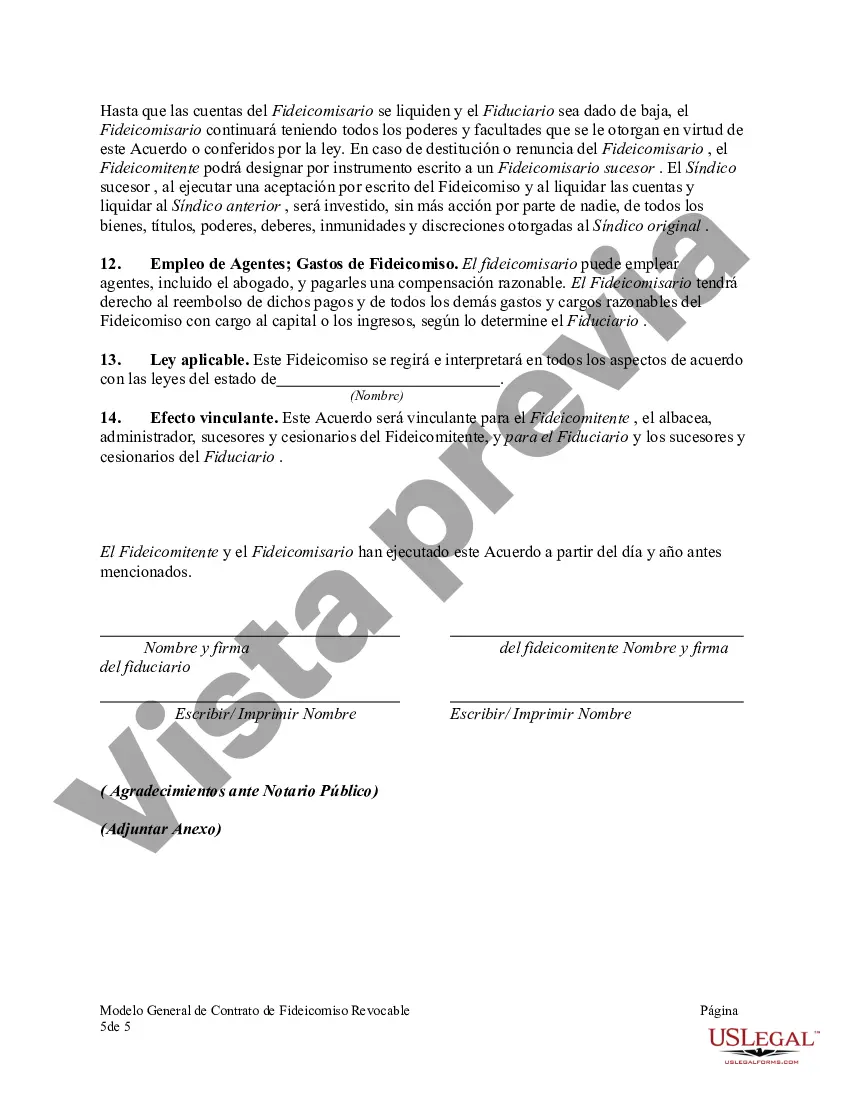

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Fideicomiso revocable para la propiedad - Revocable Trust for Property

Description

How to fill out Wisconsin Fideicomiso Revocable Para La Propiedad?

Have you ever found yourself in a situation where you require documents for business or specific purposes nearly every day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, including the Wisconsin Revocable Trust for Property, designed to comply with state and federal regulations.

Once you find the appropriate document, click Purchase now.

Select your pricing plan, fill out the necessary information to create your account, and pay for your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Wisconsin Revocable Trust for Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for the correct city/state.

- Utilize the Preview button to review the form.

- Check the description to confirm that you have selected the correct document.

- If the document does not meet your needs, use the Search area to find one that fits your requirements.

Form popularity

FAQ

A Wisconsin Revocable Trust for Property is often the most suitable trust to hold real estate. This type of trust allows for easy management and control over how your property is handled during your lifetime and after your death. It helps in avoiding probate and simplifies the transfer process to your beneficiaries. Additionally, this flexible option allows you to modify terms as your circumstances evolve.

Leaving a house to your children can be effectively managed through a Wisconsin Revocable Trust for Property. This trust allows you to dictate how your property is distributed after your passing while providing instructions on how to manage it. With this trust, you can maintain oversight during your lifetime, ensuring your wishes are honored. Utilizing a platform like uslegalforms can help streamline the process and clarify your intentions.

A Wisconsin Revocable Trust for Property is often considered the best option for managing property. It allows you to maintain control while simplifying the transfer of property upon your death. This type of trust can help avoid probate, which saves time and expenses for your heirs. You can easily adjust the trust to reflect changes in your circumstances.

To avoid estate tax, many consider irrevocable trusts, as they remove assets from your taxable estate. However, a Wisconsin Revocable Trust for Property can also minimize taxes if structured correctly. This trust allows for adjustments during your lifetime, enabling you to optimize tax benefits periodically. Consulting with a professional can help you decide the best option for your situation.

An irrevocable trust can limit your control over the assets placed within it. Once you transfer property into this type of trust, you generally cannot remove it or change the terms. This means you might not benefit from the property or make changes in your future if needed. For many, a Wisconsin Revocable Trust for Property offers more flexibility and control, as it allows you to modify terms while still achieving estate planning goals.

The main difference between a revocable trust and an irrevocable trust lies in the control you maintain over your assets. With a Wisconsin Revocable Trust for Property, you can change the terms or revoke the trust at any time. In contrast, an irrevocable trust generally cannot be altered once established, which may offer tax benefits but limits your control.

The greatest advantage of a revocable trust is the control it gives you over your assets while you're alive and the ease of transferring those assets after your death. Unlike a will, which goes through probate, a Wisconsin Revocable Trust for Property allows for quicker and more private distribution to your beneficiaries. This makes it a smart choice for proactive estate planning.

Establishing a Wisconsin Revocable Trust for Property offers numerous benefits, including avoiding probate and maintaining privacy. Your assets can transfer seamlessly upon your passing without court involvement. Additionally, you retain the flexibility to modify the trust during your lifetime, ensuring it meets your evolving needs.

A revocable trust can be established in any state, but Wisconsin often stands out as a favorable option. This is due to its beneficial laws that support estate planning, particularly regarding the Wisconsin Revocable Trust for Property. When considering your specific needs and assets, consulting a local attorney can help you understand how Wisconsin's laws work to your advantage.

Certain types of assets typically cannot be placed in an irrevocable trust, such as retirement accounts, pension plans, and life insurance policies with beneficiary designations. It’s important to consult with an expert to navigate these limitations effectively. A Wisconsin Revocable Trust for Property may provide a suitable alternative, allowing you to structure your estate plan more effectively and achieve your goals.

Interesting Questions

More info

Legal Questions About Revocable Living Trusts We offer information and legal counsel for individuals who are at risk for estate or living trust fraud. If you are considering creating an estate or living trust, we are here to guide you through the process, so you can protect your assets and avoid unnecessary legal costs and expenses. Will estate or living trust funds become worthless after the death of a spouse or significant other? There are some situations that can be a problem, but these can be avoided by following the instructions on the Revocable Living Trust Lawyer Form. Here are some things to keep in mind: If the Revocable Living Trust Lawyer Form is signed with the intent or knowledge of the dying person or a party in interest, their share of the estate or living trust may become worthless at the death of the dying person or an identifiable party in interest. This is not a legal issue.