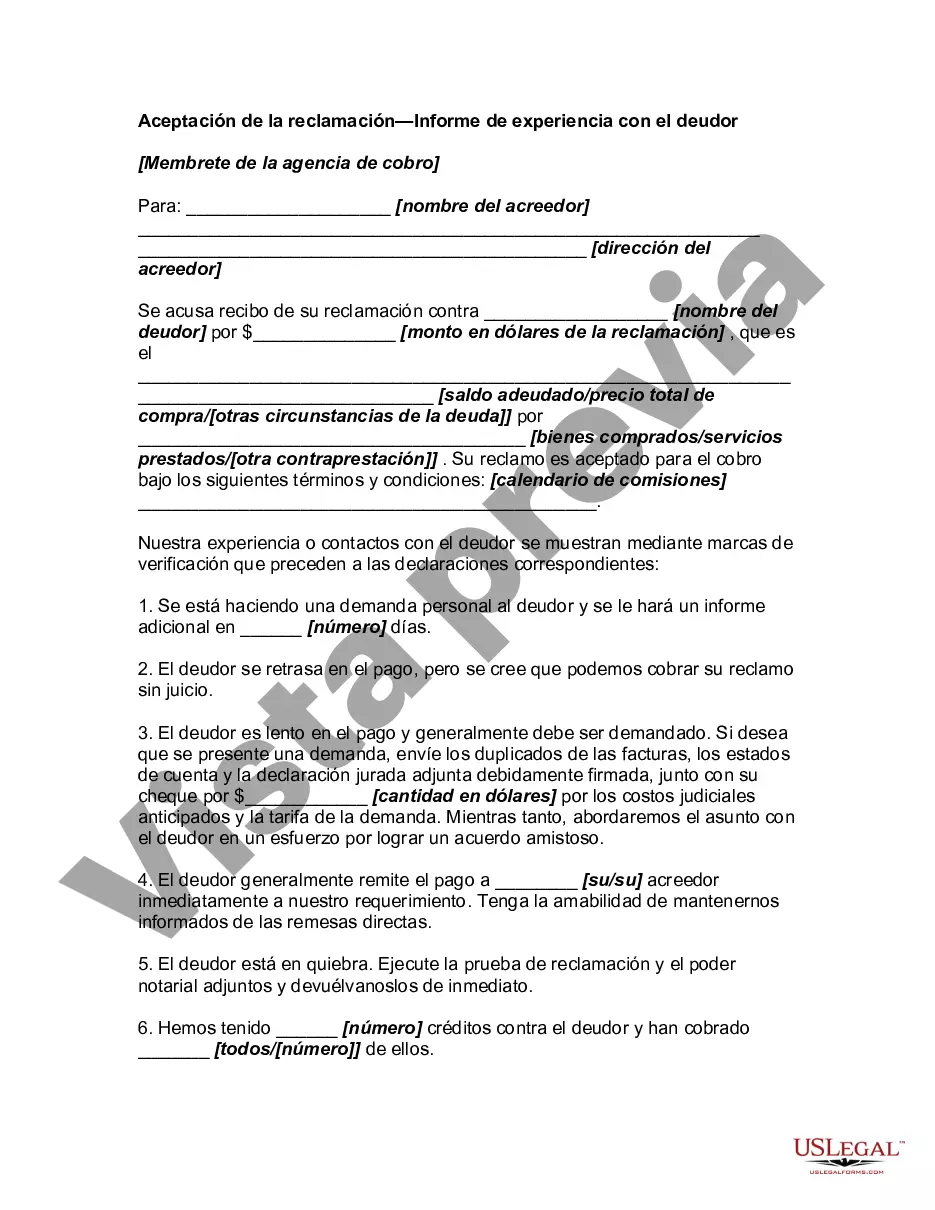

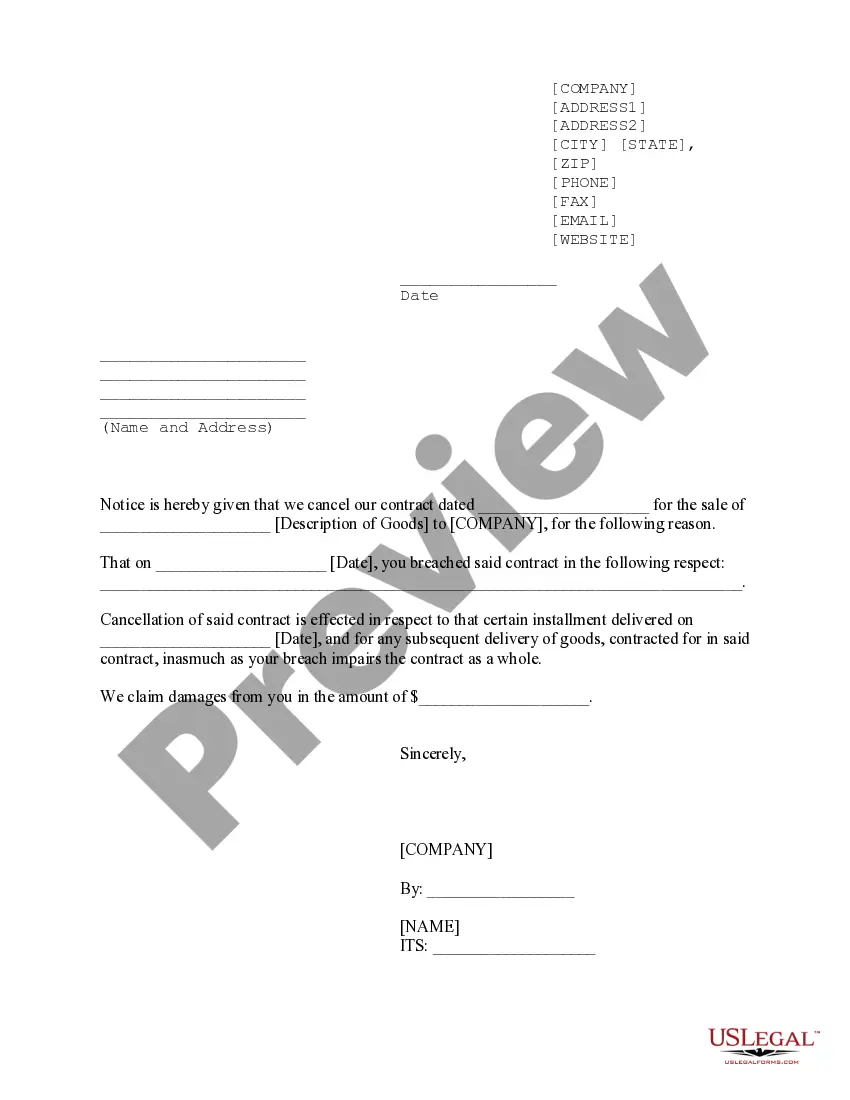

Title: Understanding the Wisconsin Acceptance of Claim by Collection Agency and Reporting experiences with Debtors Introduction: The Wisconsin Acceptance of Claim by Collection Agency and Report of Experience with Debtor is a crucial process within the debt collection system. It involves the acceptance of claims by collection agencies and the reporting of experiences with debtors. In this article, we will explore the various aspects of this process, including its purpose, requirements, procedures, and the importance of accurate reporting. Additionally, we will delve into different types of acceptance of claim forms in Wisconsin and how they pertain to reporting experiences with debtors. Keywords: Wisconsin, Acceptance of Claim, Collection Agency, Report of Experience, Debtor, Requirements, Procedures, Reporting, Types. 1. Purpose of the Wisconsin Acceptance of Claim by Collection Agency: The purpose of Wisconsin Acceptance of Claim by Collection Agency is to provide a framework for the proper acknowledgment and handling of claims made by collection agencies against debtors. It aims to ensure fair practices, maintain records, and foster accountability within the debt collection process. 2. Components of the Wisconsin Acceptance of Claim by Collection Agency: a) Claimant Information: Name, contact details, and identification of the collection agency filing the claim. b) Debtor Information: Name, contact details, and details of the outstanding debt. c) Documentation: Supporting documents such as copies of invoices, contracts, and other relevant records proving the existence and validity of the debt. d) Certification: Signature and date, acknowledging the veracity of the information provided. 3. Reporting Experiences with Debtors: The Report of Experience with Debtor is a vital tool for maintaining accurate records of interactions, negotiations, and outcomes with debtors. It helps track the progress of collection efforts, facilitates legal proceedings when necessary, and serves as a reliable reference for future dealings with the same or similar debtors. 