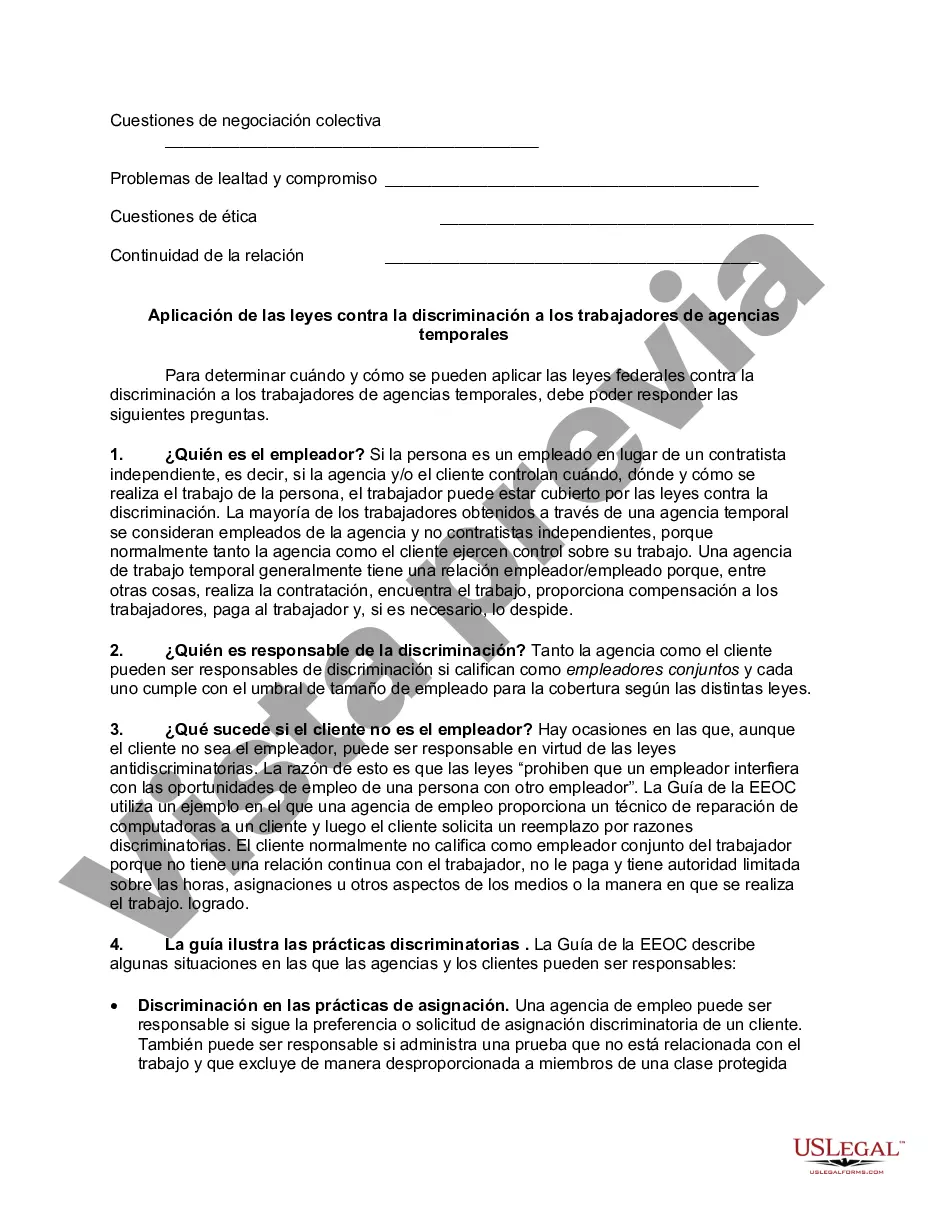

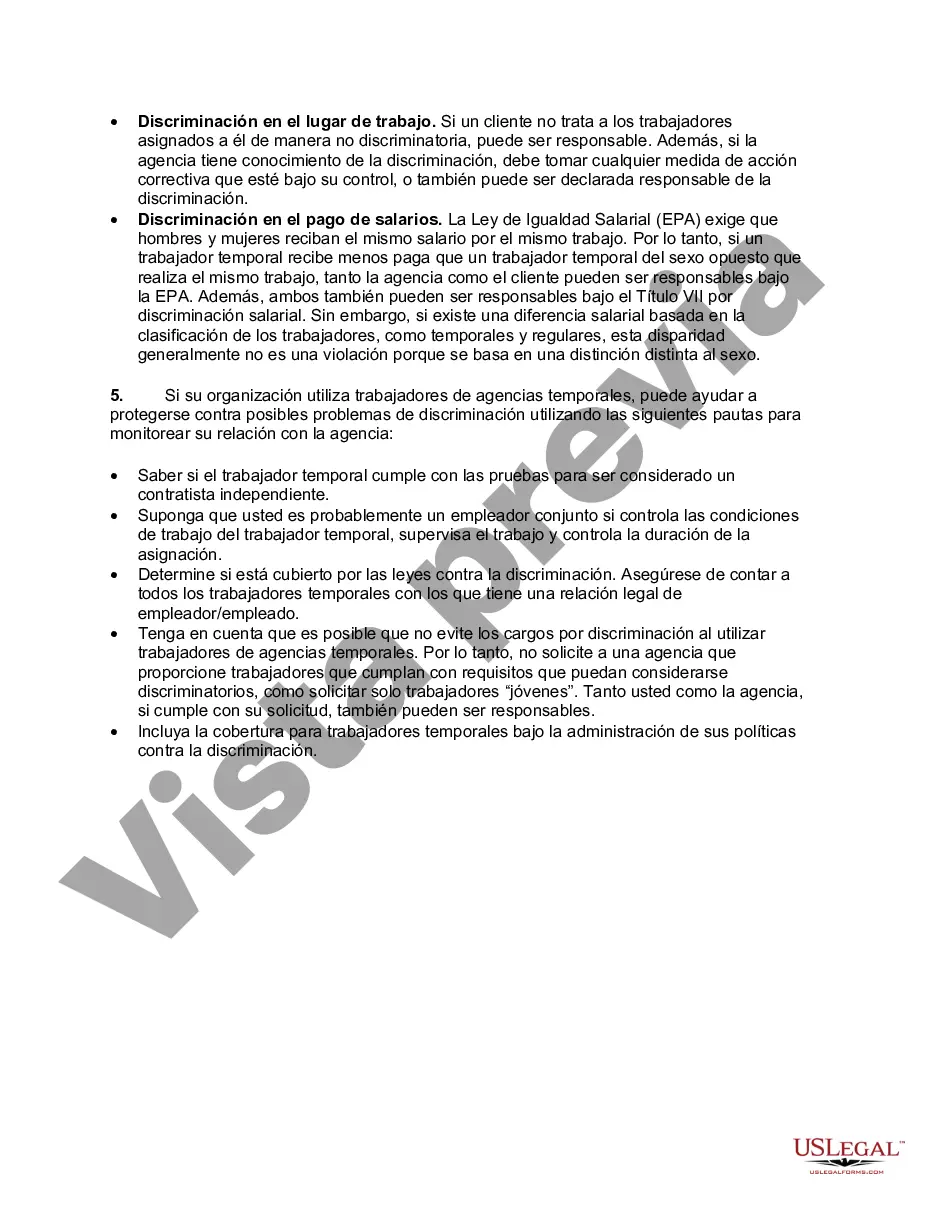

Wisconsin Worksheet — Contingent Worker is a document that provides a comprehensive overview and analysis of the contingent worker status in the state of Wisconsin. Contingent workers refer to individuals who are not traditional employees but rather work on a temporary or contract basis. This worksheet primarily aims to assist employers and HR professionals in understanding the various aspects related to contingent workers, such as their legal classification, tax implications, benefits, and rights. It serves as a crucial tool in ensuring compliance with state regulations and facilitating proper management of contingent workers within the organization. The Wisconsin Worksheet — Contingent Worker covers several key areas, including: 1. Definition and Types: This section defines who qualifies as a contingent worker in Wisconsin. It distinguishes between various types of contingent workers, such as independent contractors, temporary employees, freelancers, and consultants. 2. Legal Classification: Here, the worksheet delves into the legal considerations surrounding contingent worker classification. It explains the determining factors used by state authorities, such as the level of control exerted by the employer and the nature of the work performed. 3. Tax Obligations: Understanding the tax implications of hiring contingent workers is crucial for both employers and workers themselves. This section outlines the employer's responsibilities in terms of withholding taxes, issuing tax forms, and reporting requirements. It also provides guidance on the tax obligations of contingent workers. 4. Benefits and Protections: Wisconsin Worksheet — Contingent Worker sheds light on the rights and benefits contingent workers are entitled to under state law. It outlines issues such as minimum wage requirements, workers' compensation, unemployment insurance, and discrimination protection. 