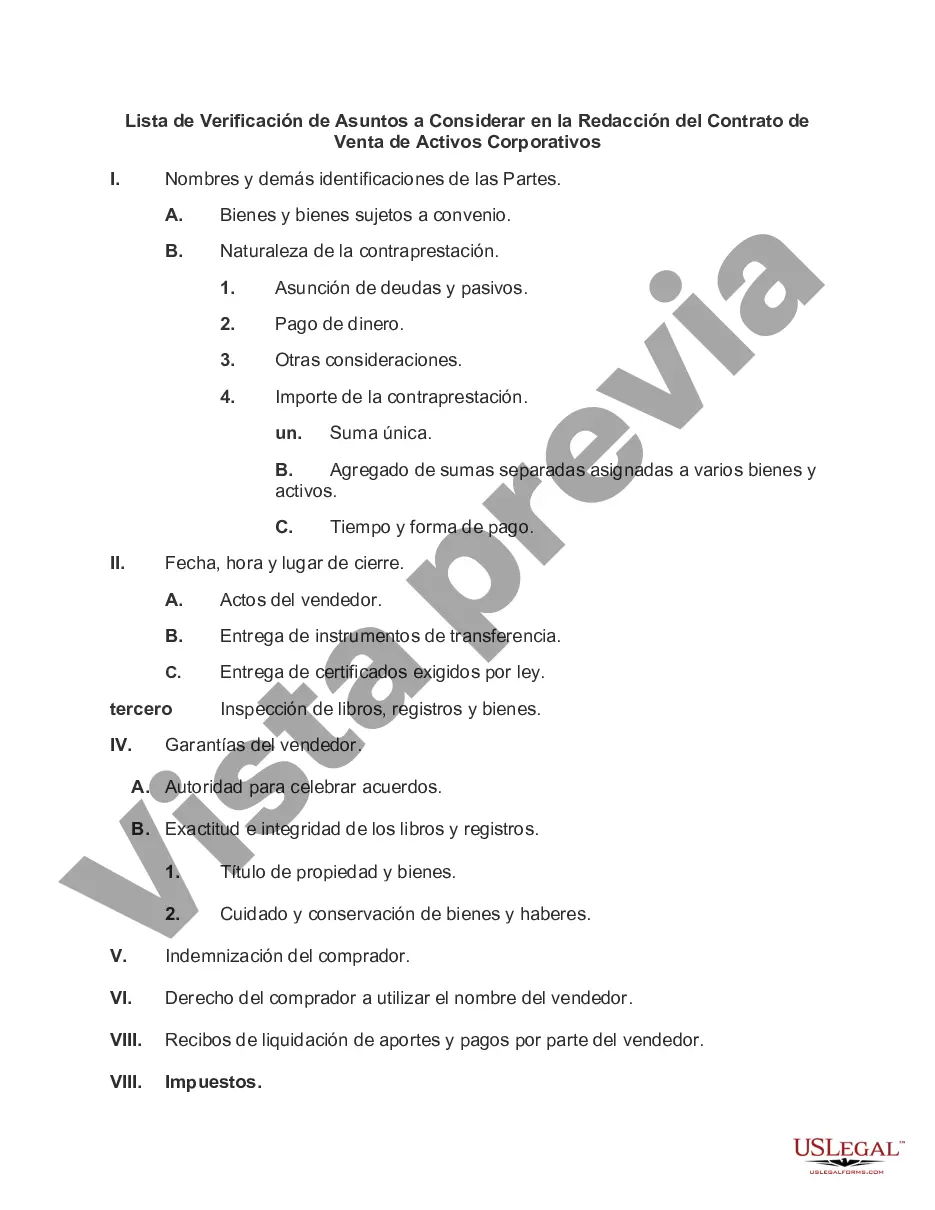

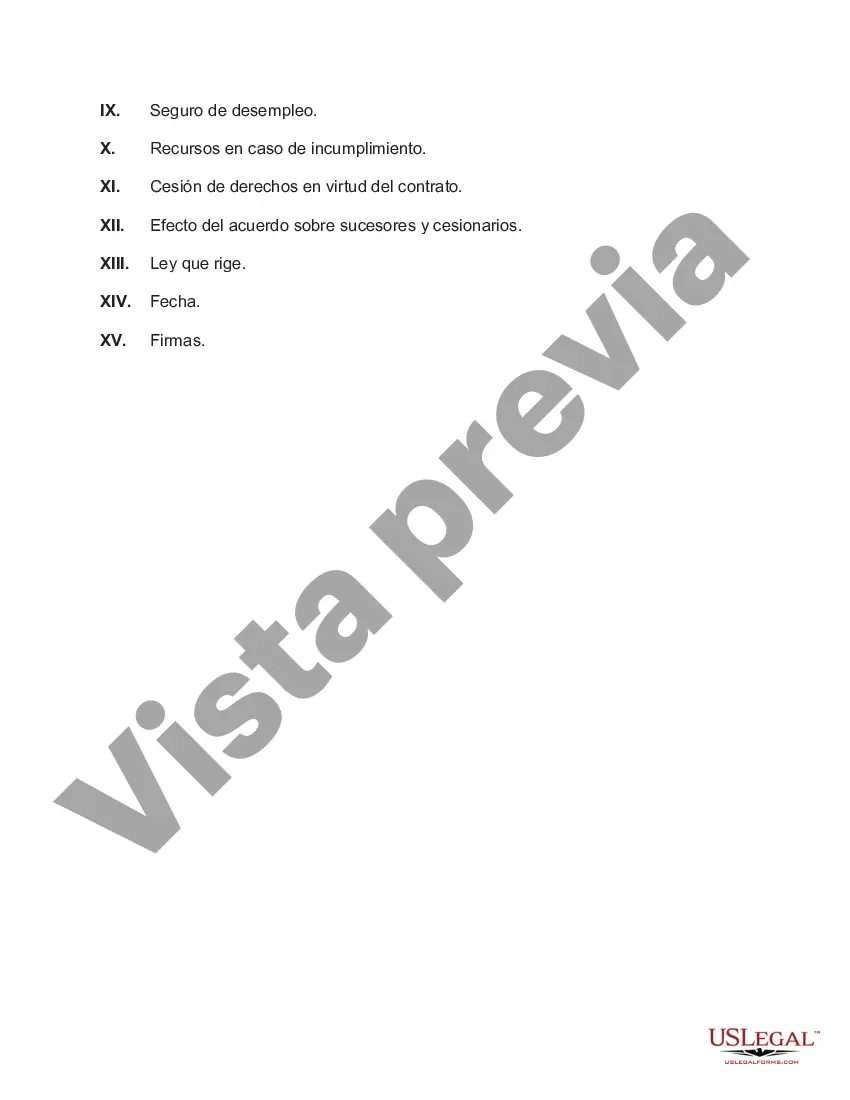

Title: Drafting an Agreement for Sale of Corporate Assets in Wisconsin: Comprehensive Checklist Introduction: When entering into an agreement for the sale of corporate assets in Wisconsin, it is crucial to ensure that all necessary details and considerations are addressed. This comprehensive checklist outlines the various matters that should be considered in drafting an agreement for the sale of corporate assets in Wisconsin, ensuring a thorough and legally sound transaction. 1. Parties Involved and Definitions: — Clearly identify the buyer and seller. — Define key terms used throughout the agreement. 2. Purchase Price and Payment Terms: — Specify the total purchase price and any additional consideration terms. — Outline the acceptable payment methods and the timeline for payment. 3. Assets to be Sold: — Provide a detailed list of all assets included in the sale, including tangible and intangible assets. — Specify any excluded assets or liabilities. 4. Representations and Warranties: — Include representations and warranties from both the buyer and the seller regarding their authority, ownership, and financial conditions. — Address any limitations or disclaimers of representations and warranties. 5. Due Diligence and Investigation: — Specify a timeframe for the buyer's due diligence process. — Detail the seller's cooperation and disclosure obligations during this period. 6. Approvals and Consents: — Identify any required third-party consents, such as creditor approvals or regulatory clearances. — Determine a timeline for obtaining these consents. 7. Employee and Employment Matters: — Address the treatment of existing employees, including any transfer obligations or severance arrangements. — Consider non-compete and non-solicitation provisions. 8. Closing and Closing Conditions: — Specify the conditions precedent to closing. — Determine the location, date, and time of the closing. 9. Indemnification and Liability: — Allocate responsibility for liabilities arising before and after the closing. — Establish the terms and limitations of indemnification. 10. Governing Law and Jurisdiction: — Determine that the agreement will be governed by and interpreted under Wisconsin law. — Specify the jurisdiction for resolving disputes. Different Types of Wisconsin Checklists for Sale of Corporate Assets: 1. Checklist for Asset Purchase Agreement: — Specifically focused on the sale of corporate assets, both tangible and intangible. 2. Checklist for Stock Purchase Agreement: — Focused on the sale and transfer of corporate stock or shares. 