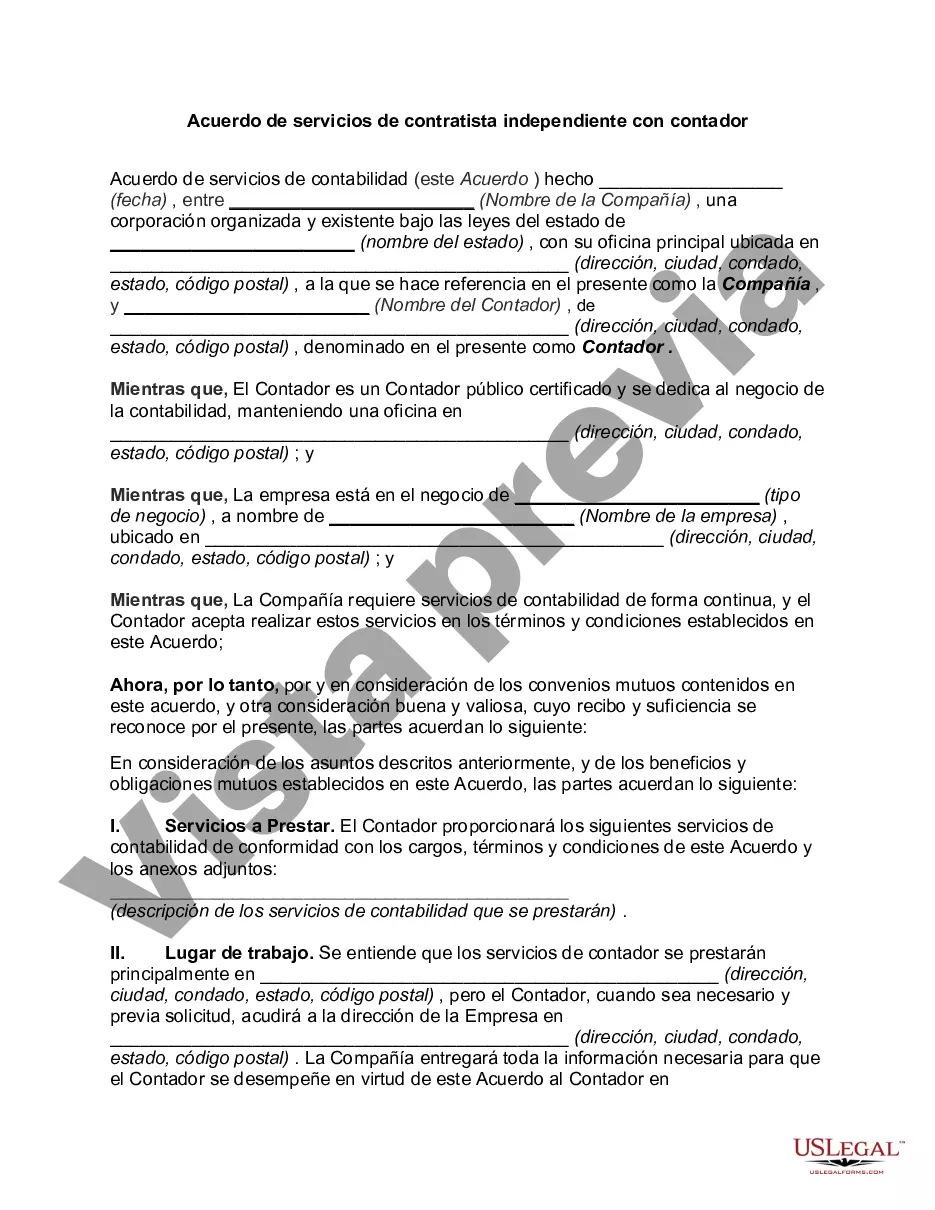

Wisconsin Independent Contractor Agreement for Accountant and Bookkeeper is a legal document that establishes a formal working relationship between an independent accountant or bookkeeper and a client in the state of Wisconsin. This agreement outlines the terms and conditions of the business arrangement, ensuring that both parties are protected and their expectations are clearly defined. The agreement typically includes key provisions such as: 1. Scope of Work: Clearly defining the services that the accountant or bookkeeper will provide. It may include tasks like maintaining financial records, preparing tax returns, conducting audits, or providing financial advisory services. 2. Compensation: Outlining the agreed-upon payment structure, whether it is an hourly rate, fixed fee, or commission-based. Additionally, the frequency and method of payment should be specified. 3. Duration and Termination: Specifying the length of the agreement, including the start date and the possibility of renewal. Termination conditions, such as breach of contract, non-performance, or mutual agreement, should also be addressed. 4. Independent Contractor Status: Clarifying that the accountant or bookkeeper is an independent contractor rather than an employee, thus highlighting that they are responsible for their own taxes, insurance, and other business-related expenses. 5. Confidentiality: Including provisions to protect the client's confidential information, trade secrets, and any proprietary knowledge obtained during the engagement. 6. Intellectual Property: Addressing ownership rights to any work product, reports, or other intellectual property created during the course of the engagement. 7. Indemnification: Defining responsibility in case of any claims, damages, or liabilities that may arise during the contractual relationship. 8. Non-Solicitation: Restricting the accountant or bookkeeper from directly soliciting the client's customers or employees for a specified period after the termination of the agreement. 