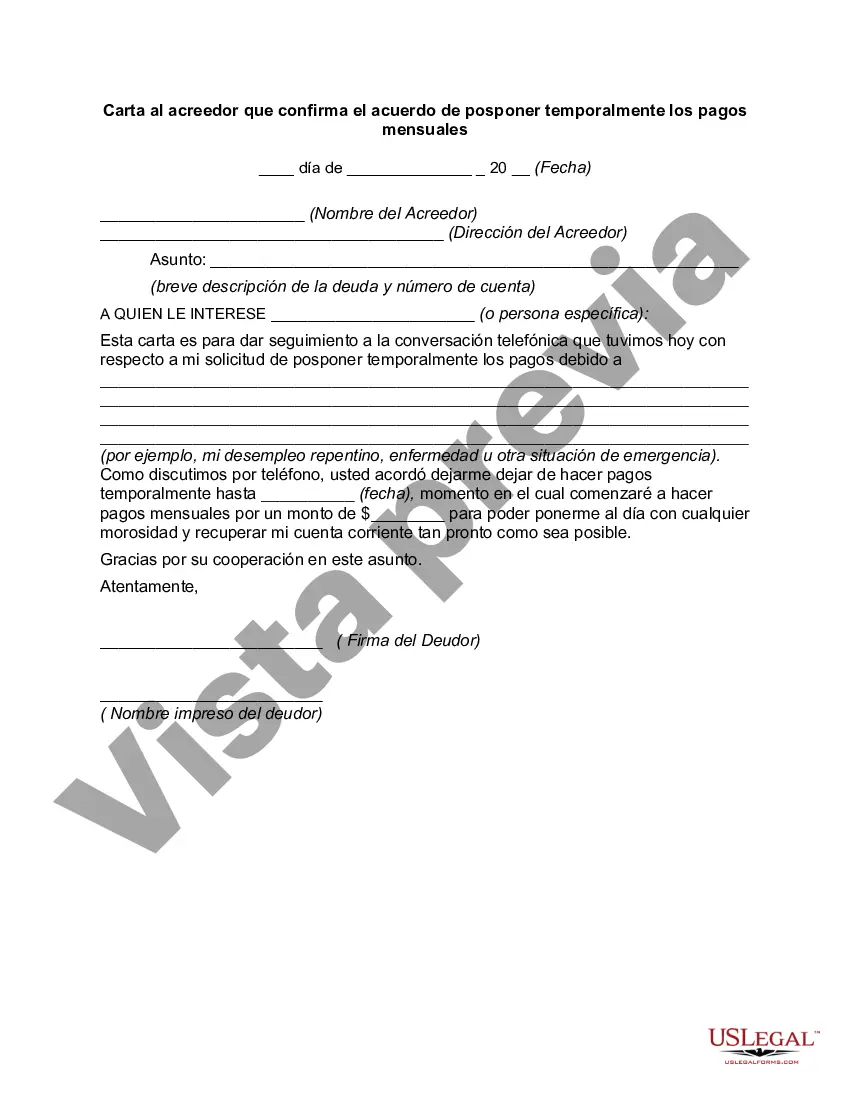

Title: Wisconsin Letter to Creditor Confirming Agreement for Temporary Postponement of Monthly Payments Introduction: In this article, we will provide a detailed description of a Wisconsin letter to a creditor that confirms an agreement to temporarily postpone monthly payments. This type of letter is typically used when borrowers in Wisconsin are facing financial challenges and need temporary relief from their payment obligations. We will also explore a few variations of this letter based on specific situations. Content: 1. Purpose of the Wisconsin Letter to Creditor: The main purpose of this letter is to formally communicate with your creditor in Wisconsin to reach an agreement for temporary postponement of monthly payments. It is an essential tool for borrowers who are experiencing financial hardship due to unexpected circumstances like job loss, medical emergencies, or other financial setbacks. 2. Key Elements of the Letter: — Sender Information: Start the letter by clearly stating your name, address, and contact details. — Creditor Information: Provide the creditor's name, address, and contact details. — Account/Applicant Details: Mention the relevant account number or any other identifying information pertaining to the loan or credit account. — Reason for Request: Briefly explain the reason for your financial hardship, emphasizing its temporary nature. — Request for Temporary Postponement: Clearly state your request to temporarily postpone monthly payments for a specific period. Mention the proposed new payment start date. — Duration of the Temporary Postponement: Specify the timeline for the suspension of payments, ensuring it aligns with your financial circumstances. — Payment Adjustment Agreement: Discuss the agreed-upon arrangement for the postponed payments, such as extending the loan term or recalculating the payment schedule, to ensure any potential loans do not accrue additional interest or penalties. — Contact Information: Provide your preferred method of contact (phone, email), ensuring that the creditor has a way to reach you if necessary. — Gratitude: Conclude the letter with a polite expression of gratitude, thanking the creditor for considering your request and their cooperation during this difficult time. 3. Variations of Wisconsin Letter: a. Wisconsin Letter to Creditor Confirming Temporary Postponement due to Job Loss: This variation specifically addresses the situation where the borrower has lost their job. It elaborates on the job loss circumstances and the steps the borrower is taking to secure new employment. b. Wisconsin Letter to Creditor Confirming Temporary Postponement due to Medical Emergency: This variation centers around a medical emergency, providing details about the nature of the situation, medical treatments, and the associated expenses that have caused financial stress. c. Wisconsin Letter to Creditor Confirming Temporary Postponement due to Natural Disaster: In the event of a natural disaster, this variation highlights the impact on the borrower's personal property, the need for funding the recovery and repair process, and the temporary inability to make regular