Title: Wisconsin Resolution of Meeting of LLC Members to Make Specific Loan: A Comprehensive Guide Introduction: In Wisconsin, the Resolution of Meeting of LLC Members to Make Specific Loan refers to a formal process wherein the members of a limited liability company (LLC) gather to discuss and approve a specific loan. This document outlines the key aspects, protocols, and legal requirements surrounding the resolution. Types of Wisconsin Resolution of Meeting of LLC Members to Make Specific Loan: 1. Resolution to Secure Operational Funds: This type of resolution is commonly used when an LLC requires additional funds to meet its day-to-day business operations. Members convene a meeting to discuss the loan details and other relevant matters to ensure the smooth functioning of the company. 2. Resolution for Expansion and Growth: In certain cases, an LLC may opt to acquire new assets, expand its operations, or invest in new ventures. A resolution meeting is conducted to deliberate and approve a specific loan that will enable the company's expansion plans. 3. Resolution for Emergency Financing: During unexpected financial constraints or emergencies, an LLC may require immediate funds to sustain its operations. A resolution meeting is convened urgently to authorize a specific loan to address such financial crises. Key Elements of a Wisconsin Resolution of Meeting of LLC Members to Make Specific Loan: a) Notice and Meeting Arrangement: The members of the LLC are informed about the scheduled meeting well in advance, following the provisions mentioned in the LLC operating agreement. The notice should include the date, time, location, and purpose of the meeting. b) Quorum Requirement: A minimum number of LLC members, as stipulated in the operating agreement, must be present to establish a valid meeting. The meeting can only proceed and resolutions can be passed if the required quorum is achieved. c) Loan Proposal Presentation: The individual or group seeking the loan presents a detailed proposal to the members during the meeting. The proposal should cover essential information such as the purpose of the loan, amount requested, repayment terms, interest rates, and collateral (if applicable). d) Discussion and Voting: Following the presentation, members discuss the loan proposal and raise any questions or concerns they may have. A formal vote is then conducted to approve or reject the loan request. The voting process may differ, depending on the provisions outlined in the LLC operating agreement. e) Documenting the Resolution: Once the loan resolution is passed, it must be documented accurately. The LLC Secretary or any authorized person must record the minutes of the meeting, including details of the loan resolution, voting results, and any additional terms or conditions agreed upon. Conclusion: A Wisconsin Resolution of Meeting of LLC Members to Make Specific Loan serves as a pivotal decision-making procedure for an LLC when seeking external financial resources. By following the appropriate protocols and ensuring compliance with the LLC operating agreement, members can safeguard the company's interests and facilitate its growth, financial stability, and overall success.

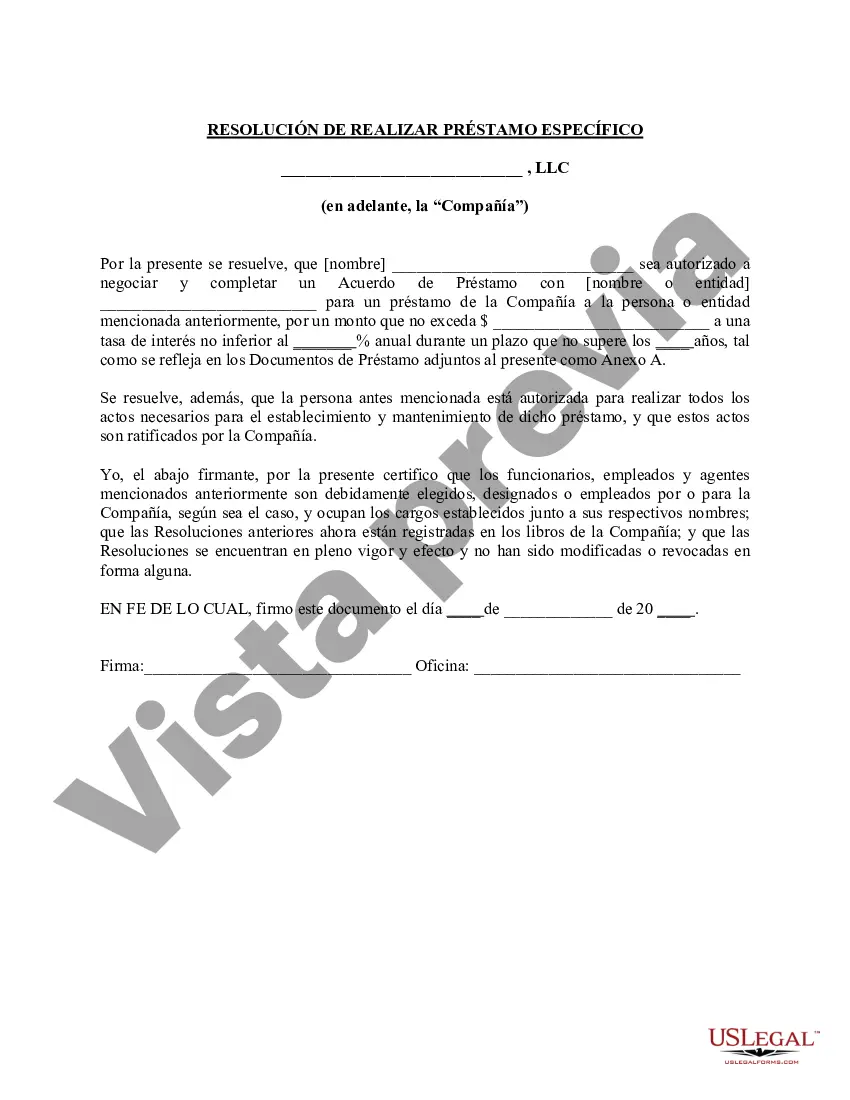

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Resolución de la reunión de los miembros de la LLC para hacer un préstamo específico - Resolution of Meeting of LLC Members to Make Specific Loan

Description

How to fill out Wisconsin Resolución De La Reunión De Los Miembros De La LLC Para Hacer Un Préstamo Específico?

Finding the right legitimate file design can be quite a battle. Of course, there are a lot of web templates available on the net, but how do you find the legitimate type you require? Utilize the US Legal Forms internet site. The support delivers a large number of web templates, for example the Wisconsin Resolution of Meeting of LLC Members to Make Specific Loan, that you can use for business and private demands. Each of the varieties are checked out by professionals and satisfy federal and state requirements.

In case you are already authorized, log in for your accounts and click the Down load switch to find the Wisconsin Resolution of Meeting of LLC Members to Make Specific Loan. Make use of your accounts to check with the legitimate varieties you might have bought previously. Visit the My Forms tab of your own accounts and have yet another copy from the file you require.

In case you are a whole new consumer of US Legal Forms, allow me to share straightforward recommendations that you can adhere to:

- Initial, be sure you have chosen the appropriate type to your town/county. It is possible to check out the form while using Review switch and study the form explanation to make certain it will be the right one for you.

- When the type will not satisfy your preferences, make use of the Seach discipline to get the appropriate type.

- Once you are certain that the form is suitable, select the Get now switch to find the type.

- Opt for the pricing strategy you would like and type in the necessary info. Make your accounts and pay money for an order utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the data file file format and obtain the legitimate file design for your device.

- Comprehensive, edit and print and indicator the attained Wisconsin Resolution of Meeting of LLC Members to Make Specific Loan.

US Legal Forms is the largest library of legitimate varieties for which you can discover different file web templates. Utilize the service to obtain expertly-manufactured paperwork that adhere to condition requirements.