9. Governing Law and Jurisdiction: Determining that the agreement will be governed by the laws of the state of Wisconsin and which courts will have jurisdiction in case of any disputes. There may be variations of the Wisconsin Independent Contractor Agreement for Accountant and Bookkeeper depending on the specific needs or specialized services required by the client. Examples of these variations include: 1. Wisconsin Independent Contractor Agreement for Tax Preparation Services: Catered specifically to accountants providing tax-related services, such as filing personal or business tax returns, offering tax planning advice, and representing clients before tax authorities. 2. Wisconsin Independent Contractor Agreement for Forensic Accounting Services: Focused on accountants or bookkeepers offering forensic accounting services, which involve investigating and interpreting financial records for legal matters such as fraud investigations or disputes. 3. Wisconsin Independent Contractor Agreement for Financial Advisory Services: Tailored to accountants or bookkeepers who provide comprehensive financial planning, analysis, and advisory services to individuals or businesses. In conclusion, the Wisconsin Independent Contractor Agreement for Accountant and Bookkeeper is a vital legal document that protects the rights and defines the responsibilities of the parties involved in an independent contractor-client relationship. By addressing essential elements in the agreement, such as scope of work, compensation, confidentiality, and termination conditions, both the accountant/bookkeeper and client can ensure a mutual understanding and a successful working arrangement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Acuerdo de contratista independiente para contador y tenedor de libros - Independent Contractor Agreement for Accountant and Bookkeeper

Description

How to fill out Wisconsin Acuerdo De Contratista Independiente Para Contador Y Tenedor De Libros?

