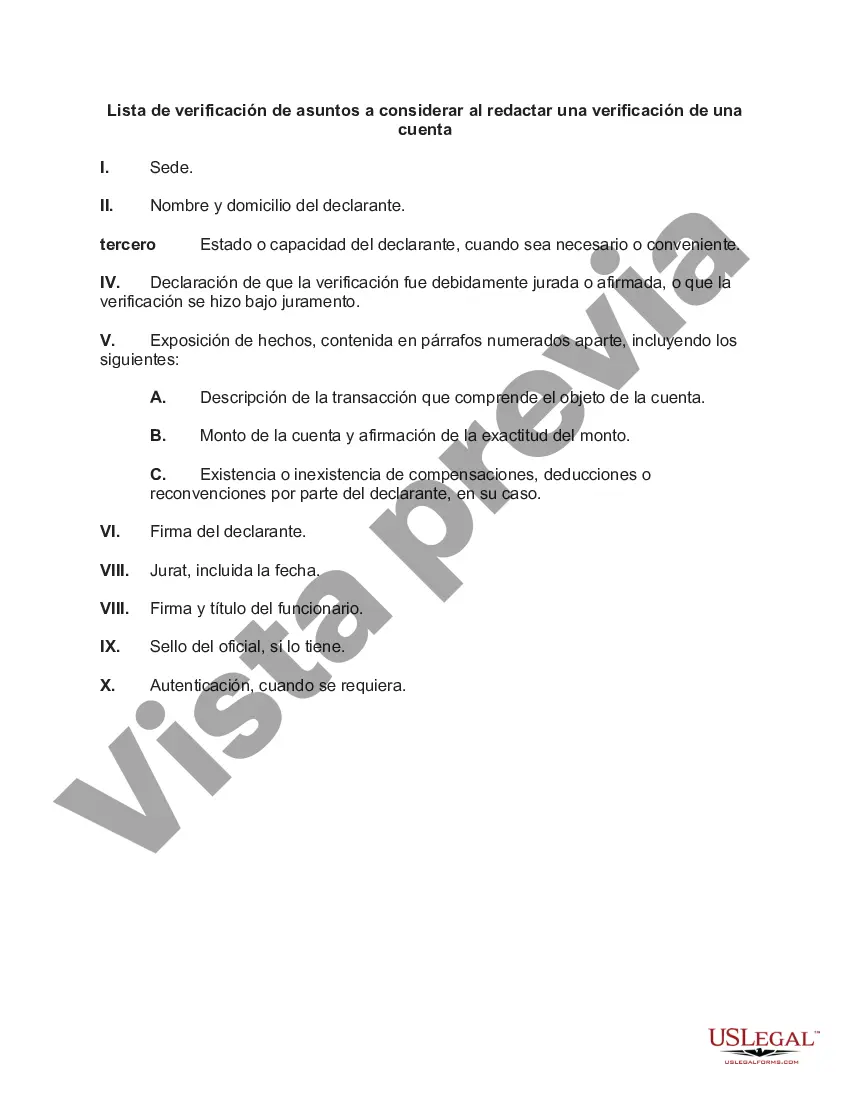

Wisconsin Checklist of Matters to be Considered in Drafting a Verification of an Account is a comprehensive document that outlines the necessary guidelines and considerations when creating a verification of an account in the state of Wisconsin. This checklist serves as a valuable resource for individuals and businesses involved in financial transactions, legal proceedings, or any situation requiring an accurate and reliable verification of accounts. Key factors taken into account when drafting a verification of an account in Wisconsin include: 1. Comprehensive Account Details: The verification must include specific and accurate details about the account, such as the account holder's name, account number, account type, and any relevant transaction history. 2. Proper Identification: It is essential to verify the identity of the individual or organization seeking the verification of an account. Proper identification measures should be implemented, such as checking identification documents, verifying signatures, or requesting additional proof of identity. 3. Verified Account Balances: The verification must reflect the current account balance accurately. The account holder's bank statements or relevant financial records should be cross-referenced to ensure the accuracy of the information provided. 4. Dates and Timestamps: Verification documents should include dates and timestamps to indicate when the account balance or any specific transactions were verified. This ensures the document's credibility and relevance within a specific timeframe. 5. Professional Language and Formatting: The verification should be drafted using professional language, maintaining clarity and transparency. The document should be properly formatted, and all relevant sections should be organized sequentially to enhance readability. Different types of Wisconsin Checklists of Matters to be Considered in Drafting a Verification of an Account may exist based on the specific purpose or nature of the account being verified. For instance: 1. Personal Bank Account Verification: This checklist focuses on personal banking accounts, covering matters specific to individuals' financial records, including their account balances, transaction history, and account holder information. 2. Business Account Verification: This type of checklist caters to businesses or organizations, taking into consideration factors such as business account verification, auditing requirements, and legal compliance. 3. Legal Proceedings Account Verification: In a legal context, there may be a distinct checklist that addresses the requirements for account verification during court proceedings or legal disputes. This checklist may outline specific considerations such as admissibility, authentication, and compliance with legal standards. In conclusion, a Wisconsin Checklist of Matters to be Considered in Drafting a Verification of an Account is a vital tool for ensuring accurate and reliable verifications in financial, legal, or business contexts. Taking into account various key factors and specific types of account verification, this checklist serves as a practical resource for anyone involved in drafting and creating verified account statements in the state of Wisconsin.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Lista de verificación de asuntos a considerar al redactar una verificación de una cuenta - Checklist of Matters to be Considered in Drafting a Verification of an Account

Description

How to fill out Wisconsin Lista De Verificación De Asuntos A Considerar Al Redactar Una Verificación De Una Cuenta?

If you wish to comprehensive, down load, or produce lawful document layouts, use US Legal Forms, the largest collection of lawful forms, that can be found on the web. Use the site`s simple and handy look for to obtain the paperwork you require. Different layouts for enterprise and specific uses are sorted by categories and suggests, or search phrases. Use US Legal Forms to obtain the Wisconsin Checklist of Matters to be Considered in Drafting a Verification of an Account in a handful of mouse clicks.

If you are currently a US Legal Forms client, log in to your bank account and click on the Acquire option to find the Wisconsin Checklist of Matters to be Considered in Drafting a Verification of an Account. You may also accessibility forms you previously saved inside the My Forms tab of the bank account.

If you use US Legal Forms the first time, follow the instructions beneath:

- Step 1. Ensure you have chosen the shape for that proper metropolis/land.

- Step 2. Take advantage of the Preview solution to look through the form`s articles. Do not overlook to learn the information.

- Step 3. If you are not happy with all the develop, take advantage of the Search field near the top of the display screen to discover other variations in the lawful develop format.

- Step 4. When you have discovered the shape you require, go through the Buy now option. Pick the rates strategy you prefer and include your qualifications to register for the bank account.

- Step 5. Process the financial transaction. You may use your Мisa or Ьastercard or PayPal bank account to accomplish the financial transaction.

- Step 6. Choose the formatting in the lawful develop and down load it in your product.

- Step 7. Full, modify and produce or sign the Wisconsin Checklist of Matters to be Considered in Drafting a Verification of an Account.

Each and every lawful document format you acquire is your own property forever. You might have acces to each and every develop you saved within your acccount. Click the My Forms portion and pick a develop to produce or down load yet again.

Remain competitive and down load, and produce the Wisconsin Checklist of Matters to be Considered in Drafting a Verification of an Account with US Legal Forms. There are many skilled and express-certain forms you can use for your enterprise or specific requirements.