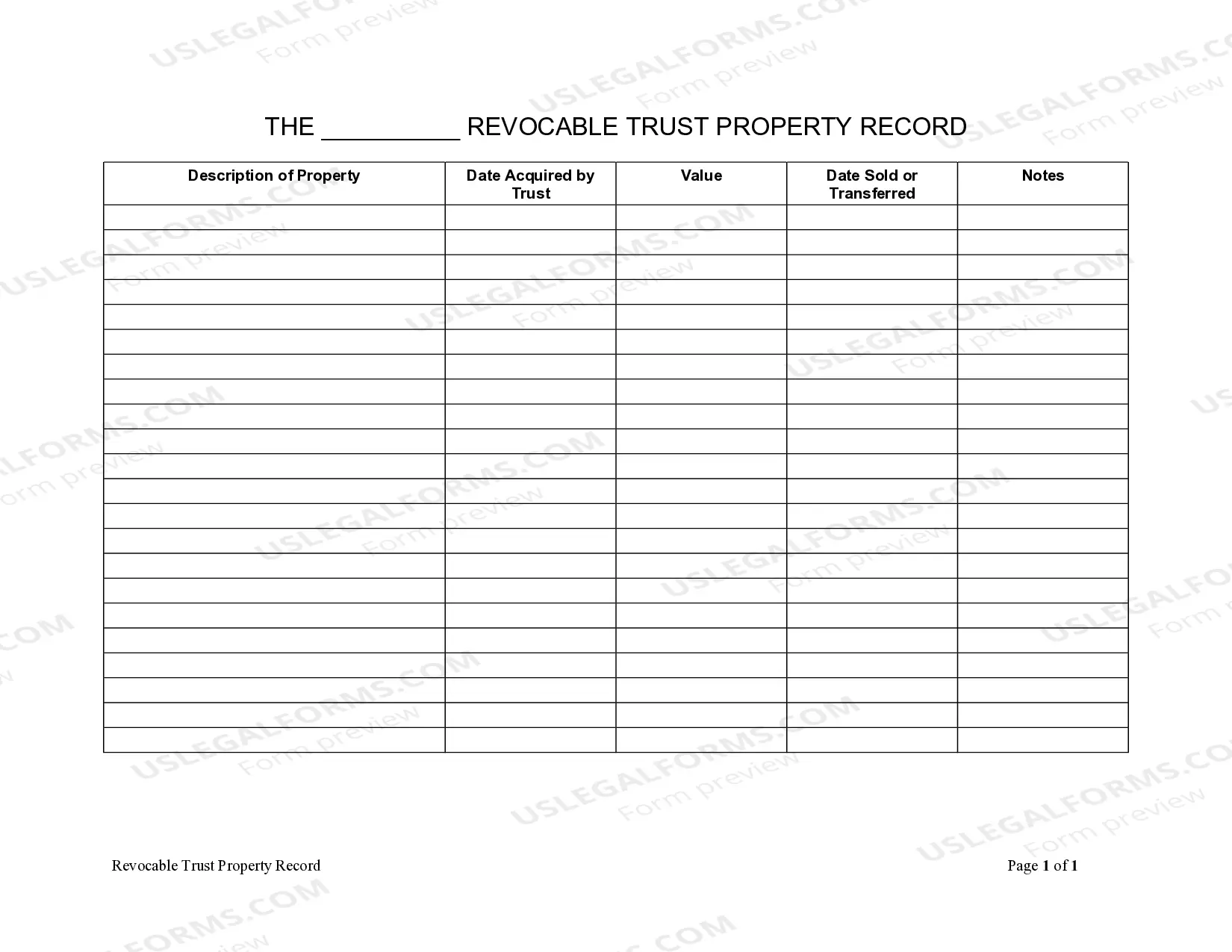

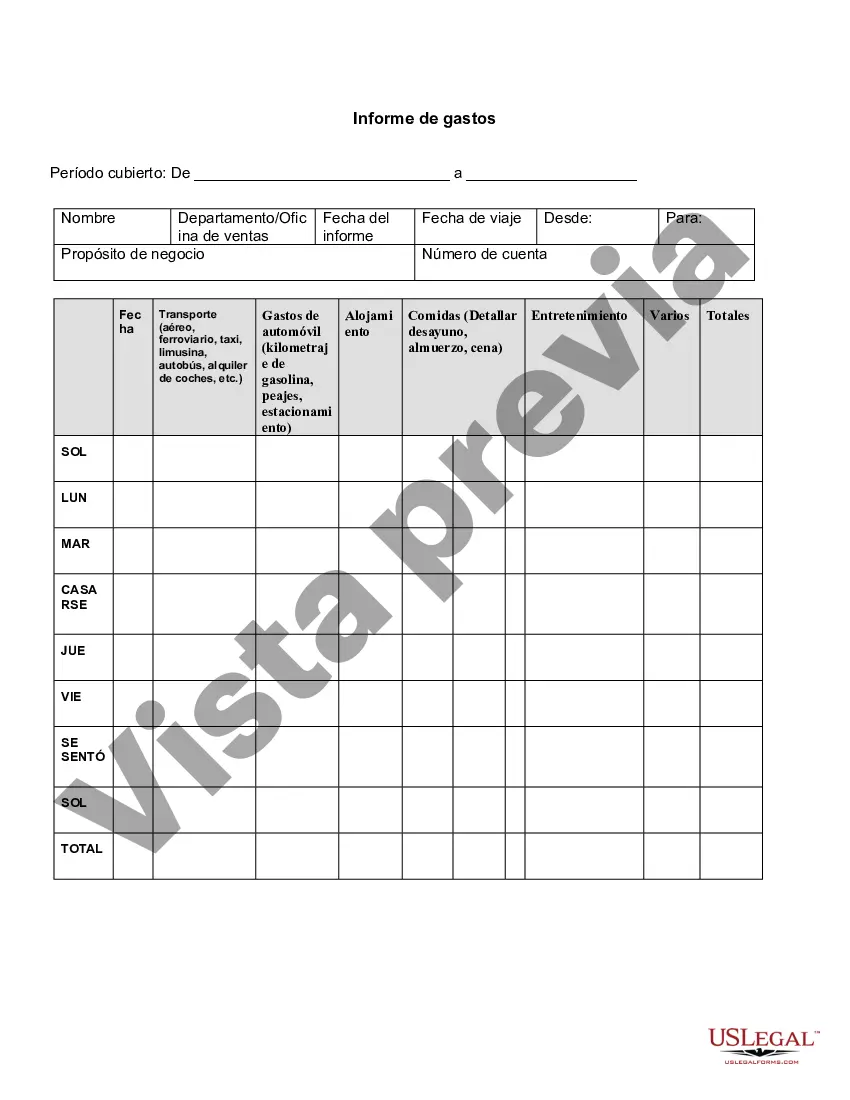

Wisconsin Expense Report is a standardized document that is utilized by individuals or employees to document and report their business-related expenses incurred during official travel or other work-related activities within the state of Wisconsin. This report is designed to provide an organized and comprehensive breakdown of various expenses such as transportation, accommodation, meals, entertainment, and other miscellaneous costs. The purpose of the Wisconsin Expense Report is twofold: firstly, it allows the traveler to request reimbursement for the expenses they have incurred, and secondly, it enables the company or organization to track and control expenditure, ensuring that expenses are legitimate and within company policies. The Wisconsin Expense Report usually consists of several sections. These sections may include: 1. Personal Information: This section requires the traveler to provide their full name, employee identification number, department, contact details, and the purpose of the trip. 2. Trip Details: Here, the traveler is required to specify the duration of the trip, start and end date, destination, and the purpose of the trip. 3. Expense Categories: This section provides a breakdown of various expense categories such as transportation (airfare, mileage, car rental), accommodation (hotel, lodging), meals (breakfast, lunch, dinner), entertainment (client meetings, conferences), and miscellaneous expenses (parking, tolls). 