The Wisconsin Payroll Deduction Authorization Form is a document that allows employees in the state of Wisconsin to authorize their employers to deduct a certain amount of money from their wages. This form is an essential tool to facilitate the payment of various deductions, such as health insurance premiums, retirement contributions, taxes, and charitable donations. It ensures a streamlined process and helps both employers and employees to keep track of deductions accurately. The Wisconsin Payroll Deduction Authorization Form is designed to comply with Wisconsin state laws and regulations concerning payroll deductions. By completing this form, employees provide written consent for the employer to deduct a specified sum from their wages on a regular basis. This authorization can be one-time or ongoing, depending on the nature of the deduction. It gives employers legal authorization to enact the necessary payroll deduction. Wisconsin offers various types of payroll deductions, and therefore, there may be different versions of the Wisconsin Payroll Deduction Authorization Form. Some common types include: 1. Health Insurance Deduction Authorization Form: This form authorizes the deduction of health insurance premiums from an employee's paycheck. It ensures that employees can enjoy the benefits of health insurance without having to worry about making separate payments. 2. Retirement Contribution Deduction Authorization Form: This form allows employees to authorize their employers to deduct a portion of their wages for retirement savings. By completing this form, employees can contribute to their retirement funds effortlessly. 3. Tax Withholding Authorization Form: This form enables employees to specify the amount of taxes they want their employer to deduct from their paychecks. It helps ensure compliance with Wisconsin tax regulations and streamlines the tax payment process. 4. Charitable Donation Deduction Authorization Form: This form grants employees the opportunity to contribute to charitable organizations through automatic payroll deductions. By completing this form, employees can support causes they care about conveniently while enjoying potential tax benefits. These are just a few examples of the different types of Wisconsin Payroll Deduction Authorization Forms available. It's important for employers to provide the correct form to their employees based on the type of deduction being authorized. By using these forms, Wisconsin employers can efficiently manage payroll deductions while maintaining legal compliance and employee satisfaction.

