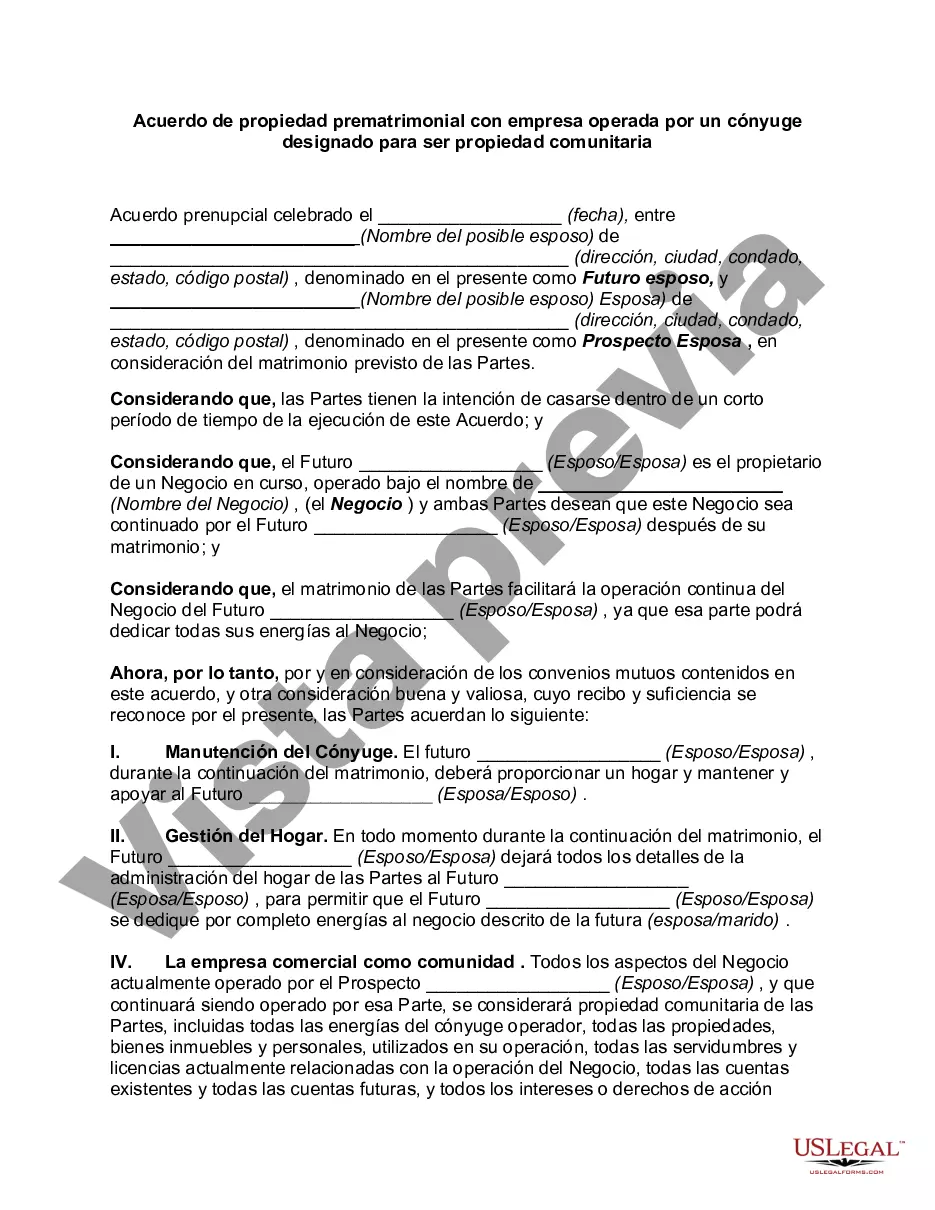

A Wisconsin Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property is a legal contract entered into by individuals getting married in the state of Wisconsin. This agreement aims to outline the rights, responsibilities, and division of assets in the event of a divorce and specifically addresses the treatment of a business owned and operated by one spouse during the marriage. In Wisconsin, there are two primary types of prenuptial property agreements that can be used when a business operated by one spouse is designated as community property. These are: 1. Traditional Prenuptial Property Agreement: This type of agreement allows couples to determine the division of property, including a business, in case of a divorce. The spouses can specify how the business's value and any future earnings will be handled, whether it remains separate property or becomes part of the community property. This agreement can also lay out the terms of ownership, management, and distribution of profits during the marriage. 2. Community Property Agreement: In Wisconsin, couples have the option to create a Community Property Agreement (CPA) that designates all or specific assets, including a business, as community property. By signing a CPA, both spouses agree to treat specified assets as jointly owned throughout their marriage. If the marriage ends in divorce, these assets, including the business, will be divided equally among the spouses unless otherwise stated in the agreement. A CPA can offer certain tax advantages and simplify the division of assets later on. Regardless of the type chosen, a Wisconsin Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property typically addresses the following key elements: 1. Business Ownership: The agreement will clarify the ownership of the business, whether it remains the sole property of the operating spouse, or if it becomes community property. 2. Valuation of the Business: It is crucial to outline the methodology used to value the business if a divorce occurs. This can be done by specifying an agreed-upon valuation method or by appointing an independent appraiser. 3. Distribution of Assets: The agreement will define how the business's assets, income, and profits will be distributed in case of divorce. This may include the division of shares, sale of the business, or other agreed-upon arrangements. 4. Spousal Support: The agreement can address whether and how spousal support or alimony will be provided, considering the circumstances of the business and its impact on the spouse who did not actively operate the business. 5. Financial Obligations: Any financial obligations related to the business, such as debts, loans, or obligations to business partners, investors, or third parties, can be outlined in the agreement, specifying how they will be apportioned in case of divorce. 