monthly payments. Conclusion: Writing a well-structured and informative Wisconsin letter to a creditor confirming a temporary postponement of monthly payments is crucial for borrowers facing financial hardship. By clearly and respectfully communicating your situation, providing necessary details, and proposing a mutually agreeable arrangement, you increase the likelihood of achieving temporary relief. Remember to tailor your letter to your specific circumstances, whether it's job loss, a medical emergency, or natural disaster-related challenges.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Carta al acreedor que confirma el acuerdo de posponer temporalmente los pagos mensuales - Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed

Description

How to fill out Wisconsin Carta Al Acreedor Que Confirma El Acuerdo De Posponer Temporalmente Los Pagos Mensuales?

US Legal Forms - one of the most significant libraries of legal varieties in the United States - gives a wide range of legal record web templates you may download or print. Making use of the web site, you can find thousands of varieties for enterprise and specific reasons, sorted by types, claims, or keywords.You will discover the most recent variations of varieties much like the Wisconsin Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed within minutes.

If you already have a membership, log in and download Wisconsin Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed from the US Legal Forms collection. The Download button will show up on each type you perspective. You get access to all in the past saved varieties within the My Forms tab of your profile.

If you wish to use US Legal Forms the first time, listed here are straightforward recommendations to obtain started out:

- Ensure you have picked the right type for the city/region. Go through the Review button to examine the form`s content material. Look at the type information to ensure that you have selected the correct type.

- In the event the type doesn`t fit your demands, utilize the Look for area towards the top of the monitor to discover the one that does.

- In case you are happy with the form, verify your decision by simply clicking the Buy now button. Then, select the prices plan you want and provide your qualifications to register on an profile.

- Procedure the transaction. Make use of charge card or PayPal profile to finish the transaction.

- Select the file format and download the form on the device.

- Make alterations. Fill out, revise and print and indicator the saved Wisconsin Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed.

Each and every design you added to your money does not have an expiration day which is the one you have forever. So, if you wish to download or print an additional version, just visit the My Forms segment and then click about the type you want.

Gain access to the Wisconsin Letter to Creditor Confirming Agreement that Monthly Payments be Temporarily Postponed with US Legal Forms, the most substantial collection of legal record web templates. Use thousands of specialist and status-particular web templates that meet up with your small business or specific requirements and demands.