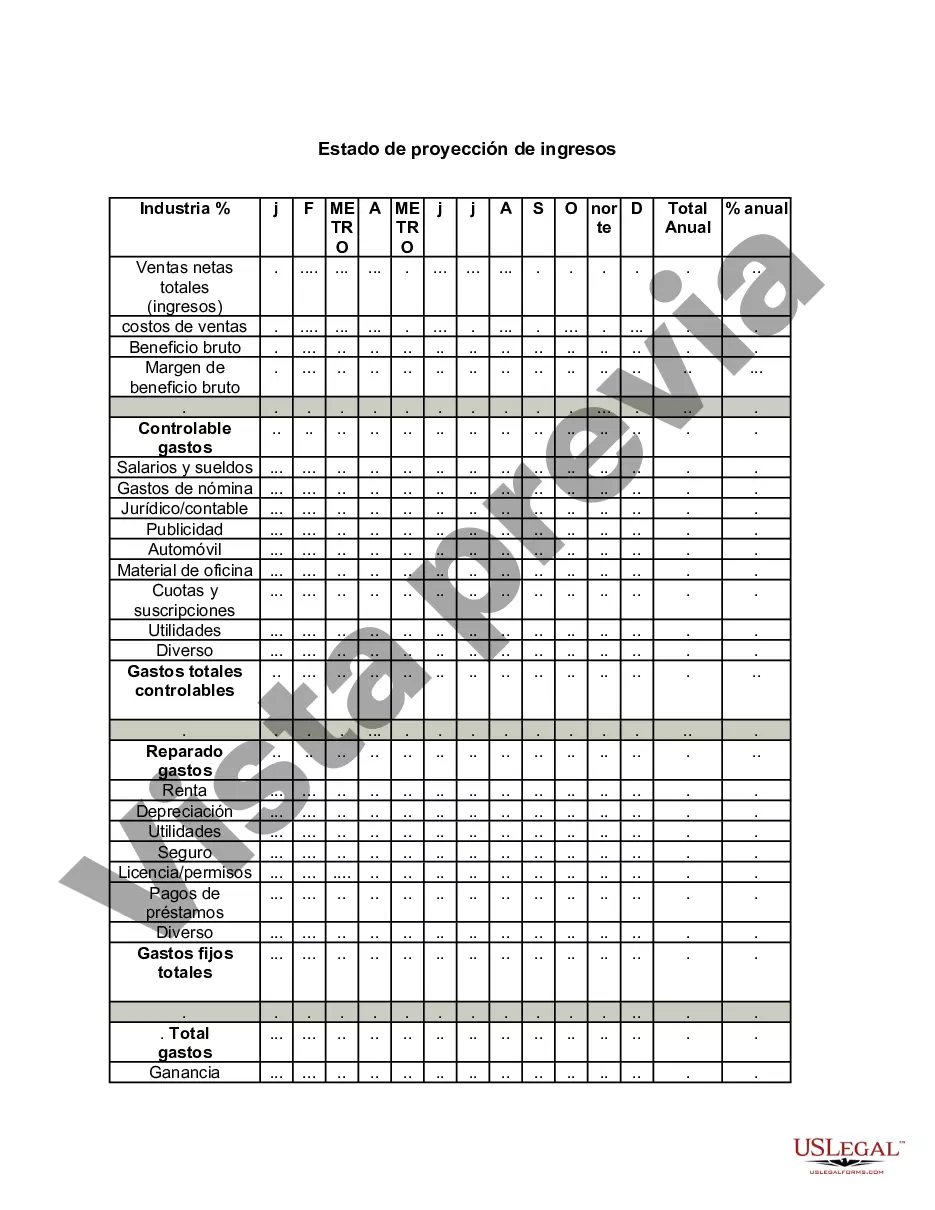

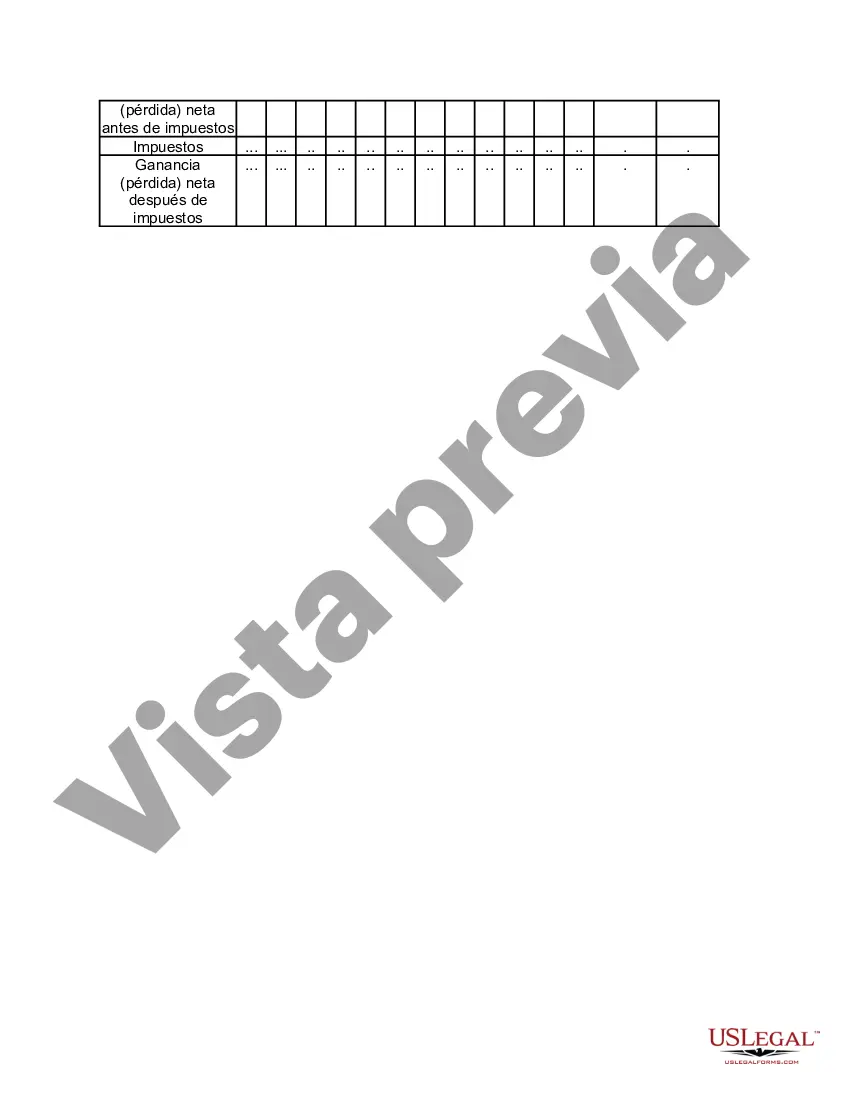

Wisconsin Income Projections Statement is a financial document that provides a detailed estimate of an individual or business's expected income in the state of Wisconsin. It forecasts the anticipated revenue and earnings based on various projected factors and assumptions. This statement proves to be an essential tool for individuals, entrepreneurs, and organizations residing or operating in Wisconsin, as it assists in strategic financial planning, budgeting, investment decision-making, and evaluating potential profitability. The Wisconsin Income Projections Statement typically includes key components such as: 1. Revenue Projections: This section outlines the estimated sales or revenue generated from the core business activities, taking into account factors like market trends, customer demand, historical data, and industry analysis. It provides a clear picture of anticipated income over a specified period, usually monthly, quarterly, or annually. 2. Expense Projections: Here, the projected expenses for running the business or personal finances are included. This may cover costs such as production, marketing, salaries, utilities, and administrative expenses. Accurately estimating expenses helps in better financial management and cost control. 3. Profit Projections: This part calculates the expected profit margin by deducting the projected expenses from the projected revenue. It gives an insight into the overall profitability of the business or individual income over the specified period. 4. Cash Flow Projections: Cash flow projections forecast the estimated cash inflows and outflows during a specified time frame. It helps in ensuring sufficient liquidity to cover expenses and identifies potential cash flow gaps that may require attention. 5. Growth Assumptions: Income projections statements may also incorporate growth assumptions, such as the expected increase in sales or market share. These assumptions aid in estimating the potential growth trajectory and financial impact on income. Different types of Wisconsin Income Projections Statements exist depending on the specific purpose or scope they serve. These may include: 1. Personal Income Projections: Tailored for individuals, this statement estimates the anticipated income and expenses for personal finances, helping with managing personal budgeting, savings planning, and investment decisions. 2. Business Income Projections: Specifically designed for businesses, this statement assists entrepreneurs in forecasting sales and growth, setting financial goals, attracting investors, securing loans, and overall financial management. 3. Short-Term Income Projections: These statements focus on estimating income and expenses for a shorter period, typically up to one year. They are useful for short-term financial planning, budgeting, and identifying immediate financial needs. 