Merger refers to the situation where one of the constituent corporations remains in being and absorbs into itself the other constituent corporation. It refers to the case where no new corporation is created, but where one of the constituent corporations ceases to exist, being absorbed by the remaining corporation.

Generally, statutes authorizing the combination of corporations prescribe the steps by which consolidation or merger may be effected. The general procedure is that the constituent corporations make a contract setting forth the terms of the merger or consolidation, which is subsequently ratified by the requisite number of stockholders of each corporation.

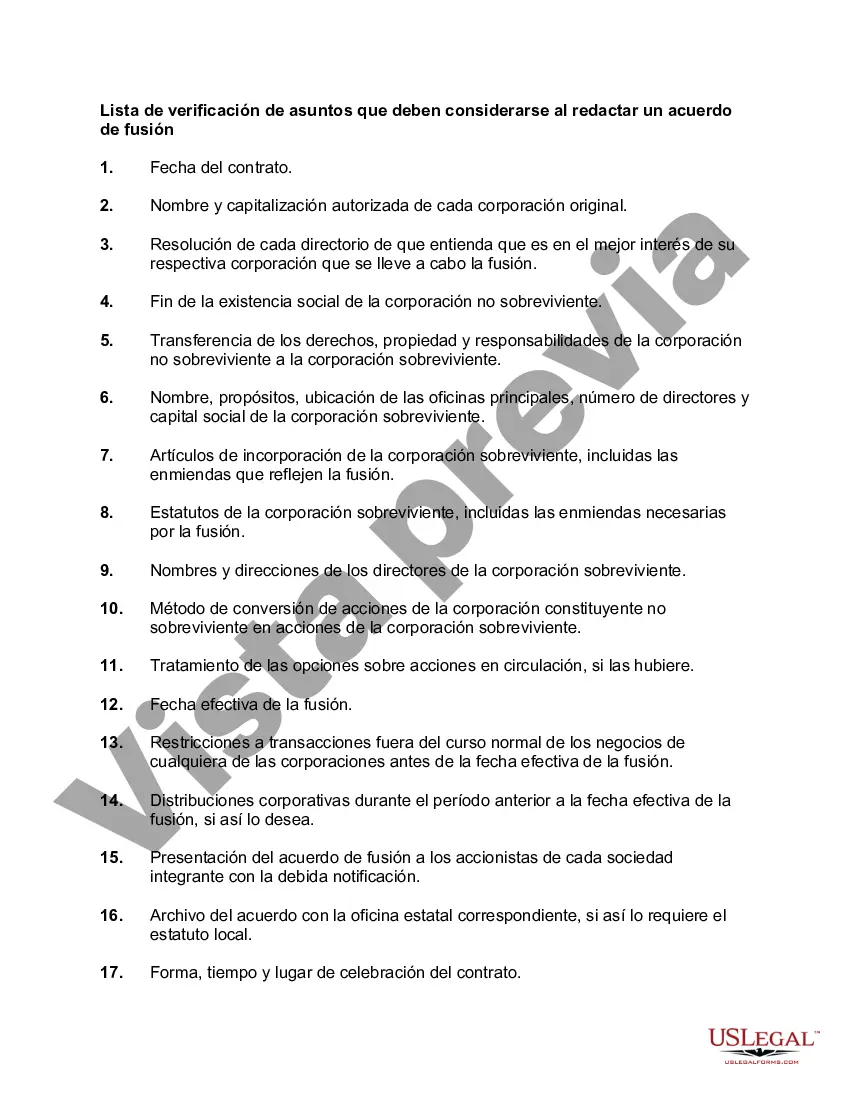

Wisconsin Merger Agreement Checklist: A Comprehensive Guide for Drafting a Merger Agreement Introduction: Drafting a merger agreement requires careful consideration of various legal, financial, and operational aspects to ensure a smooth and successful merger. In the state of Wisconsin, specific factors and provisions need to be taken into account to comply with state laws and regulations. This checklist outlines the key matters to be considered when drafting a merger agreement in Wisconsin, covering both general considerations and provisions unique to the state. 1. General Considerations: 1.1. Defining Parties: Clearly identify the merging entities, including their legal names, business names, and registered addresses. 1.2. Agreement Term: Specify the duration and effective date of the merger agreement. 1.3. Merger Purpose: Clearly state the primary objectives and reasons for the merger. 1.4. Merger Structure: Outline the proposed structure of the merger, whether it involves a statutory merger, stock purchase, or asset acquisition. 1.5. Consideration and Exchange Ratio: Determine the consideration to be given to the shareholders of the target entity and specify the exchange ratio, if applicable. 1.6. Board Approvals: Ensure that the merger agreement is ratified and approved by the boards of directors of both entities. 2. Wisconsin-Specific Provisions: 2.1. Compliance with Wisconsin Statutes: Ensure that the merger agreement adheres to the specific requirements outlined in the Wisconsin Business Corporation Act (Chapter 180) or other relevant Wisconsin statutes. 2.2. Reporting to State Authorities: Address any necessary filings or notifications required by the Wisconsin Department of Financial Institutions or other relevant state agencies. 2.3. Shareholder Approval: Verify the specific shareholder approval requirements as set forth in the Wisconsin statutes and establish the procedure for obtaining such approvals. 2.4. Dissenting Shareholders' Rights: Define the rights and obligations regarding dissenting shareholders and their entitlement to fair value in accordance with Wisconsin law. 2.5. Liability Protection: Consider including provisions to protect directors and officers from certain liabilities arising out of the merger in accordance with Wisconsin corporate law. 2.6. Taxes: Address any Wisconsin state tax implications resulting from the merger and allocate tax responsibilities between the parties. Additional Types of Wisconsin Checklist of Matters for Consideration: 1. Checklist for Drafting a Wisconsin LLC Merger Agreement: This checklist would focus on the unique requirements and considerations specific to limited liability company (LLC) mergers in Wisconsin, including compliance with the Wisconsin Limited Liability Company Act (Chapter 183) and the formation of a new LLC or the merger of existing LCS. 2. Checklist for Drafting a Wisconsin Partnership Merger Agreement: This checklist would outline the specific considerations and provisions relevant to mergers involving partnerships in Wisconsin, including compliance with the Wisconsin Revised Uniform Partnership Act (Chapter 178) and the rights and obligations of partners during the merger process. Conclusion: Drafting a merger agreement in Wisconsin requires a comprehensive understanding of