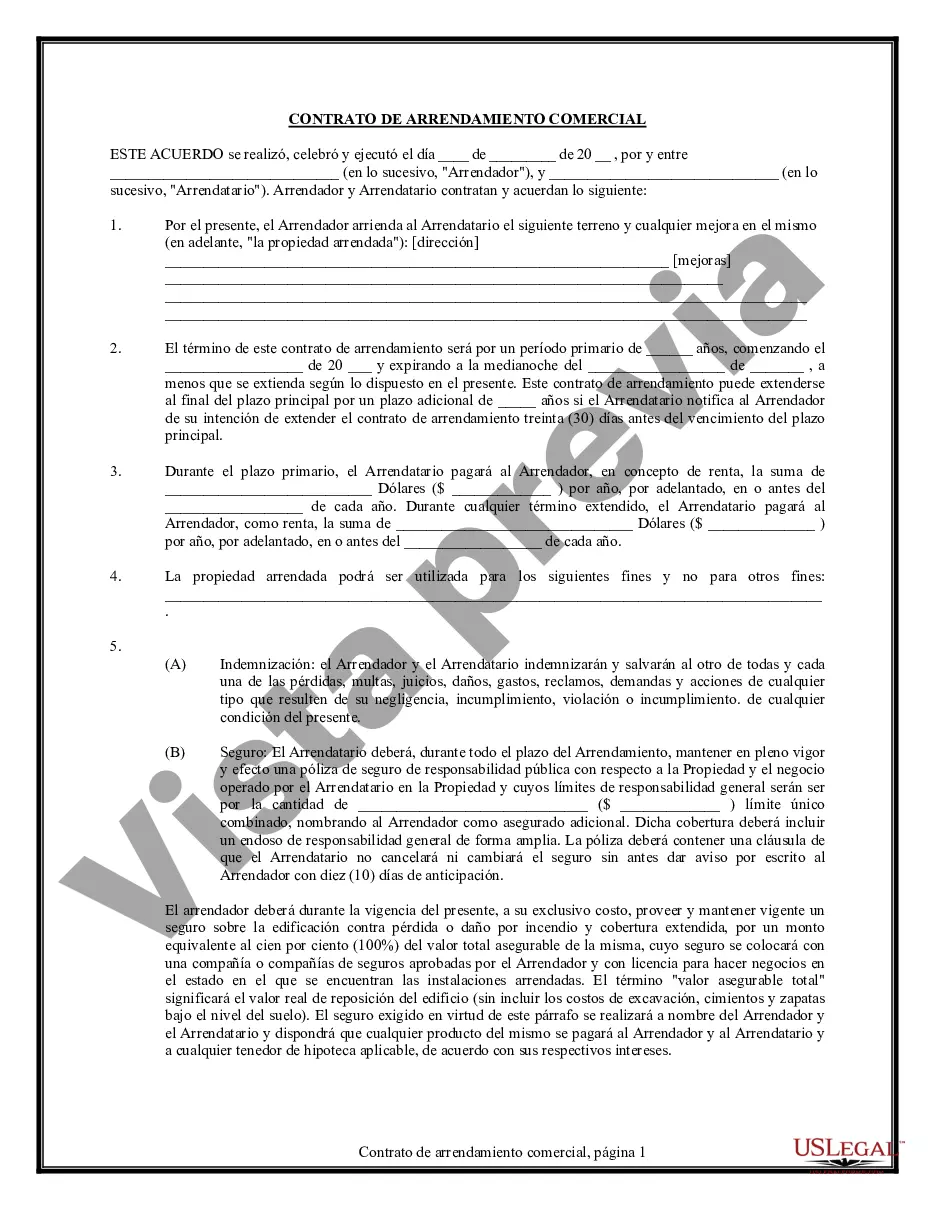

A Wisconsin Commercial Lease Agreement for Restaurant is a legally binding document that outlines the terms and conditions between the landlord and the tenant for leasing a commercial space specifically intended for restaurant purposes in the state of Wisconsin. This comprehensive agreement provides clarity and protection for both parties involved in the leasing process. The Wisconsin Commercial Lease Agreement for Restaurant typically includes essential details such as the names of the landlord and tenant, the property address, and the lease term duration. It also highlights the rent amount, payment schedule, and any additional costs such as utilities or maintenance fees. Several important clauses are commonly found within this agreement. One such clause is the permitted use clause, which restricts the tenant from using the leased space for any other purposes other than a restaurant. This clause ensures that the property is used solely for its intended commercial purpose. Another crucial clause is the maintenance and repairs clause, which outlines the responsibilities of both the landlord and the tenant regarding the maintenance and repair works. It clearly specifies who is responsible for structural repairs, renovations, plumbing, electrical, and other maintenance tasks. The indemnification clause is also significant in this agreement as it protects both the landlord and the tenant from any claims, damages, or liabilities that may arise during the lease term. This clause ensures that each party remains responsible for their own actions and any consequences that may occur during the leasing period. In addition to the standard Wisconsin Commercial Lease Agreement for Restaurant, there may be variations or subtypes available based on specific requirements or circumstances. Some of these specialized lease agreements include: 1. Triple Net Lease: This type of lease typically places the financial responsibilities for property taxes, insurance, and maintenance costs on the tenant, in addition to the base rent. 2. Percentage Lease: A percentage lease structure involves the tenant paying a certain percentage of their total revenue as rent, in addition to a base rent amount. This arrangement is commonly used when the success of the restaurant is directly tied to its revenue. 3. Gross Lease: A gross lease includes a fixed amount of rent that includes all operating expenses. The landlord is responsible for paying property taxes, insurance, utility bills, and common area maintenance costs. 