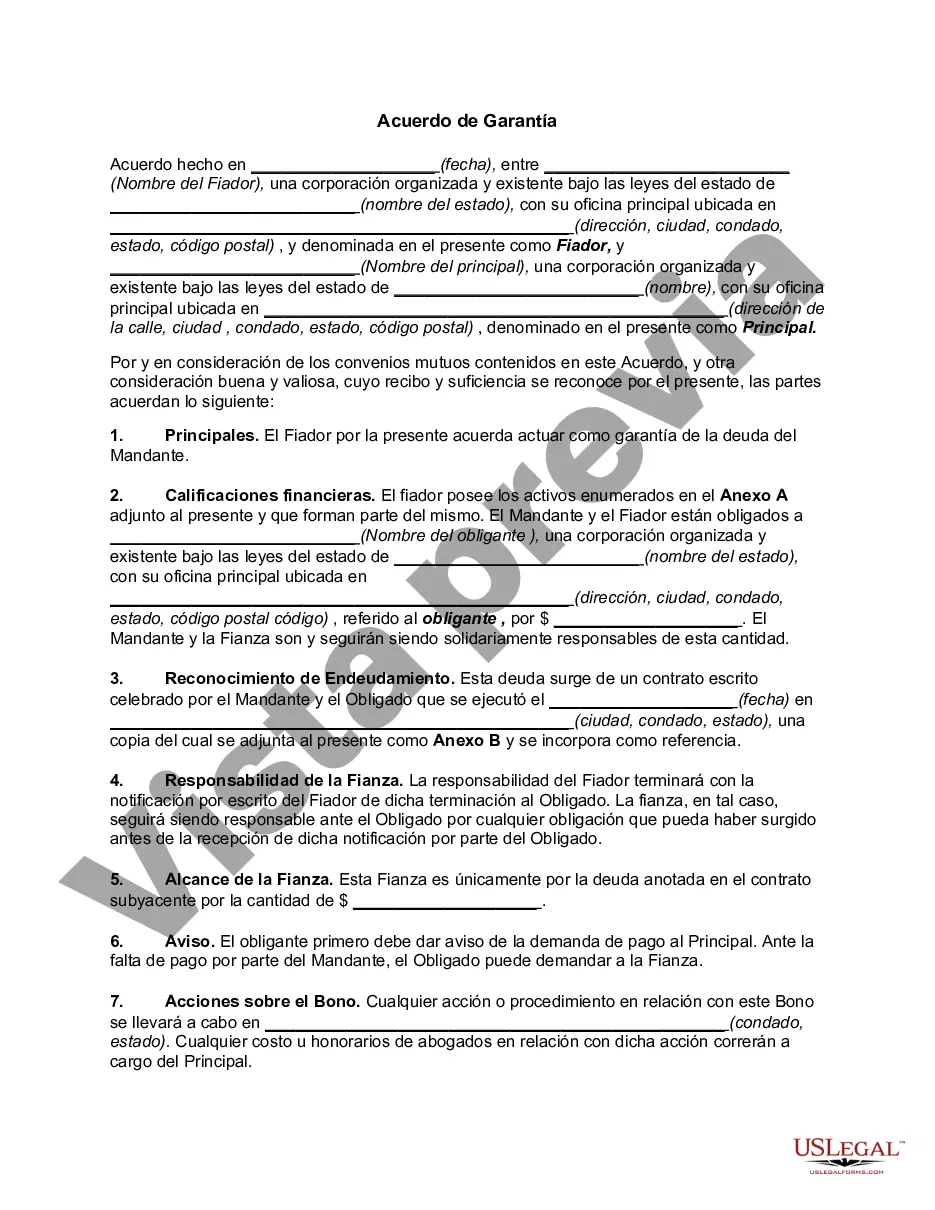

A Wisconsin Surety Agreement is a legal contract between three parties: the principal (the party who requires a bond), the surety (the party providing the bond), and the obliged (the party protected by the bond). This agreement ensures that in the event the principal fails to fulfill their obligations or defaults on a contract, the surety will step in and provide compensation to the obliged. The Wisconsin Surety Agreement serves as a guarantee that the principal will fulfill its contractual obligations, such as completing a construction project, complying with laws and regulations, or repaying a loan. By signing this legally binding document, the principal agrees to indemnify the surety for any loss incurred as a result of their actions or inaction. There are various types of Wisconsin Surety Agreements catering to different industries and needs. Some common types include: 1. Performance Bonds: These bonds guarantee that the principal will complete a project as specified in the contract, meeting all specifications and quality standards. If the principal fails to do so, the surety will compensate the obliged for any financial loss. 2. Payment Bonds: Payment bonds ensure that subcontractors and suppliers will be paid by the principal on time for their services and materials. If the principal fails to make these payments, the surety steps in to fulfill the financial obligations. 3. Bid Bonds: Bid bonds are typically required during the bidding process for construction projects. This bond assures the project owner that if the principal is awarded the contract, they will enter into the contract and provide the necessary performance and payment bonds. 4. License and Permit Bonds: These bonds are commonly required by Wisconsin government agencies as a prerequisite for obtaining licenses or permits. They ensure that the principal will comply with all applicable laws, regulations, and codes. 5. Court Bonds: When a court requires a guarantee of payment or performance, court bonds are used. These include appeal bonds, guardian or trustee bonds, and injunction bonds, among others. Wisconsin Surety Agreements play a crucial role in protecting the interests of all parties involved in a contractual relationship. They provide financial security and serve as a strong deterrent against non-performance or default by the principal. It is essential to understand the specific type of surety agreement required for a particular situation to ensure compliance with Wisconsin laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Acuerdo de Garantía - Surety Agreement

Description

How to fill out Wisconsin Acuerdo De Garantía?

If you want to complete, down load, or print legal document web templates, use US Legal Forms, the most important collection of legal types, that can be found on the Internet. Take advantage of the site`s basic and handy search to discover the paperwork you want. A variety of web templates for organization and personal functions are categorized by groups and says, or search phrases. Use US Legal Forms to discover the Wisconsin Surety Agreement with a number of clicks.

If you are presently a US Legal Forms customer, log in to your account and click on the Download button to find the Wisconsin Surety Agreement. You can even access types you formerly acquired inside the My Forms tab of your own account.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for that correct town/nation.

- Step 2. Utilize the Review choice to check out the form`s content. Don`t forget to read through the information.

- Step 3. If you are not satisfied with all the type, use the Lookup field near the top of the monitor to discover other variations of the legal type template.

- Step 4. After you have located the form you want, click the Acquire now button. Choose the costs prepare you choose and add your accreditations to register to have an account.

- Step 5. Approach the transaction. You can utilize your credit card or PayPal account to accomplish the transaction.

- Step 6. Select the format of the legal type and down load it on your gadget.

- Step 7. Full, revise and print or sign the Wisconsin Surety Agreement.

Every single legal document template you get is your own property permanently. You possess acces to every type you acquired within your acccount. Click the My Forms area and choose a type to print or down load yet again.

Contend and down load, and print the Wisconsin Surety Agreement with US Legal Forms. There are many specialist and status-particular types you can use to your organization or personal needs.