5. Hiring and Termination Considerations: This part focuses on the specific considerations involved in hiring and terminating contingent workers. It discusses recruitment methods, contract negotiations, performance evaluations, and the necessary steps for legally ending the working relationship. 6. Record keeping and Documentation: Maintaining accurate records is essential when dealing with contingent workers. The worksheet includes guidelines on the types of records employers should keep, such as contracts, timesheets, invoices, and any relevant communications. Different types of Wisconsin Worksheet — Contingent Worker may exist based on industry-specific regulations or specific employer requirements. For example, there could be tailored versions for healthcare organizations, construction companies, or tech startups. These variations might highlight additional considerations unique to the respective industries, such as compliance requirements or sector-specific employment laws. In summary, the Wisconsin Worksheet — Contingent Worker provides a comprehensive guide for employers and HR professionals to navigate the complexities of contingent worker management in Wisconsin. It encompasses crucial aspects like legal classification, tax obligations, benefits, and hiring considerations. By utilizing this resource, employers can ensure compliance with state regulations and effectively manage their contingent workforce.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Hoja de trabajo - Trabajador eventual - Worksheet - Contingent Worker

Description

How to fill out Wisconsin Hoja De Trabajo - Trabajador Eventual?

It is possible to spend several hours on the Internet searching for the legal papers format which fits the federal and state specifications you want. US Legal Forms offers thousands of legal types which can be reviewed by pros. It is possible to acquire or print out the Wisconsin Worksheet - Contingent Worker from my assistance.

If you currently have a US Legal Forms accounts, you can log in and click on the Download switch. Afterward, you can complete, modify, print out, or sign the Wisconsin Worksheet - Contingent Worker. Every legal papers format you buy is your own property permanently. To get yet another version associated with a acquired kind, go to the My Forms tab and click on the related switch.

If you are using the US Legal Forms website the first time, keep to the straightforward guidelines beneath:

- Very first, make sure that you have chosen the best papers format for that county/area of your liking. Look at the kind outline to ensure you have picked out the correct kind. If accessible, utilize the Review switch to search throughout the papers format also.

- If you would like get yet another model of the kind, utilize the Look for area to find the format that suits you and specifications.

- Once you have located the format you desire, click Get now to carry on.

- Find the rates strategy you desire, key in your qualifications, and register for an account on US Legal Forms.

- Complete the financial transaction. You can utilize your charge card or PayPal accounts to cover the legal kind.

- Find the format of the papers and acquire it for your system.

- Make alterations for your papers if necessary. It is possible to complete, modify and sign and print out Wisconsin Worksheet - Contingent Worker.

Download and print out thousands of papers web templates making use of the US Legal Forms web site, that offers the most important selection of legal types. Use specialist and state-particular web templates to deal with your business or person requirements.