A Wisconsin Simple Promissory Note for Tuition Fee is a legal document that outlines the terms of a loan agreement between a student (borrower) and a lender. It serves as a binding agreement stating that the borrower will repay the loan amount taken for educational expenses within a specified period and under specific conditions. The Wisconsin Simple Promissory Note for Tuition Fee includes key elements such as the loan amount, interest rate, repayment terms, and any additional charges or fees. The document typically includes the personal details of both the borrower and lender, along with the date of the agreement and the agreed-upon period for repayment. There are different types of Wisconsin Simple Promissory Notes for Tuition Fee, each varying based on the specific terms and conditions agreed upon by both parties. Some common variations include: 1. Fixed Interest Rate Simple Promissory Note: This type of agreement specifies a predetermined interest rate that remains constant throughout the repayment period. It provides both the borrower and lender with clarity on the interest amount and facilitates easier financial planning. 2. Variable Interest Rate Simple Promissory Note: Unlike the fixed interest rate option, this type of promissory note allows the interest rate to fluctuate over time. The interest rate is usually linked to a benchmark rate, such as the prime rate or a treasury index, and adjusts periodically based on changes in the economy. 3. Installment Repayment Simple Promissory Note: This arrangement breaks down the loan repayment into equal installments over a specified period. The borrower agrees to repay the principal along with accrued interest in regular fixed payments until the loan is fully repaid. 4. Balloon Payment Simple Promissory Note: In this type of agreement, the borrower pays smaller regular installments throughout the loan term, with a larger one-time payment due at the end of the agreed-upon period. The balloon payment is typically higher than the regular installments and may require the borrower to secure additional funds or refinance the loan. 5. Interest-Only Simple Promissory Note: Under this arrangement, the borrower is only required to make interest payments during a specific period, usually at the start of the loan term. Once the interest-only period ends, the borrower must begin making principal and interest payments. Wisconsin Simple Promissory Notes for Tuition Fees are crucial for formalizing the loan agreement between parties involved in educational financing. It provides legal protection, establishes clear repayment expectations, and outlines the consequences of defaulting on loan payments. It is essential for both borrowers and lenders to thoroughly understand and agree upon the terms before entering into a Wisconsin Simple Promissory Note for Tuition Fee.

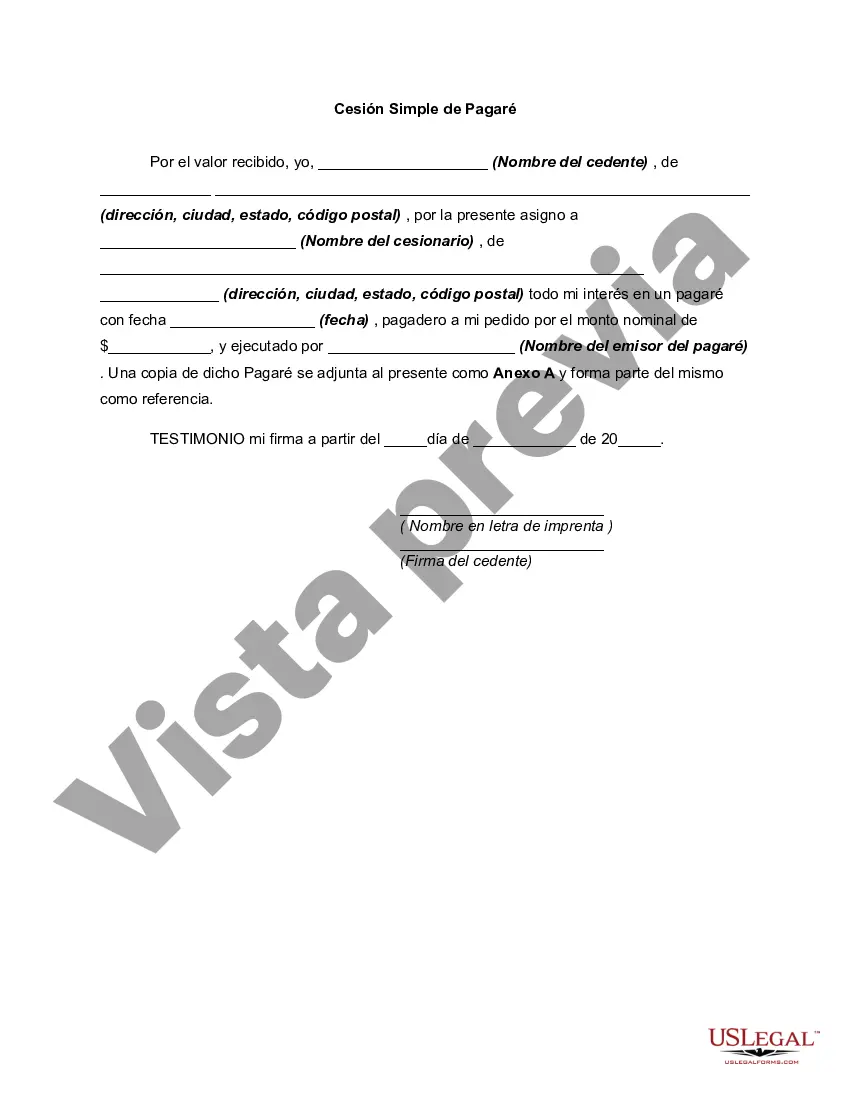

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Pagaré simple de matrícula - Simple Promissory Note for Tutition Fee

Description

How to fill out Wisconsin Pagaré Simple De Matrícula?

If you need to full, obtain, or produce legitimate papers themes, use US Legal Forms, the largest collection of legitimate kinds, which can be found on-line. Utilize the site`s simple and practical search to obtain the files you want. Different themes for organization and individual reasons are sorted by groups and claims, or keywords. Use US Legal Forms to obtain the Wisconsin Simple Promissory Note for Tutition Fee in a number of mouse clicks.

When you are previously a US Legal Forms customer, log in to the account and then click the Acquire option to find the Wisconsin Simple Promissory Note for Tutition Fee. Also you can entry kinds you previously downloaded within the My Forms tab of the account.

Should you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape for the correct area/country.

- Step 2. Make use of the Preview method to examine the form`s content. Do not overlook to read the outline.

- Step 3. When you are unsatisfied together with the type, use the Look for discipline near the top of the display screen to get other versions of your legitimate type web template.

- Step 4. Upon having identified the shape you want, go through the Purchase now option. Select the pricing plan you choose and include your accreditations to register for an account.

- Step 5. Process the deal. You can utilize your Мisa or Ьastercard or PayPal account to accomplish the deal.

- Step 6. Pick the file format of your legitimate type and obtain it on the system.

- Step 7. Complete, modify and produce or signal the Wisconsin Simple Promissory Note for Tutition Fee.

Every legitimate papers web template you get is your own property eternally. You might have acces to each type you downloaded with your acccount. Go through the My Forms segment and select a type to produce or obtain again.

Remain competitive and obtain, and produce the Wisconsin Simple Promissory Note for Tutition Fee with US Legal Forms. There are many expert and state-distinct kinds you may use for your personal organization or individual requirements.