both general merger principles and the specific legal framework of the state. By considering the general checklist items and the unique provisions outlined in this guide and tailoring them to the appropriate entity type, parties can ensure the adequacy, compliance, and success of their merger agreements in the state of Wisconsin.Wisconsin Merger Agreement Checklist: A Comprehensive Guide for Drafting a Merger Agreement Introduction: Drafting a merger agreement requires careful consideration of various legal, financial, and operational aspects to ensure a smooth and successful merger. In the state of Wisconsin, specific factors and provisions need to be taken into account to comply with state laws and regulations. This checklist outlines the key matters to be considered when drafting a merger agreement in Wisconsin, covering both general considerations and provisions unique to the state. 1. General Considerations: 1.1. Defining Parties: Clearly identify the merging entities, including their legal names, business names, and registered addresses. 1.2. Agreement Term: Specify the duration and effective date of the merger agreement. 1.3. Merger Purpose: Clearly state the primary objectives and reasons for the merger. 1.4. Merger Structure: Outline the proposed structure of the merger, whether it involves a statutory merger, stock purchase, or asset acquisition. 1.5. Consideration and Exchange Ratio: Determine the consideration to be given to the shareholders of the target entity and specify the exchange ratio, if applicable. 1.6. Board Approvals: Ensure that the merger agreement is ratified and approved by the boards of directors of both entities. 2. Wisconsin-Specific Provisions: 2.1. Compliance with Wisconsin Statutes: Ensure that the merger agreement adheres to the specific requirements outlined in the Wisconsin Business Corporation Act (Chapter 180) or other relevant Wisconsin statutes. 2.2. Reporting to State Authorities: Address any necessary filings or notifications required by the Wisconsin Department of Financial Institutions or other relevant state agencies. 2.3. Shareholder Approval: Verify the specific shareholder approval requirements as set forth in the Wisconsin statutes and establish the procedure for obtaining such approvals. 2.4. Dissenting Shareholders' Rights: Define the rights and obligations regarding dissenting shareholders and their entitlement to fair value in accordance with Wisconsin law. 2.5. Liability Protection: Consider including provisions to protect directors and officers from certain liabilities arising out of the merger in accordance with Wisconsin corporate law. 2.6. Taxes: Address any Wisconsin state tax implications resulting from the merger and allocate tax responsibilities between the parties. Additional Types of Wisconsin Checklist of Matters for Consideration: 1. Checklist for Drafting a Wisconsin LLC Merger Agreement: This checklist would focus on the unique requirements and considerations specific to limited liability company (LLC) mergers in Wisconsin, including compliance with the Wisconsin Limited Liability Company Act (Chapter 183) and the formation of a new LLC or the merger of existing LCS. 2. Checklist for Drafting a Wisconsin Partnership Merger Agreement: This checklist would outline the specific considerations and provisions relevant to mergers involving partnerships in Wisconsin, including compliance with the Wisconsin Revised Uniform Partnership Act (Chapter 178) and the rights and obligations of partners during the merger process. Conclusion: Drafting a merger agreement in Wisconsin requires a comprehensive understanding of both general merger principles and the specific legal framework of the state. By considering the general checklist items and the unique provisions outlined in this guide and tailoring them to the appropriate entity type, parties can ensure the adequacy, compliance, and success of their merger agreements in the state of Wisconsin.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.