4. Importance of Accurate Reporting: a) Legal Compliance: Proper reporting ensures adherence to state and federal regulations, preventing legal complications in debt collection processes. b) Efficient Communication: Accurate reports provide essential information to relevant parties involved, such as lawyers, courts, or other collection agencies. c) Evidence: Detailed reports can serve as valuable evidence during legal proceedings, enhancing the chances of successful debt recovery. d) Trend Analysis: Analyzing reported experiences aids in identifying patterns related to debt repayment, debtor behavior, and potential changes in collection strategies. Types of Wisconsin Acceptance of Claim by Collection Agency and Report of Experience with Debtor: 1. Initial Claim Acceptance: This form is filled when a collection agency initially accepts a claim against a debtor. It includes basic claimant, debtor, and debt details, providing the groundwork for further proceedings. 2. Ongoing Claim Updates: As collection efforts progress, this form allows collection agencies to report updated experiences with the debtor, including communication logs, payment arrangements, and any changes in the status of the debt. 3. Closure Report: This report documents the final outcome of a claim, indicating if the debt has been fully recovered, partially recovered, or remains unpaid. It summarizes the collection agency's overall experience with the debtor and concludes the claim process. Conclusion: The Wisconsin Acceptance of Claim by Collection Agency and Report of Experience with Debtor is an integral part of the debt collection process. By providing a structured guideline, it ensures fair practices and accurate reporting for successful debt recovery. Understanding these procedures and leveraging the various forms associated with them can enhance the efficiency of debt collection agencies while ensuring compliance with legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Aceptación de Reclamo por Agencia de Cobranza e Informe de Experiencia con Deudor - Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Wisconsin Aceptación De Reclamo Por Agencia De Cobranza E Informe De Experiencia Con Deudor?

