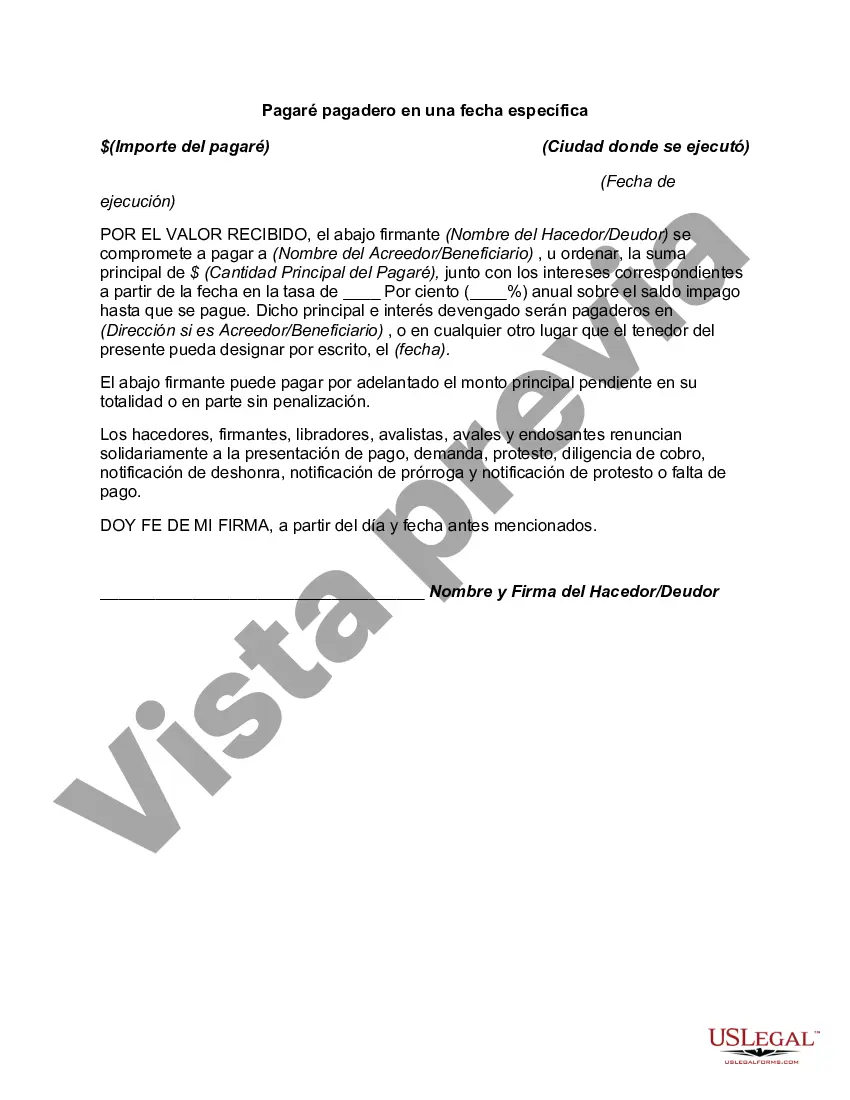

A Wisconsin Promissory Note Payable on a Specific Date is a legally binding document that outlines the terms and conditions of a loan agreement between a borrower and a lender in the state of Wisconsin. This type of promissory note specifies a specific date on which the borrower is obligated to repay the loan amount, including any interest or fees that may have been agreed upon. Wisconsin Promissory Notes Payable on a Specific Date can vary depending on the purpose and conditions of the loan. Here are some different types: 1. Personal Loan Promissory Note: This type of promissory note is commonly used for loans between individuals and/or family members. It outlines the loan amount, repayment terms, interest rate (if applicable), and any other conditions agreed upon by both parties. 2. Business Loan Promissory Note: This promissory note is used when a business borrows money from an individual or another business entity. It details the loan amount, repayment terms, interest rate, collateral (if any), and any other relevant provisions. 3. Real Estate Promissory Note: In real estate transactions, a promissory note is often used to document the terms of a loan for purchasing or refinancing a property. It includes the loan amount, interest rate, repayment schedule, and any relevant provisions specific to the transaction. 4. Student Loan Promissory Note: This type of promissory note is used for educational loans, usually issued by governmental or private entities. It outlines the loan amount, repayment terms, interest rate, deferment or forbearance options, and any other conditions related to the specific student loan program. 5. Installment Sale Promissory Note: This type of promissory note is utilized when a seller agrees to finance the purchase of a good or service over a specified period. It outlines the purchase price, agreed-upon installments, interest rate (if applicable), and any other terms or conditions relevant to the transaction. When dealing with a Wisconsin Promissory Note Payable on a Specific Date, it is crucial to consult with a legal professional to ensure all necessary information and obligations are accurately outlined within the document. Adhering to the specific requirements set by the state ensures the enforceability and validity of the promissory note.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Pagaré pagadero en una fecha específica - Promissory Note Payable on a Specific Date

Description

How to fill out Wisconsin Pagaré Pagadero En Una Fecha Específica?

US Legal Forms - one of several biggest libraries of authorized types in the USA - provides a wide range of authorized record web templates you can acquire or produce. Using the internet site, you can find thousands of types for business and specific purposes, sorted by types, says, or keywords and phrases.You can get the most recent types of types like the Wisconsin Promissory Note Payable on a Specific Date in seconds.

If you currently have a monthly subscription, log in and acquire Wisconsin Promissory Note Payable on a Specific Date through the US Legal Forms catalogue. The Download button can look on every single form you see. You have accessibility to all previously delivered electronically types within the My Forms tab of your own accounts.

If you want to use US Legal Forms initially, here are simple guidelines to obtain began:

- Be sure to have chosen the best form for your metropolis/area. Click the Review button to analyze the form`s information. Read the form explanation to actually have selected the proper form.

- In case the form does not match your specifications, use the Look for area on top of the display to find the the one that does.

- If you are happy with the form, confirm your decision by clicking the Get now button. Then, select the pricing program you want and offer your credentials to sign up for the accounts.

- Process the financial transaction. Use your charge card or PayPal accounts to finish the financial transaction.

- Choose the formatting and acquire the form on your product.

- Make alterations. Fill out, change and produce and indication the delivered electronically Wisconsin Promissory Note Payable on a Specific Date.

Every format you included in your account does not have an expiration date and is the one you have eternally. So, if you want to acquire or produce yet another version, just proceed to the My Forms area and click in the form you need.

Gain access to the Wisconsin Promissory Note Payable on a Specific Date with US Legal Forms, probably the most extensive catalogue of authorized record web templates. Use thousands of professional and condition-particular web templates that fulfill your business or specific demands and specifications.