Wisconsin Yearly Expenses: A Comprehensive Guide to Understanding Wisconsin — a state known for its beautiful landscapes, vibrant cities, and strong sense of community. If you are considering moving to or residing in this Midwestern gem, it is crucial to gain a deep understanding of the state's yearly expenses. In this article, we will provide an insightful overview of the various types of Wisconsin yearly expenses and shed light on the financial aspects of living in this captivating state. 1. Housing Expenses: Housing expenses form a significant portion of an individual or a family's yearly budget. In Wisconsin, where housing costs are generally lower than the national average, one can find a range of housing options suiting different budgets. Whether you opt for renting or buying, factors such as location, size, and amenities play a crucial role in determining the annual expenses. Popular cities like Madison, Milwaukee, and Green Bay may have slightly higher housing costs compared to other regions in the state. 2. Utilities: Utilities encompass essential services like water, electricity, gas, and waste management. These expenses vary based on factors such as the size of the property, the number of occupants, and weather conditions. While the cost of utilities in Wisconsin is relatively affordable compared to some other states, it's important to research local utility providers and consider energy-efficient measures to lower expenses. 3. Transportation Costs: Transportation expenses are a primary consideration for individuals commuting to work or traveling frequently. Wisconsin offers a variety of transportation options, such as owning a car, using public transit, or opting for ride-share services. Vehicle-related costs, including car payments, insurance, fuel, maintenance, and registration fees, form a considerable portion of the yearly expenses. Public transit costs and frequency vary based on the specific region and commuting needs. 4. Healthcare Expenses: Healthcare expenses are crucial for maintaining one's well-being and financial stability. Wisconsin boasts a strong healthcare system with numerous hospitals, healthcare providers, and insurance options. Yearly healthcare expenses include insurance premiums, out-of-pocket costs, prescription medications, regular doctor visits, and preventive care. Researching and selecting the most suitable health insurance plan is essential to manage healthcare expenses effectively. 5. Education Costs: For families with children or individuals pursuing higher education, education costs are a significant consideration. Wisconsin is renowned for its quality public and private education institutions. Yearly education expenses may encompass tuition fees, books, supplies, transportation, and extra-curricular activities for students of all ages. Researching scholarship and financial aid opportunities can help alleviate the burden of education costs. 6. Tax Obligations: Understanding tax obligations is vital for assessing overall expenses. Wisconsin imposes various taxes, including income tax, property tax, sales tax, and vehicle-related taxes. It is essential to be aware of the tax rates, exemptions, and deductions applicable to your specific situation to accurately estimate yearly expenses and plan accordingly. Overall, Wisconsin offers a relatively affordable cost of living while providing an excellent standard of living. By carefully analyzing and considering the aforementioned yearly expenses, individuals and families can make well-informed financial decisions when residing in the state. Researching regional differences, exploring cost-saving measures, and seeking expert advice can further help individuals effectively manage their finances and enjoy all that Wisconsin has to offer.

