A Wisconsin Charitable Gift Annuity refers to a philanthropic financial arrangement between a donor and a nonprofit organization in the state of Wisconsin. It involves the donor making a charitable gift to the organization and receiving regular fixed payments for life in return. Wisconsin Charitable Gift Annuities provide a unique opportunity for individuals to support causes close to their hearts while also ensuring financial security during retirement. By donating a sum of money or assets to a nonprofit organization, donors can establish a gift annuity that guarantees them a steady income stream for the rest of their lives. The Wisconsin Charitable Gift Annuity program offers several benefits to both donors and nonprofit organizations. Donors receive a charitable tax deduction for the year of the gift, and a portion of the fixed payments they receive may be tax-free. Additionally, the annuity payments are often higher than returns from other investments, providing a reliable income source. Nonprofit organizations benefit from the Wisconsin Charitable Gift Annuity program by securing a significant donation to support their mission. These donations can be used to fund various programs and initiatives, helping them advance their cause and make a difference in the community. The gift annuity program also allows nonprofits to build and maintain long-term relationships with donors, fostering a sense of engagement and loyalty. While the Wisconsin Charitable Gift Annuity is a basic program, there may be different types available depending on the nonprofit organization offering them. They may include: 1. Immediate Charitable Gift Annuity: This type of annuity provides fixed payments to the donor that begin immediately after the gift is made. 2. Deferred Charitable Gift Annuity: With this option, donors make a gift but delay the annuity payments until a future date, typically at retirement age. This allows donors to receive higher payments when they are likely to need the income more. 3. Flexible Charitable Gift Annuity: Some organizations may offer a flexible gift annuity where the donor can choose to receive variable annuity payments instead of fixed amounts. This option allows donors to potentially benefit from increased payments if the investment performance is favorable. In conclusion, a Wisconsin Charitable Gift Annuity is a philanthropic tool that allows individuals to support charitable causes while securing a reliable income stream for their lifetime. It is a mutually beneficial arrangement for both donors and nonprofit organizations, providing tax benefits and financial stability. By having different types of annuity options available, nonprofits can cater to the diverse needs and preferences of their donors.

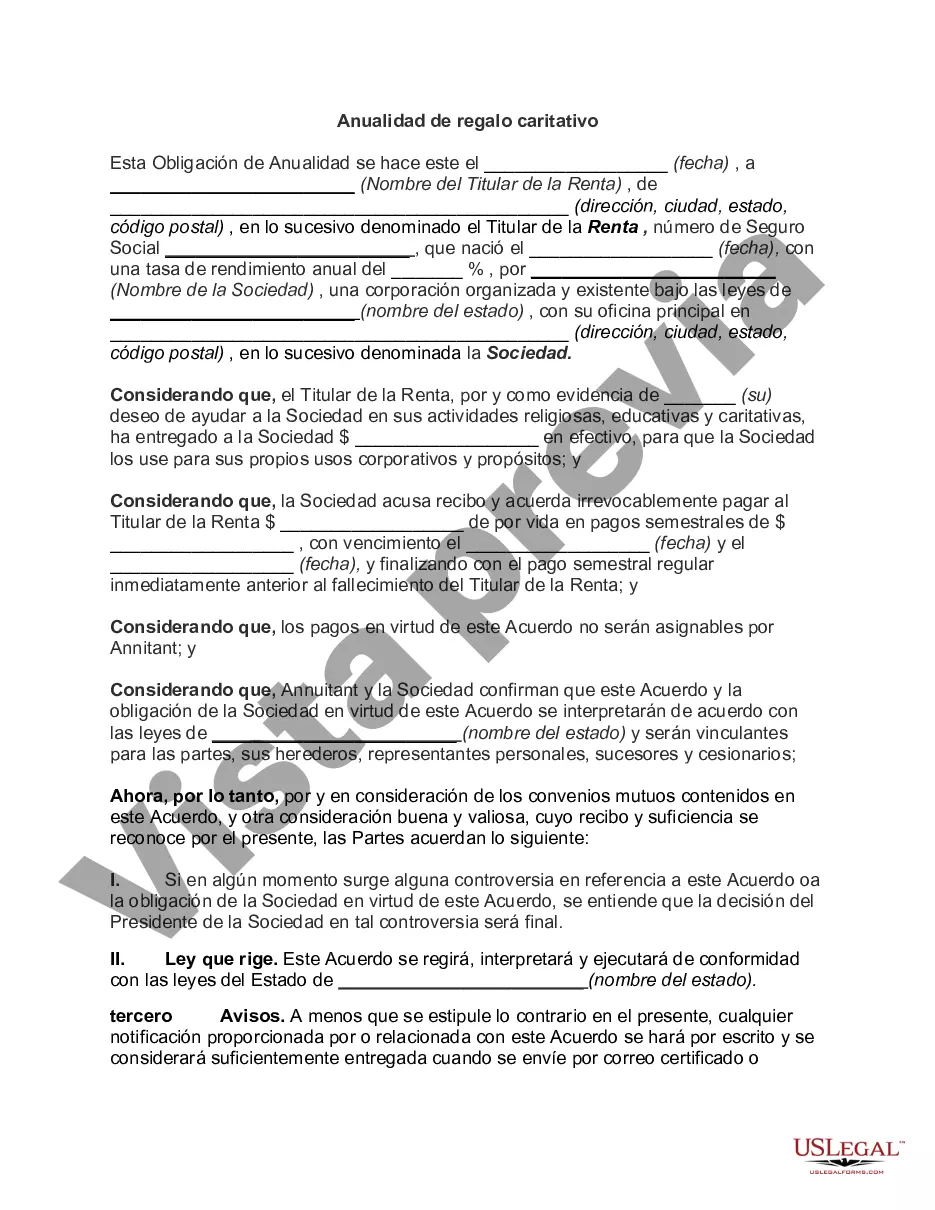

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Anualidad de regalo caritativo - Charitable Gift Annuity

Description

How to fill out Wisconsin Anualidad De Regalo Caritativo?

Are you currently within a placement the place you will need documents for both company or personal reasons almost every day? There are tons of legal record layouts accessible on the Internet, but finding kinds you can rely on is not effortless. US Legal Forms offers thousands of form layouts, such as the Wisconsin Charitable Gift Annuity, that are published to meet federal and state specifications.

When you are presently informed about US Legal Forms website and also have a merchant account, basically log in. Following that, you are able to down load the Wisconsin Charitable Gift Annuity design.

If you do not offer an profile and want to begin to use US Legal Forms, abide by these steps:

- Discover the form you need and ensure it is for that right town/state.

- Use the Review key to analyze the shape.

- Look at the outline to ensure that you have chosen the appropriate form.

- When the form is not what you are seeking, utilize the Lookup discipline to find the form that fits your needs and specifications.

- When you obtain the right form, click Buy now.

- Pick the rates program you need, submit the necessary information to produce your money, and buy an order making use of your PayPal or bank card.

- Select a hassle-free paper formatting and down load your backup.

Get all of the record layouts you have purchased in the My Forms menus. You can aquire a extra backup of Wisconsin Charitable Gift Annuity at any time, if necessary. Just select the necessary form to down load or printing the record design.

Use US Legal Forms, by far the most extensive selection of legal kinds, to save lots of some time and steer clear of blunders. The service offers skillfully manufactured legal record layouts which you can use for an array of reasons. Generate a merchant account on US Legal Forms and begin making your way of life a little easier.