4. Sublease Agreement: This allows the tenant to sublease a portion or the entire leased space to another party. It requires consent from the landlord and is typically subject to specific terms and conditions. When entering into a Wisconsin Commercial Lease Agreement for Restaurant, it is crucial for both parties to carefully read and understand all the terms and conditions outlined in the document. Seeking legal advice may be beneficial to ensure compliance and to protect the interests of both the landlord and the tenant.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Contrato de Arrendamiento Comercial para Restaurante - Commercial Lease Agreement for Restaurant

Description

How to fill out Wisconsin Contrato De Arrendamiento Comercial Para Restaurante?

Have you been within a situation where you need papers for possibly company or person purposes just about every working day? There are a variety of lawful document layouts available on the net, but locating ones you can rely is not simple. US Legal Forms offers a large number of kind layouts, like the Wisconsin Commercial Lease Agreement for Restaurant, that happen to be composed to meet state and federal demands.

When you are presently knowledgeable about US Legal Forms web site and also have a free account, simply log in. Next, you are able to obtain the Wisconsin Commercial Lease Agreement for Restaurant web template.

If you do not have an bank account and would like to start using US Legal Forms, abide by these steps:

- Find the kind you will need and ensure it is for your appropriate town/state.

- Utilize the Preview switch to examine the form.

- Look at the outline to ensure that you have chosen the proper kind.

- In case the kind is not what you`re searching for, take advantage of the Look for area to obtain the kind that meets your requirements and demands.

- Once you get the appropriate kind, just click Buy now.

- Choose the prices plan you need, complete the required details to generate your money, and purchase the order using your PayPal or Visa or Mastercard.

- Select a handy data file formatting and obtain your backup.

Get each of the document layouts you may have bought in the My Forms menus. You can obtain a extra backup of Wisconsin Commercial Lease Agreement for Restaurant any time, if needed. Just click on the essential kind to obtain or produce the document web template.

Use US Legal Forms, the most considerable collection of lawful types, to save lots of time as well as stay away from faults. The service offers skillfully made lawful document layouts that can be used for a range of purposes. Produce a free account on US Legal Forms and begin producing your daily life easier.