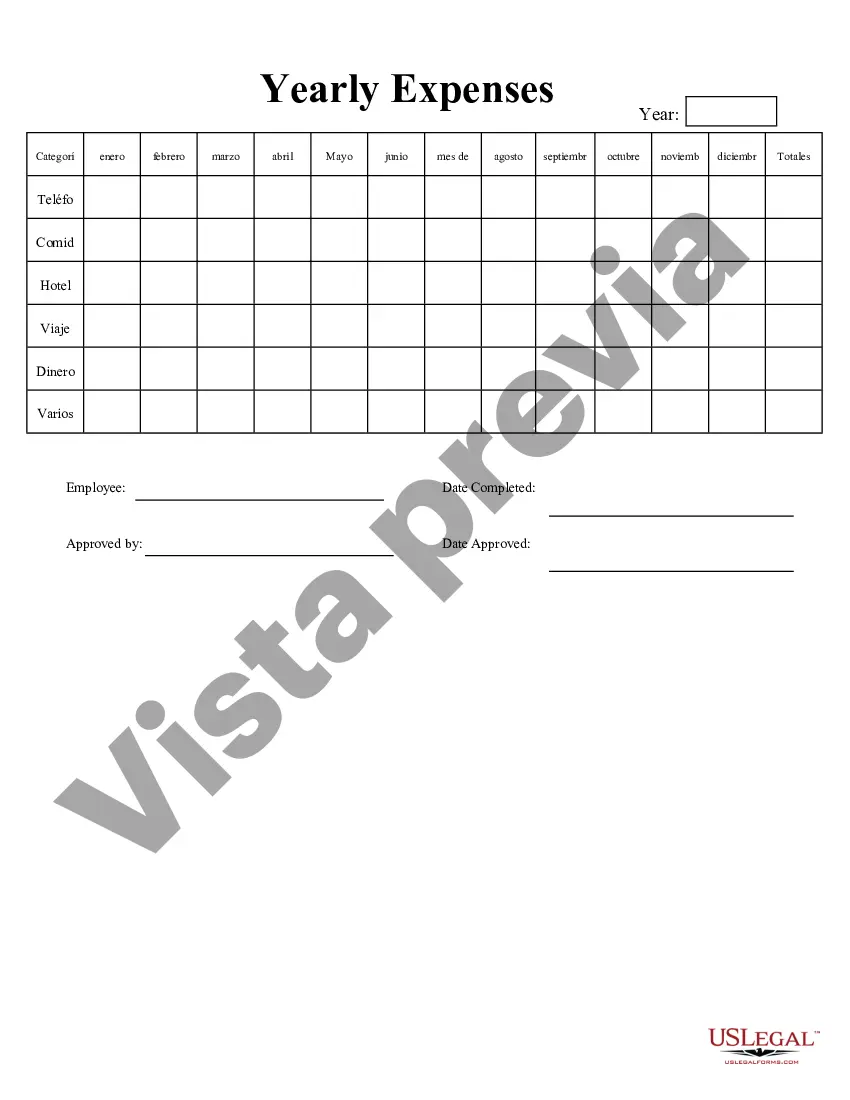

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Gastos Anuales - Yearly Expenses

Description

How to fill out Wisconsin Gastos Anuales?

If you wish to complete, acquire, or print lawful record themes, use US Legal Forms, the largest assortment of lawful kinds, which can be found on-line. Take advantage of the site`s simple and practical look for to find the files you will need. A variety of themes for enterprise and personal purposes are categorized by types and says, or key phrases. Use US Legal Forms to find the Wisconsin Yearly Expenses in a handful of clicks.

Should you be presently a US Legal Forms client, log in to your account and click the Download key to get the Wisconsin Yearly Expenses. You can even access kinds you earlier downloaded inside the My Forms tab of your account.

If you are using US Legal Forms initially, refer to the instructions under:

- Step 1. Make sure you have chosen the form for that correct town/land.

- Step 2. Make use of the Review option to look over the form`s information. Do not overlook to see the explanation.

- Step 3. Should you be unhappy with all the develop, utilize the Look for discipline at the top of the monitor to locate other types of your lawful develop format.

- Step 4. Once you have located the form you will need, select the Purchase now key. Pick the pricing plan you like and include your accreditations to sign up for an account.

- Step 5. Process the deal. You can utilize your charge card or PayPal account to finish the deal.

- Step 6. Find the structure of your lawful develop and acquire it on your own device.

- Step 7. Comprehensive, change and print or indicator the Wisconsin Yearly Expenses.

Every single lawful record format you purchase is your own property permanently. You have acces to each and every develop you downloaded in your acccount. Click on the My Forms section and select a develop to print or acquire yet again.

Compete and acquire, and print the Wisconsin Yearly Expenses with US Legal Forms. There are millions of specialist and express-distinct kinds you may use for the enterprise or personal needs.