4. Itemized Expenses: Within each category, the traveler is expected to itemize their expenses, indicating the date, description, vendor, amount, and any supporting documentation such as receipts or invoices. 5. Total Expenses: This section calculates the total amount spent for each category as well as the grand total for the entire trip. 6. Approval and Signature: Once the report is completed, the traveler must obtain approval from their supervisor or designated authority. They may also need to provide additional supporting documents or explanations. Types of Wisconsin Expense Reports may vary depending on the specific organization or purpose. Some common variations include: 1. Conferences or Workshops Expense Report: Used by employees attending conferences, seminars, or workshops in Wisconsin. 2. Field Work Expense Report: Designed for employees who travel within Wisconsin for fieldwork or site visits as part of their job responsibilities. 3. Sales or Client visits Expense Report: Utilized by sales representatives or employees who engage in client meetings or sales-related activities within the state of Wisconsin. 4. Commuting Expense Report: Applicable for cases where employees are authorized for commuting expenses, such as reimbursement for mileage or public transportation costs due to work-related travel in Wisconsin. In conclusion, the Wisconsin Expense Report serves as a crucial tool in tracking and documenting business-related expenses within the state. It ensures transparency, accountability, and adherence to company policies while providing employees with the means to seek reimbursement for their legitimate expenses.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Informe de gastos - Expense Report