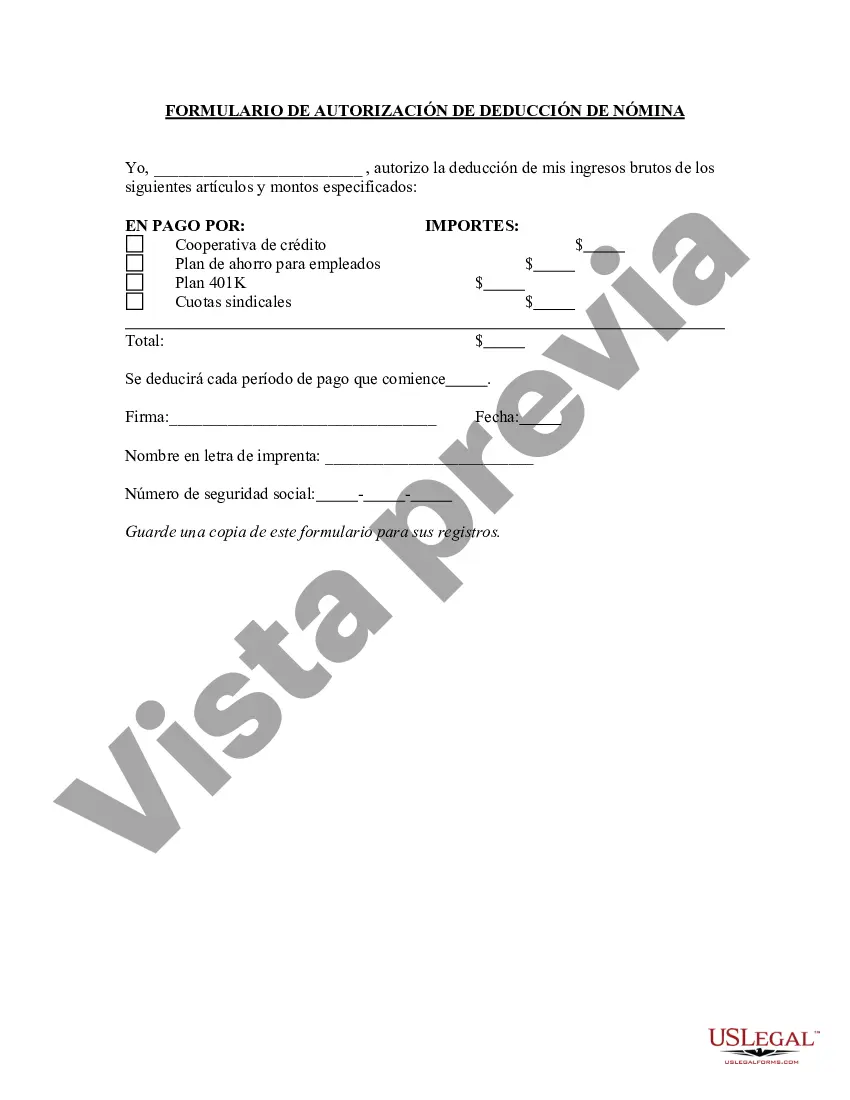

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Formulario de Autorización de Deducción de Nómina - Payroll Deduction Authorization Form

Description

How to fill out Wisconsin Formulario De Autorización De Deducción De Nómina?

US Legal Forms - one of many biggest libraries of lawful kinds in the USA - provides a variety of lawful papers layouts you may acquire or print. Utilizing the site, you can find a large number of kinds for business and personal uses, categorized by groups, states, or key phrases.You can get the most up-to-date variations of kinds like the Wisconsin Payroll Deduction Authorization Form in seconds.

If you already have a registration, log in and acquire Wisconsin Payroll Deduction Authorization Form through the US Legal Forms collection. The Down load option will appear on every type you look at. You gain access to all in the past acquired kinds from the My Forms tab of the profile.

If you wish to use US Legal Forms for the first time, listed here are basic directions to help you started:

- Be sure you have chosen the proper type for your personal town/county. Click on the Review option to review the form`s information. Read the type explanation to ensure that you have selected the proper type.

- If the type does not fit your demands, make use of the Search field at the top of the screen to obtain the one who does.

- Should you be content with the form, affirm your choice by clicking on the Purchase now option. Then, select the costs prepare you prefer and provide your accreditations to sign up on an profile.

- Process the financial transaction. Make use of Visa or Mastercard or PayPal profile to accomplish the financial transaction.

- Select the file format and acquire the form on your system.

- Make adjustments. Fill up, revise and print and indicator the acquired Wisconsin Payroll Deduction Authorization Form.

Each and every design you included with your money does not have an expiry time which is yours eternally. So, if you want to acquire or print yet another backup, just go to the My Forms area and click around the type you require.

Obtain access to the Wisconsin Payroll Deduction Authorization Form with US Legal Forms, probably the most extensive collection of lawful papers layouts. Use a large number of specialist and express-particular layouts that fulfill your organization or personal demands and demands.

Form popularity

FAQ

A payroll deduction authorization form is a written agreement an employee must sign if they want certain voluntary deductions taken from their paycheck. These forms should be as clear and specific as possible so employees know how much money voluntary deductions will take out of their paycheck.

Form WT20114 will be used by your employer to determine the amount of Wisconsin income tax to be withheld from your paychecks.

Authorized deductions are limited to: deductions which the employer is required to withhold by law or court order; deductions for the reasonable cost of board, lodging, and facilities furnished to the employee; and.

A wage deduction authorization agreement is an agreement between an employer and their employee where the employee authorizes the employer to deduct wages from their paycheck.

Mandatory Payroll Tax DeductionsFederal income tax withholding. Social Security & Medicare taxes also known as FICA taxes. State income tax withholding. Local tax withholdings such as city or county taxes, state disability or unemployment insurance.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Form WT20114 will be used by your employer to determine the amount of Wisconsin income tax to be withheld from your paychecks.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

The amount the employer withholds from an employee's gross pay for taxes, wage garnishment and company benefits are called payroll deductions. Some examples include 401(k) contributions, Medicare and Social Security tax, income tax and health insurance premiums.

Form WT-4A is an agreement between the employee and employer that a lesser amount will be withheld from the employee's wages than is provided for in the Wisconsin income tax withholding tables.