4. Long-Term Income Projections: These statements provide income forecasts for an extended period, usually beyond one year, aiding in long-term financial planning, investment evaluations, and identifying future growth opportunities. In conclusion, the Wisconsin Income Projections Statement is a vital financial document that enables individuals and businesses operating in Wisconsin to estimate and plan their expected income, expenses, and overall financial performance. It serves as a roadmap for financial decision-making and helps in achieving financial stability, growth, and success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Estado de proyección de ingresos - Income Projections Statement

Description

How to fill out Wisconsin Estado De Proyección De Ingresos?

If you wish to full, download, or print lawful file layouts, use US Legal Forms, the biggest assortment of lawful types, which can be found on the Internet. Take advantage of the site`s basic and handy lookup to get the paperwork you will need. Numerous layouts for business and specific purposes are categorized by classes and states, or keywords. Use US Legal Forms to get the Wisconsin Income Projections Statement with a number of clicks.

When you are previously a US Legal Forms client, log in to the accounts and then click the Acquire key to find the Wisconsin Income Projections Statement. You may also entry types you earlier downloaded from the My Forms tab of your respective accounts.

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape to the correct town/land.

- Step 2. Make use of the Preview method to examine the form`s content. Do not overlook to read through the information.

- Step 3. When you are not happy using the kind, utilize the Look for industry on top of the monitor to get other models from the lawful kind format.

- Step 4. Once you have located the shape you will need, select the Get now key. Pick the prices plan you choose and add your references to sign up on an accounts.

- Step 5. Approach the deal. You can utilize your charge card or PayPal accounts to perform the deal.

- Step 6. Pick the formatting from the lawful kind and download it on your gadget.

- Step 7. Comprehensive, modify and print or indicator the Wisconsin Income Projections Statement.

Each lawful file format you get is the one you have for a long time. You possess acces to every single kind you downloaded within your acccount. Go through the My Forms section and select a kind to print or download yet again.

Compete and download, and print the Wisconsin Income Projections Statement with US Legal Forms. There are many professional and status-distinct types you can utilize for the business or specific demands.