A Wisconsin commercial lease agreement for tenants is a legally binding contract between a landlord and a tenant that outlines the terms and conditions of renting a commercial property in the state of Wisconsin. This agreement specifies the rights and obligations of both parties and provides a framework for the smooth operation of the tenant's business. Key elements typically covered in a Wisconsin commercial lease agreement for tenants include: 1. Parties involved: The agreement identifies the landlord (property owner) and the tenant (business entity or individual) entering into the lease agreement. 2. Property details: The lease agreement provides a thorough description of the commercial property being rented, including its address, size, boundaries, and any specific designated areas (e.g., parking lot, storage space). 3. Lease term: The agreement specifies the duration of the lease, whether it's a fixed term (e.g., one year, five years) or a periodic tenancy (e.g., month-to-month). Additionally, it indicates the start and end dates of the lease. 4. Rent details: This section outlines the rental amount, frequency (e.g., monthly, quarterly), and the acceptable methods of payment. It may also detail any penalties applicable for late payments. 5. Security deposit: The agreement may include provisions regarding the security deposit, including the amount to be paid, conditions for its refund, and any deductions that may be made at the end of the tenancy. 6. Maintenance and repairs: The responsibilities for property upkeep, maintenance, and repairs are often outlined in the lease agreement. It specifies which party is responsible for what aspects, such as repairs due to normal wear and tear or damages caused by the tenant. 7. Permitted use: The lease agreement may detail the permitted purpose for which the commercial space can be used. It may restrict certain activities or require specific permits or licenses if applicable to the tenant's business. 8. Alterations and modifications: This section addresses whether the tenant is permitted to make any changes or alterations to the premises. It may outline the process for obtaining the landlord's written consent or any conditions to be met. 9. Termination provisions: The lease agreement typically describes the terms under which either party can terminate the lease before its expiration, including notice periods, penalties, and conditions for early termination. Different types of Wisconsin commercial lease agreements for tenants can include: 1. Gross Lease: Under this type of lease, the tenant pays a fixed rent amount, and the landlord covers most operating expenses, such as utilities, property taxes, and maintenance costs. 2. Net Lease: In a net lease, the tenant pays a base rent plus additional expenses, such as property taxes, insurance, and maintenance costs. 3. Triple Net Lease: This type of lease places the responsibility for all operating expenses, including taxes, insurance, and maintenance, solely on the tenant. 4. Percentage Lease: Typically used in retail leases, this agreement includes a percentage of the tenant's monthly or annual sales in addition to base rent. It is important for both landlords and tenants to carefully review and understand all terms and clauses within a Wisconsin commercial lease agreement to ensure harmonious and legally compliant occupancy of the commercial space. Consulting with an attorney or local legal professional on specific lease terms and conditions is highly recommended.

