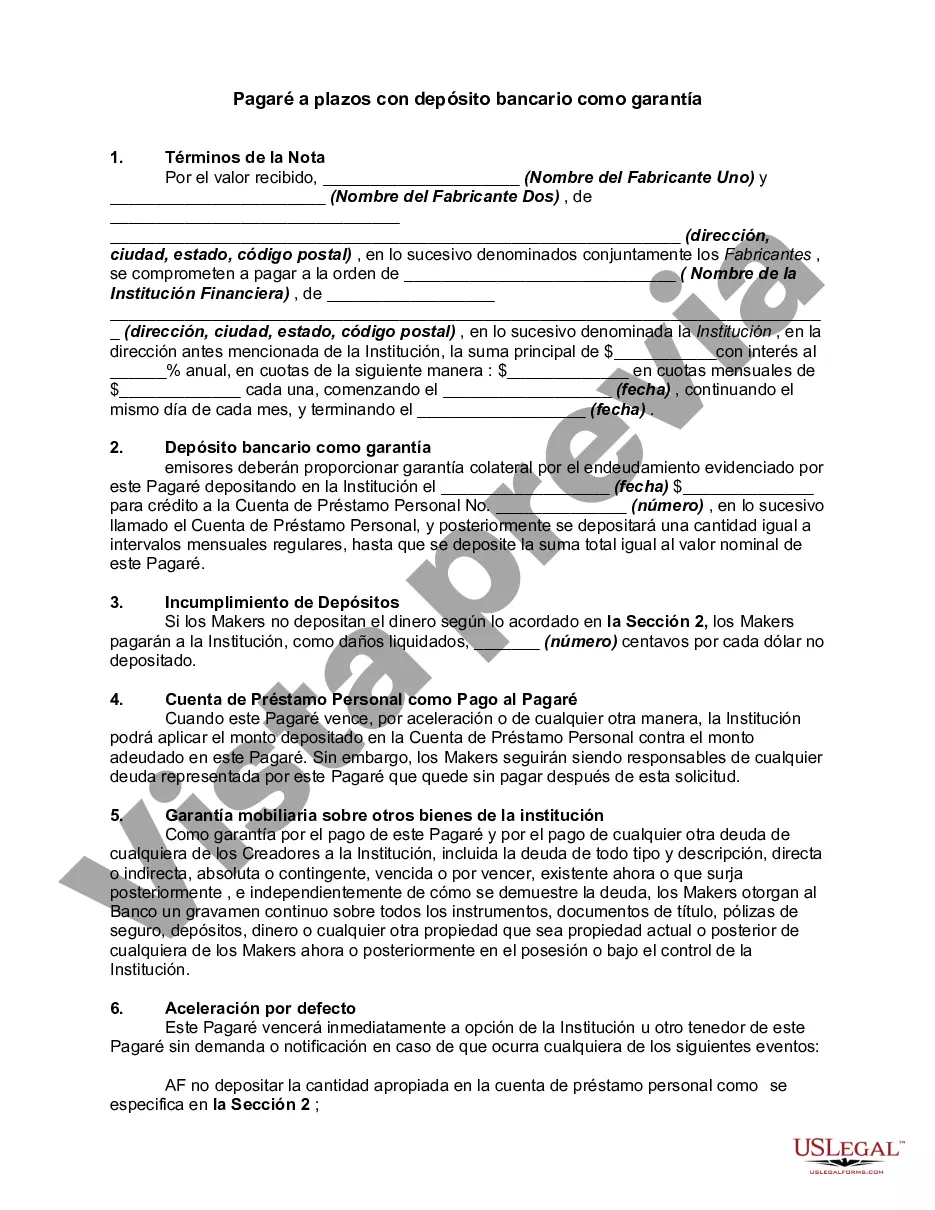

Keywords: Wisconsin, Installment Promissory Note, Bank Deposit, Collateral, Types A Wisconsin Installment Promissory Note with Bank Deposit as Collateral is a legal document used in the state of Wisconsin to secure a loan with a bank deposit. This type of promissory note outlines specific terms and conditions of the loan, including repayment schedule, interest rate, and any applicable fees. The Wisconsin Installment Promissory Note with Bank Deposit as Collateral serves as a binding agreement between the borrower and the lender. By offering their bank deposit as collateral, the borrower provides security for the loan, giving the lender confidence that they can recover their funds in case of default. There are two main types of Wisconsin Installment Promissory Note with Bank Deposit as Collateral: 1. Fixed-Rate: This type of promissory note has a predetermined interest rate that remains constant throughout the loan term. Borrowers who prefer stable monthly payments often opt for this type when seeking financing against their bank deposit. 2. Variable-Rate: In contrast to the fixed-rate option, the variable-rate installment promissory note has an interest rate that fluctuates over time. The rate is typically tied to a specific financial index, such as the prime rate. This type is suited for borrowers who are comfortable with potential interest rate changes in exchange for the possibility of lower rates. When drafting a Wisconsin Installment Promissory Note with Bank Deposit as Collateral, it is important to include essential details such as the borrower's and lender's names and addresses, the loan amount, interest rate, repayment schedule, and the due date of each installment. Additionally, it is important to clearly outline the consequences of default, including the lender's rights to seize the bank deposit collateral. In conclusion, a Wisconsin Installment Promissory Note with Bank Deposit as Collateral is a legally binding agreement between a borrower and a lender in Wisconsin. It provides a framework for a loan secured with a bank deposit as collateral, offering borrowers access to financing while providing lenders with confidence in repayment. Fixed-rate and variable-rate are the two main types of this promissory note, each offering different interest rate structures.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out Wisconsin Pagaré A Plazos Con Depósito Bancario Como Garantía?

US Legal Forms - one of the biggest libraries of legal forms in the USA - provides an array of legal record templates you can download or print out. Utilizing the internet site, you can get thousands of forms for organization and specific functions, sorted by types, claims, or key phrases.You will discover the most recent types of forms much like the Wisconsin Installment Promissory Note with Bank Deposit as Collateral within minutes.

If you have a subscription, log in and download Wisconsin Installment Promissory Note with Bank Deposit as Collateral through the US Legal Forms local library. The Down load key will appear on each form you look at. You have accessibility to all in the past acquired forms within the My Forms tab of your account.

In order to use US Legal Forms for the first time, allow me to share easy instructions to obtain started:

- Make sure you have chosen the best form for the metropolis/area. Select the Review key to examine the form`s information. Read the form description to actually have chosen the right form.

- If the form doesn`t match your specifications, take advantage of the Look for industry towards the top of the display screen to get the the one that does.

- When you are pleased with the form, confirm your choice by simply clicking the Buy now key. Then, select the prices strategy you like and give your accreditations to register on an account.

- Method the financial transaction. Make use of Visa or Mastercard or PayPal account to complete the financial transaction.

- Choose the format and download the form in your gadget.

- Make changes. Fill out, revise and print out and signal the acquired Wisconsin Installment Promissory Note with Bank Deposit as Collateral.

Each web template you added to your account does not have an expiration date and is yours for a long time. So, if you wish to download or print out an additional backup, just proceed to the My Forms section and click on about the form you will need.

Gain access to the Wisconsin Installment Promissory Note with Bank Deposit as Collateral with US Legal Forms, by far the most comprehensive local library of legal record templates. Use thousands of skilled and condition-certain templates that satisfy your company or specific requires and specifications.