Choosing the right authorized papers design can be quite a have a problem. Naturally, there are tons of templates available online, but how do you obtain the authorized develop you need? Make use of the US Legal Forms website. The services gives a large number of templates, such as the Wisconsin Acceptance of Claim by Collection Agency and Report of Experience with Debtor, that you can use for business and personal requirements. All the types are checked by specialists and satisfy federal and state requirements.

Should you be currently signed up, log in to the accounts and click on the Acquire option to get the Wisconsin Acceptance of Claim by Collection Agency and Report of Experience with Debtor. Make use of accounts to search through the authorized types you may have acquired in the past. Check out the My Forms tab of your respective accounts and get another copy from the papers you need.

Should you be a fresh customer of US Legal Forms, listed here are basic directions for you to follow:

- Initially, ensure you have chosen the right develop to your area/county. You may examine the form utilizing the Preview option and browse the form information to guarantee this is basically the right one for you.

- In case the develop is not going to satisfy your requirements, make use of the Seach discipline to obtain the right develop.

- When you are positive that the form is suitable, select the Buy now option to get the develop.

- Pick the rates plan you want and enter in the essential information and facts. Design your accounts and purchase your order with your PayPal accounts or Visa or Mastercard.

- Pick the data file format and acquire the authorized papers design to the device.

- Comprehensive, change and print out and indication the received Wisconsin Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

US Legal Forms may be the most significant local library of authorized types that you will find a variety of papers templates. Make use of the service to acquire appropriately-created papers that follow state requirements.