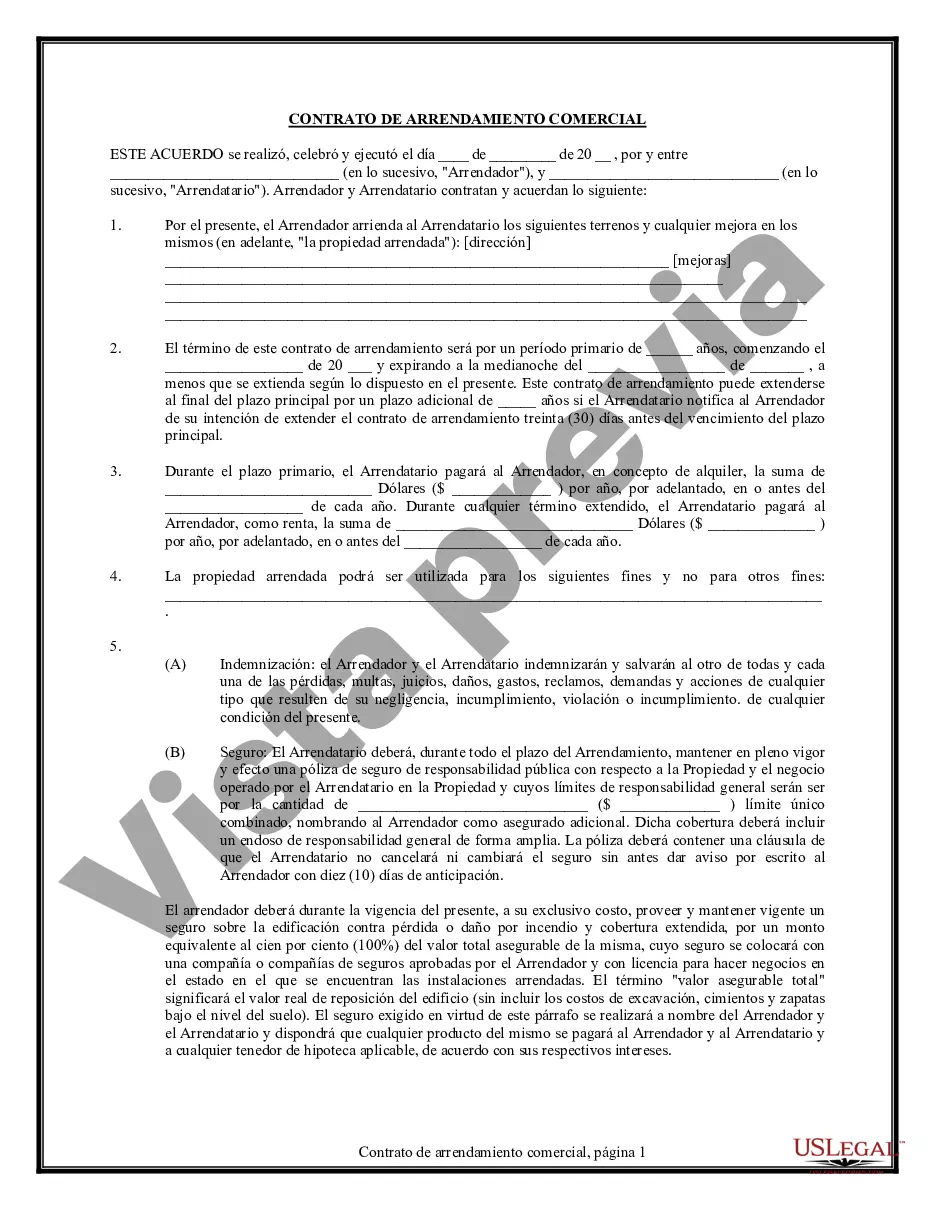

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wisconsin Contrato de Arrendamiento Comercial para Inquilino - Commercial Lease Agreement for Tenant

Description

How to fill out Wisconsin Contrato De Arrendamiento Comercial Para Inquilino?

US Legal Forms - one of the biggest libraries of legitimate forms in America - gives a wide array of legitimate record layouts you can acquire or printing. Using the internet site, you will get thousands of forms for enterprise and individual uses, sorted by categories, says, or keywords and phrases.You will find the latest types of forms just like the Wisconsin Commercial Lease Agreement for Tenant within minutes.

If you already possess a registration, log in and acquire Wisconsin Commercial Lease Agreement for Tenant in the US Legal Forms local library. The Acquire key can look on every form you perspective. You gain access to all previously acquired forms inside the My Forms tab of your own profile.

If you would like use US Legal Forms initially, listed below are simple guidelines to help you get started:

- Be sure you have chosen the right form for your metropolis/county. Click on the Preview key to check the form`s articles. See the form description to ensure that you have chosen the proper form.

- In the event the form does not suit your requirements, take advantage of the Lookup area at the top of the display screen to discover the one which does.

- In case you are content with the form, confirm your decision by clicking the Get now key. Then, select the pricing plan you favor and supply your qualifications to sign up for an profile.

- Process the purchase. Utilize your charge card or PayPal profile to perform the purchase.

- Select the format and acquire the form in your device.

- Make alterations. Load, change and printing and sign the acquired Wisconsin Commercial Lease Agreement for Tenant.

Every web template you added to your account does not have an expiry day and it is yours permanently. So, in order to acquire or printing an additional backup, just visit the My Forms portion and click on in the form you want.

Get access to the Wisconsin Commercial Lease Agreement for Tenant with US Legal Forms, one of the most substantial local library of legitimate record layouts. Use thousands of specialist and condition-certain layouts that fulfill your organization or individual demands and requirements.