Wisconsin Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a type of trust established in Wisconsin that offers specific benefits and provisions to the trust or. This type of trust allows the trust or to create a trust for their future benefit, while also providing them with income payable over a designated period. The trust is considered irrevocable, meaning that once it is established, the trust or cannot modify or revoke the terms without the consent of the beneficiaries or a court order. The Wisconsin Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time has several variations depending on the specific requirements and preferences of the trust or. Some common types include: 1. Wisconsin Irrevocable Trust with Income Payable to Trust or after Specified Time: This type of trust allows the trust or to receive income from the trust assets after a specified period. The income payments can be set up monthly, annually, or based on any other agreed-upon timeframe. 2. Wisconsin Charitable Remainder Trust: This trust allows the trust or to receive income from the trust assets during their lifetime, with the remaining assets going to a designated charitable organization after the specified time or upon the trust or's death. 3. Wisconsin Dynasty Trust: A dynasty trust is established to provide long-term wealth preservation for multiple generations. The trust assets are held in perpetuity, allowing the income to be payable to the trust or their designated beneficiaries after the specified time. 4. Wisconsin Special Needs Trust: This type of trust aims to secure the financial future of a person with special needs. The income from the trust is payable to the trust or the designated beneficiary with special needs, ensuring they have financial support while maintaining eligibility for government benefits. 5. Wisconsin Granter Retained Annuity Trust: A granter retained annuity trust allows the trust or to transfer assets into the trust while retaining an annuity payment for a specified period. After the specified time, the remaining assets are transferred to the designated beneficiaries. The Wisconsin Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time provides the trust or with the flexibility to plan for their future needs while ensuring a reliable income stream. It is important to consult with a legal professional or a financial advisor to understand the specific requirements, tax implications, and benefits associated with this type of trust.

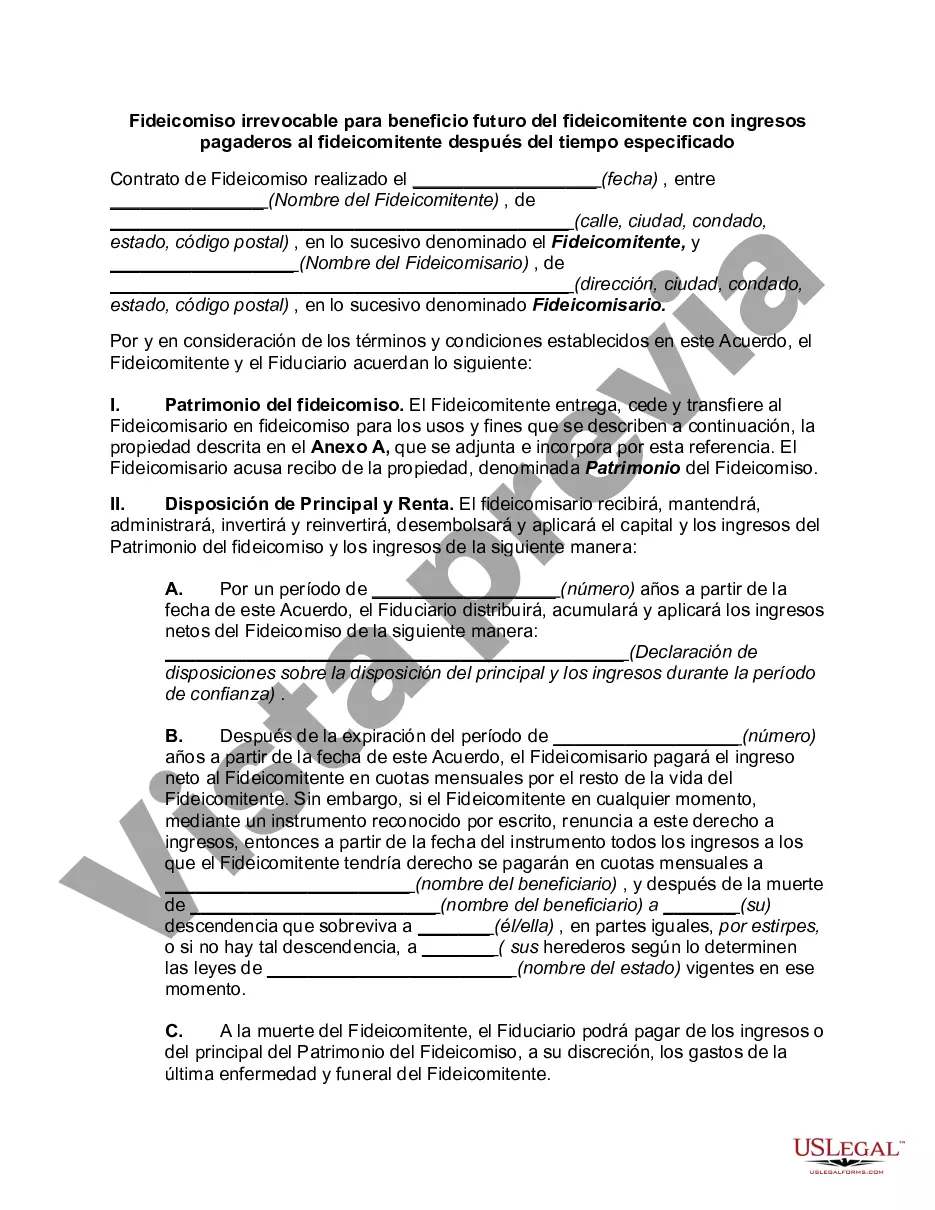

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Wisconsin Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

Are you currently inside a position the place you need to have paperwork for sometimes enterprise or personal functions nearly every time? There are tons of authorized document layouts available on the Internet, but locating types you can rely on isn`t straightforward. US Legal Forms offers a huge number of kind layouts, just like the Wisconsin Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, which can be published to satisfy federal and state demands.

If you are currently acquainted with US Legal Forms site and possess an account, simply log in. Following that, you may acquire the Wisconsin Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time template.

Unless you come with an bank account and would like to start using US Legal Forms, follow these steps:

- Obtain the kind you want and ensure it is for your appropriate town/county.

- Make use of the Preview key to examine the shape.

- Browse the outline to actually have chosen the proper kind.

- When the kind isn`t what you are seeking, take advantage of the Lookup discipline to get the kind that meets your requirements and demands.

- If you obtain the appropriate kind, click on Acquire now.

- Select the pricing prepare you desire, submit the desired details to produce your bank account, and pay for your order making use of your PayPal or bank card.

- Select a handy file formatting and acquire your version.

Get every one of the document layouts you possess bought in the My Forms menus. You may get a further version of Wisconsin Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time at any time, if necessary. Just click on the needed kind to acquire or produce the document template.

Use US Legal Forms, probably the most substantial variety of authorized forms, to save some time and steer clear of errors. The service offers expertly manufactured authorized document layouts which you can use for a variety of functions. Make an account on US Legal Forms and initiate generating your daily life a little easier.