6. Amendments and Termination: The agreement should mention the procedure for making amendments if necessary. It could also include termination provisions, such as the agreement automatically becoming void after a certain period or under specific circumstances. In summary, a Wisconsin Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property is a legally binding contract that provides clarity regarding the treatment, division, and management of a business during a marriage and in the event of a divorce in the state of Wisconsin.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Acuerdo de propiedad prematrimonial con empresa operada por un cónyuge designado para ser propiedad comunitaria - Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property

Description

How to fill out Wisconsin Acuerdo De Propiedad Prematrimonial Con Empresa Operada Por Un Cónyuge Designado Para Ser Propiedad Comunitaria?

Are you inside a position where you need to have files for both enterprise or personal uses nearly every time? There are a lot of lawful document themes available on the net, but discovering ones you can trust is not effortless. US Legal Forms offers a huge number of develop themes, like the Wisconsin Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property, which can be created to fulfill federal and state requirements.

In case you are already informed about US Legal Forms website and possess a merchant account, simply log in. Following that, it is possible to acquire the Wisconsin Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property design.

If you do not come with an profile and would like to start using US Legal Forms, adopt these measures:

- Obtain the develop you want and make sure it is for that correct town/region.

- Utilize the Preview button to review the form.

- See the outline to actually have selected the proper develop.

- In the event the develop is not what you`re seeking, utilize the Research discipline to discover the develop that suits you and requirements.

- If you find the correct develop, just click Acquire now.

- Choose the rates prepare you would like, submit the desired details to generate your money, and buy an order making use of your PayPal or credit card.

- Select a convenient paper format and acquire your duplicate.

Discover every one of the document themes you may have bought in the My Forms menus. You can aquire a further duplicate of Wisconsin Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property at any time, if necessary. Just go through the required develop to acquire or print the document design.

Use US Legal Forms, one of the most considerable variety of lawful varieties, to save efforts and avoid faults. The service offers professionally produced lawful document themes that can be used for a selection of uses. Generate a merchant account on US Legal Forms and start making your way of life easier.