Description

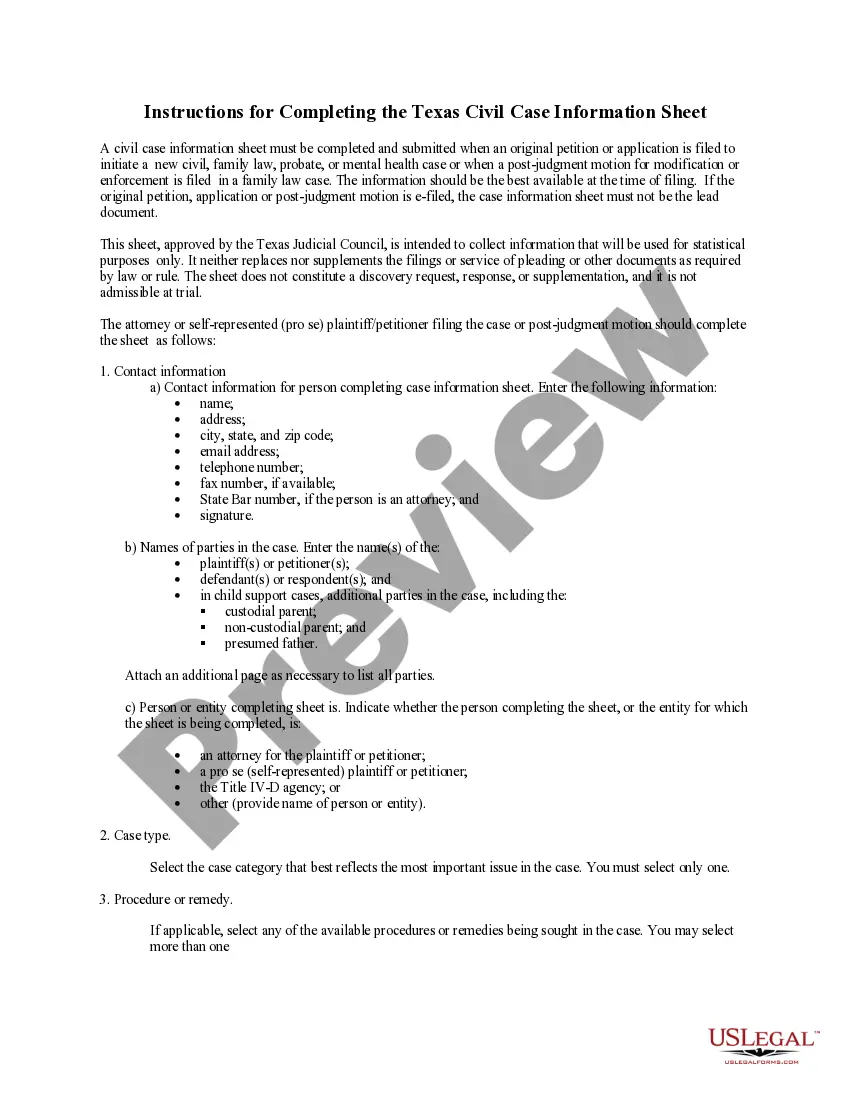

How to fill out Wisconsin Informe De Gastos?

Discovering the right legal document format might be a struggle. Needless to say, there are a lot of themes accessible on the Internet, but how can you get the legal type you want? Utilize the US Legal Forms internet site. The assistance offers 1000s of themes, like the Wisconsin Expense Report, that you can use for company and personal needs. All the kinds are checked by professionals and meet up with federal and state demands.