3. Checklist for Merger or Acquisition Agreement: — Addresses the purchase or combination of multiple entities and their assets. Conclusion: When drafting an agreement for the sale of corporate assets in Wisconsin, it is essential to consider numerous factors to protect both the buyer and the seller. This comprehensive checklist, along with its different types tailored to specific transactions, serves as an invaluable tool in assuring the completion of a well-structured and legally sound agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Lista de Verificación de Asuntos a Considerar en la Redacción del Contrato de Venta de Activos Corporativos - Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Wisconsin Lista De Verificación De Asuntos A Considerar En La Redacción Del Contrato De Venta De Activos Corporativos?

US Legal Forms - one of the biggest libraries of lawful kinds in America - provides a wide range of lawful document layouts you are able to obtain or printing. While using web site, you will get a huge number of kinds for business and person uses, categorized by groups, states, or keywords and phrases.You can get the most up-to-date variations of kinds such as the Wisconsin Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets within minutes.

If you currently have a subscription, log in and obtain Wisconsin Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets from the US Legal Forms catalogue. The Download button will show up on every form you look at. You gain access to all previously acquired kinds within the My Forms tab of the accounts.

In order to use US Legal Forms for the first time, allow me to share straightforward recommendations to obtain started:

- Ensure you have selected the right form for your personal town/county. Click on the Review button to review the form`s articles. Browse the form outline to actually have chosen the appropriate form.

- When the form doesn`t satisfy your demands, make use of the Search discipline near the top of the screen to discover the one that does.

- When you are pleased with the form, confirm your decision by simply clicking the Get now button. Then, choose the pricing program you prefer and provide your qualifications to sign up for the accounts.

- Procedure the financial transaction. Use your bank card or PayPal accounts to accomplish the financial transaction.

- Choose the structure and obtain the form on your system.

- Make alterations. Complete, change and printing and indication the acquired Wisconsin Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets.

Every single design you included in your account lacks an expiration time which is your own property permanently. So, if you want to obtain or printing yet another duplicate, just visit the My Forms segment and then click on the form you want.

Gain access to the Wisconsin Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets with US Legal Forms, by far the most substantial catalogue of lawful document layouts. Use a huge number of specialist and status-particular layouts that fulfill your organization or person requirements and demands.