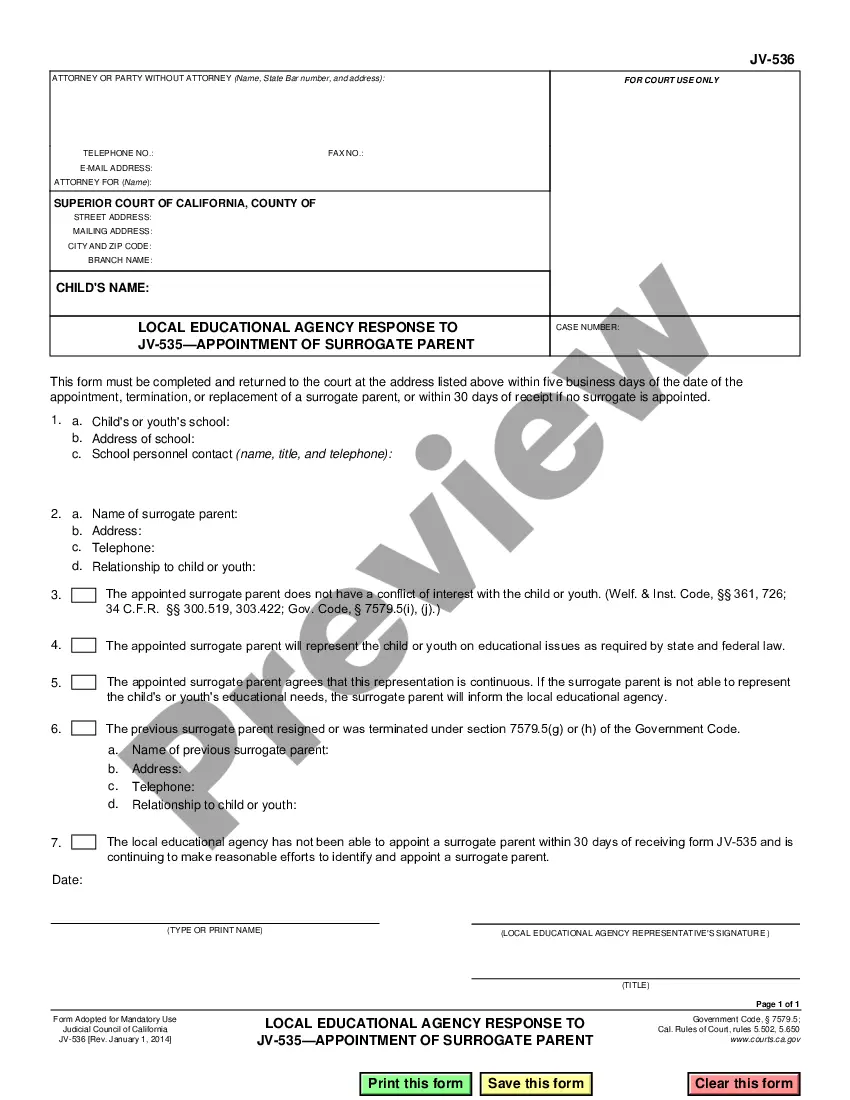

You may invest hrs on the Internet searching for the lawful papers template that suits the state and federal specifications you require. US Legal Forms provides a large number of lawful kinds which can be examined by specialists. It is possible to acquire or print the Wisconsin Independent Contractor Agreement for Accountant and Bookkeeper from the support.

If you have a US Legal Forms accounts, it is possible to log in and click on the Download option. Following that, it is possible to complete, revise, print, or signal the Wisconsin Independent Contractor Agreement for Accountant and Bookkeeper. Every lawful papers template you buy is yours eternally. To obtain an additional backup for any acquired form, visit the My Forms tab and click on the corresponding option.

If you use the US Legal Forms site the first time, adhere to the simple guidelines beneath:

- Very first, be sure that you have selected the best papers template for your area/metropolis of your choosing. See the form explanation to ensure you have selected the appropriate form. If offered, make use of the Review option to appear throughout the papers template also.

- If you wish to locate an additional variation in the form, make use of the Research industry to find the template that meets your needs and specifications.

- After you have located the template you would like, just click Get now to move forward.

- Choose the prices prepare you would like, type your accreditations, and register for your account on US Legal Forms.

- Complete the financial transaction. You can use your bank card or PayPal accounts to fund the lawful form.

- Choose the format in the papers and acquire it to your system.

- Make changes to your papers if required. You may complete, revise and signal and print Wisconsin Independent Contractor Agreement for Accountant and Bookkeeper.

Download and print a large number of papers web templates utilizing the US Legal Forms website, that offers the biggest collection of lawful kinds. Use expert and express-certain web templates to take on your business or personal demands.

Form popularity

FAQ

Small to mid-size businesses might employ their own bookkeepers. But in recent years, many have started offering bookkeeping services on a self-employed basis. This is good for businesses, as it means they can get all the benefits of a bookkeeper without having to employ a full-time member of staff.

There are no legal requirements for a self-employed bookkeeper to have any formal qualifications. However, if you are planning to start a bookkeeping business, it is essential you have bookkeeping experience.

How to Become an Independent BookkeeperGet Your Degree. No one's going to trust you with their money if you haven't studied accounting and bookkeeping.Gain Practical Experience.Add Some Credentials.Handle Your Legal Issues.Start Marketing Yourself.

Small to mid-size businesses might employ their own bookkeepers. But in recent years, many have started offering bookkeeping services on a self-employed basis. This is good for businesses, as it means they can get all the benefits of a bookkeeper without having to employ a full-time member of staff.

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

So, it's hard to say exactly what you can earn as a freelance bookkeeper in the UK. But a typical hourly rate would be between £10-A£25 depending on experience. The average hourly pay for a bookkeeper in the UK is calculated at A£11.89 by Payscale, with annual salaries between A£18,000 and A£36,000.

How to become a bookkeeperPursue a high school degree. Unlike accountants, many bookkeepers have associate's or bachelor's degrees.Acquire training. Bookkeeping training can come from a variety of sources.Apply for positions.Become a freelancer.Consider certification.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

So if you're paying unlicensed California accountants or bookkeepers as independent contractors, you're probably going to have to rehire them as employees regardless of whether or not your firm is located in California.

Yes, the company should send you a 1099. Its easy to forget to include yourself when you're doing the books! All you need to do is print out a blank form 1099 (from IRS.gov), fill it out, check the "Corrected" box, and mail to the IRS.....and keep your copy of course!