When you are previously signed up, log in in your profile and click on the Obtain switch to obtain the Wisconsin Expense Report. Utilize your profile to check with the legal kinds you have bought previously. Check out the My Forms tab of your respective profile and get an additional backup from the document you want.

When you are a new customer of US Legal Forms, listed here are basic directions for you to stick to:

- Initially, ensure you have selected the correct type for your metropolis/state. You can check out the form using the Review switch and browse the form outline to guarantee this is basically the right one for you.

- When the type does not meet up with your requirements, make use of the Seach area to find the appropriate type.

- Once you are sure that the form is acceptable, click on the Acquire now switch to obtain the type.

- Select the pricing program you desire and enter in the required details. Build your profile and pay for your order utilizing your PayPal profile or Visa or Mastercard.

- Opt for the document format and acquire the legal document format in your product.

- Total, revise and printing and signal the attained Wisconsin Expense Report.

US Legal Forms is definitely the most significant catalogue of legal kinds in which you can discover numerous document themes. Utilize the service to acquire professionally-made documents that stick to express demands.

Form popularity

FAQ

The $2500 expense rule refers to the IRS guideline that allows businesses to write off certain expenses without detailed documentation. For your Wisconsin Expense Report, if your total expense is below this threshold, you might not need to provide receipts. However, keeping a clear record is advisable to avoid complications during tax filing.

Filing an expense report typically involves completing a structured document that outlines your expenses. An effective Wisconsin Expense Report should categorize expenses, provide total amounts, and include pertinent receipts. Once completed, submit your report to the appropriate party, such as your finance department, for review and reimbursement.

The IRS requires that expense reports include adequate documentation to justify claimed expenses. For each entry in your Wisconsin Expense Report, retain receipts, notes, and any forms that support your claims. This documentation must clearly show the business purpose of each expense to satisfy IRS requirements.

To format an effective expense report, begin with a title and include your name, date, and purpose. Use a table to list each expense, along with columns for dates, descriptions, amounts, and total costs. This organized approach helps anyone reviewing your Wisconsin Expense Report quickly grasp the information.

When you report expenses on your taxes, you must detail all deductible costs incurred while generating income. A thorough Wisconsin Expense Report will simplify this process, as it organizes your expenses into clear categories. Do not forget to retain documentation, as the IRS may require proof of these expenses.

To effectively record your expenses, start by documenting each transaction as soon as it occurs. Utilize a structured format, such as a spreadsheet or an app designed for Wisconsin Expense Reports, where you can categorize expenses by type. Make sure to keep all relevant receipts and invoices since they serve as proof for each entry.

Filling out a Wisconsin Expense Report requires a few key steps. First, gather your receipts and identify the expenses that qualify for reimbursement. Next, enter the details such as date, amount, and type of expense clearly into the form. Finally, review for completeness and accuracy before submitting, ensuring a smooth reimbursement process.

An invoice is a request for payment that a vendor sends to a customer for services rendered or products delivered. In contrast, a Wisconsin Expense Report is a document employees submit to request reimbursement for costs they incurred while performing work duties. Understanding this distinction helps ensure accurate financial records.

To write an effective expense report, start with a clear title and date. List each expense, including the date, type of expense, amount, and a brief description. Incorporate a summary section at the end, detailing the total expenses. Finally, ensure that you attach copies of all relevant receipts for approval.

An example of an expense in a Wisconsin Expense Report could be travel costs incurred while attending a business conference. This might include airfare, lodging, and meals. Additionally, any materials purchased for work can also qualify as an expense. Always keep your receipts to support your claims.

More info

This report is also useful to manage budget by dividing all types of expenses, so you know which ones you can cut out. These expense report fill the bill for every business to fill this report regularly to ensure that all expenses are being properly categorized. Fill expense report with detailed details of expenses, expenses itemized and expenses by category. Fill expense report with details of all expenses, expenses by category This information is important for any business to keep for proper planning of expenditures. Write all expenses you incurred for business purposes, write down all expenses write all expense report fill Expense report with details of all expenses, expenses in detail It is also important to save this report, so you can review all transactions of expenses throughout the business process. Write down all expenses you have incurred for business purposes and also write down all expenses incurred in detail.