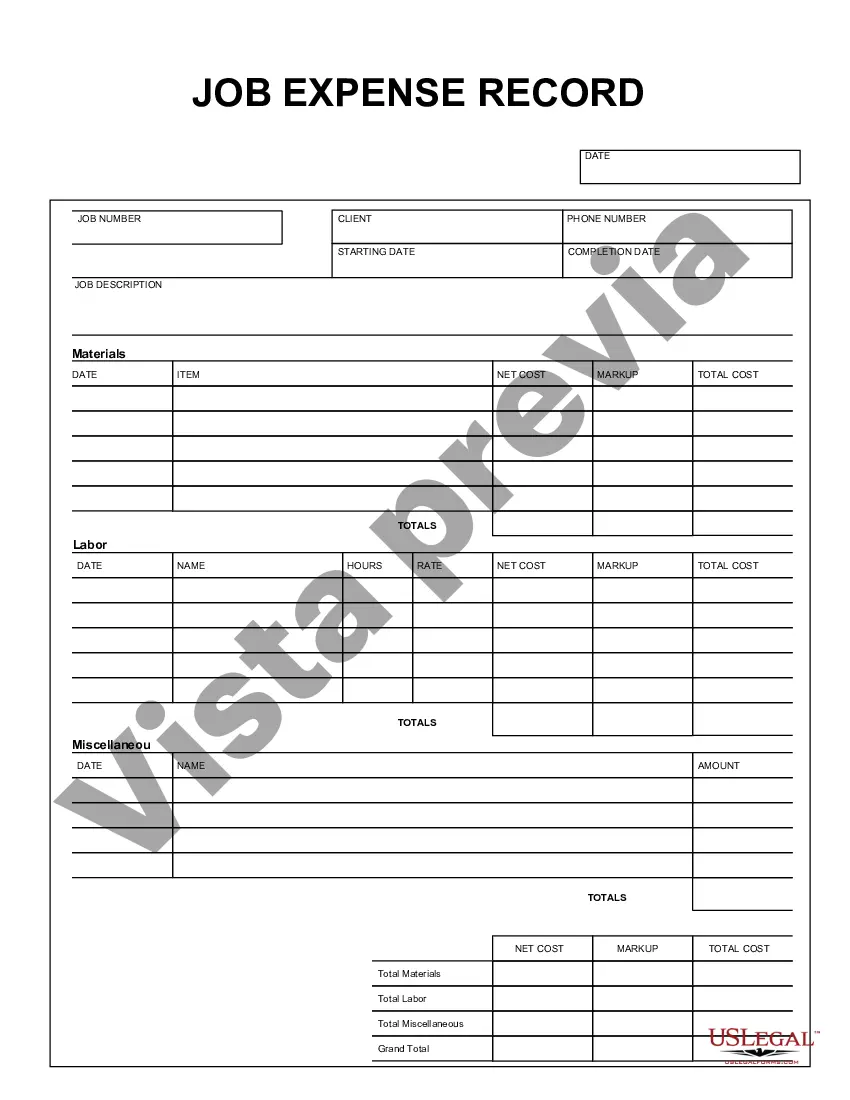

The Wisconsin Job Expense Record is an essential tool for individuals employed in the state of Wisconsin to keep track of their job-related expenses. This comprehensive document allows employees to record and monitor their expenditures accurately, ensuring that they can claim tax deductions and reimbursement for applicable business expenses. The Wisconsin Job Expense Record serves as a detailed account of various cost categories that employees may encounter while performing their job duties. These categories typically include travel expenses, transportation costs, meals and entertainment, office supplies, professional development expenses, as well as various miscellaneous expenses directly related to the job. This comprehensive tool provides a clear structure for employees to record their job expenses thoroughly. It enables individuals to document the date, a description of the expense, the purpose of the expenditure, the amount spent, and any relevant supporting documentation. This level of detail ensures that employees can substantiate their expenses accurately if required for tax purposes, audits, or potential reimbursement by their employer. In Wisconsin, there are several types of Job Expense Records that individuals may utilize depending on their specific employment circumstances: 1. Standard Job Expense Record: This is the most common type used by employees who incur various job-related expenses throughout the year. It covers a wide range of expenditure categories and provides a comprehensive space for recording detailed information about each expense. 2. Mileage and Transportation Expense Record: Specifically designed for individuals who rely heavily on transportation for their job, this record allows employees to record their mileage, gas expenses, parking fees, tolls, and other related costs. It simplifies tax deductions and expense reimbursement related to commutes, client visits, meetings, or any other job-related travel. 3. Meal and Entertainment Expense Record: Individuals in certain industries, such as sales or client-facing roles, often incur expenses related to business meals and entertainment. This record facilitates the tracking of these specific expenses, including meal costs, tips, and any other entertainment-related expenditures, allowing accurate reporting and potential tax deductions. It is crucial for Wisconsin employees to maintain accurate and up-to-date records of their job-related expenses. By utilizing the appropriate Wisconsin Job Expense Record, employees can efficiently track their expenditures, comply with tax regulations, substantiate claims, and potentially maximize their tax deductions or reimbursement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Registro de gastos de trabajo - Job Expense Record

Description

How to fill out Wisconsin Registro De Gastos De Trabajo?

US Legal Forms - one of several most significant libraries of legitimate types in the United States - offers a wide range of legitimate file layouts you can download or print. Utilizing the website, you can get a large number of types for company and person purposes, categorized by groups, suggests, or keywords and phrases.You can find the newest models of types much like the Wisconsin Job Expense Record in seconds.

If you have a monthly subscription, log in and download Wisconsin Job Expense Record from your US Legal Forms library. The Download switch can look on every single develop you look at. You get access to all earlier downloaded types from the My Forms tab of your profile.

If you want to use US Legal Forms initially, listed below are easy directions to obtain started:

- Ensure you have picked the correct develop for the area/state. Go through the Preview switch to analyze the form`s content material. Read the develop description to ensure that you have chosen the proper develop.

- In case the develop doesn`t suit your needs, utilize the Search area towards the top of the display screen to get the one that does.

- When you are satisfied with the form, validate your option by visiting the Get now switch. Then, opt for the pricing plan you like and offer your qualifications to sign up for the profile.

- Approach the deal. Use your credit card or PayPal profile to finish the deal.

- Choose the structure and download the form on the system.

- Make alterations. Complete, edit and print and indicator the downloaded Wisconsin Job Expense Record.

Each template you included in your bank account does not have an expiry date and is your own property forever. So, if you would like download or print one more backup, just proceed to the My Forms portion and click on the develop you need.

Obtain access to the Wisconsin Job Expense Record with US Legal Forms, one of the most substantial library of legitimate file layouts. Use a large number of professional and condition-distinct layouts that satisfy your business or person needs and needs.