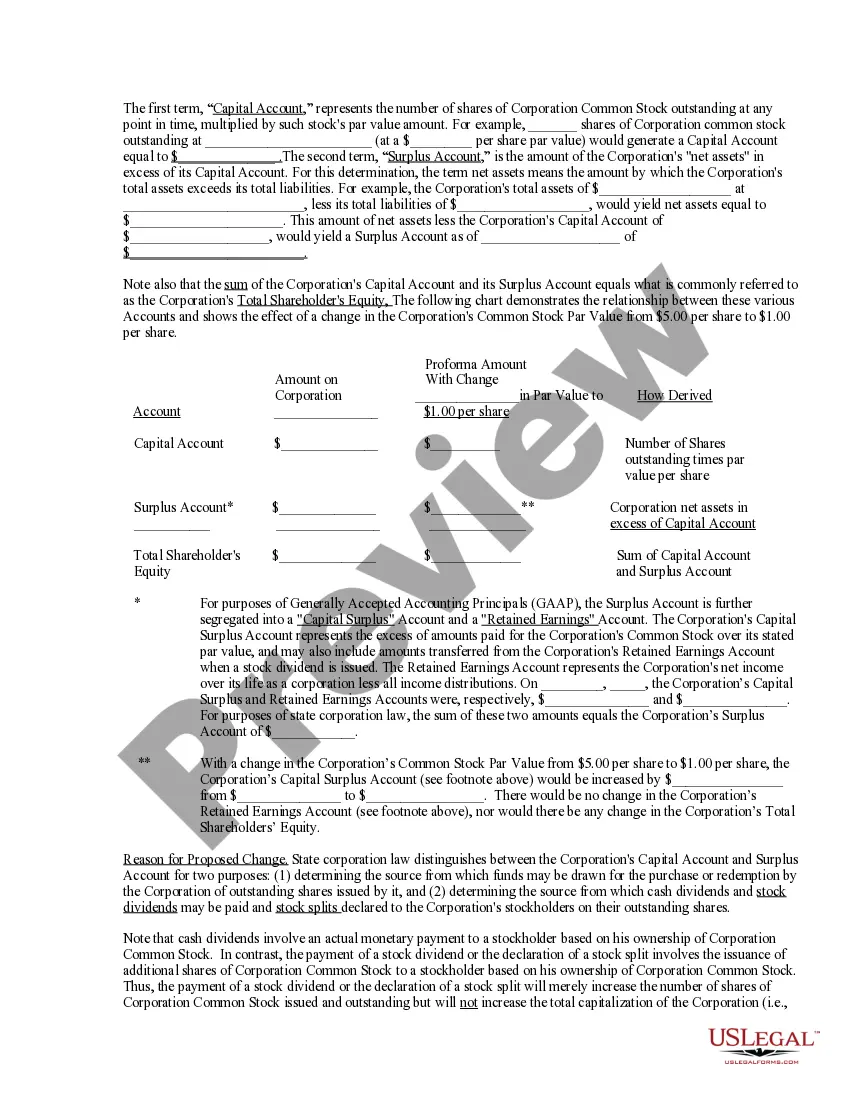

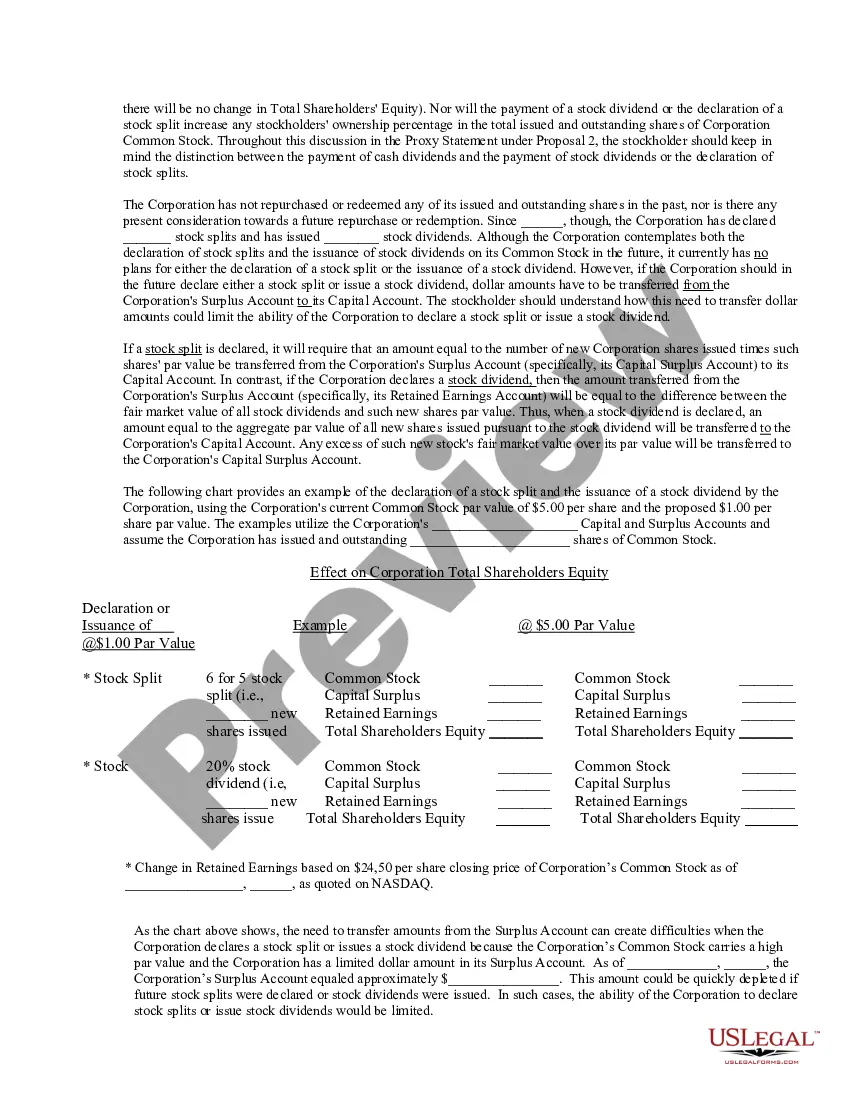

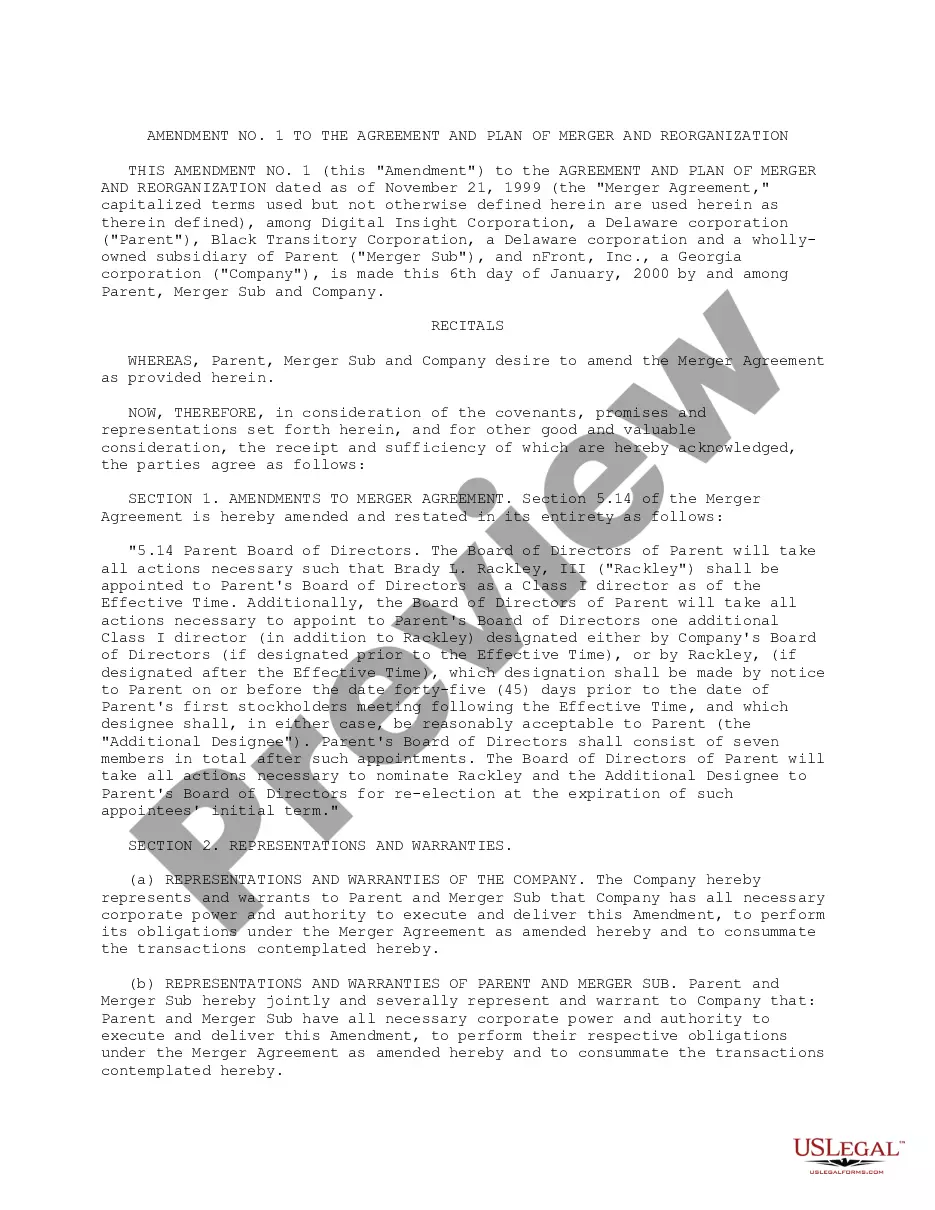

Wisconsin Amendment of Common Stock Par Value The Wisconsin Amendment of common stock par value refers to the process of altering the nominal or face value of the shares of common stock issued by a corporation in the state of Wisconsin. This amendment allows corporations to make changes to the value assigned to each share of common stock, thus influencing various aspects of the company's financial structure. The amendment of common stock par value is a significant decision for corporations, as it can affect the overall capitalization, shareholder equity, and financial stability. It involves modifying the minimum price at which shares can be issued, impacting the rights, privileges, and obligations associated with common stock ownership. In Wisconsin, there are two primary types of amendment of common stock par value commonly observed: 1. Increase in Par Value: This type of amendment involves raising the nominal value assigned to each share of common stock. Corporations might choose to increase their par value to attract more substantial investments, gain investors' confidence, or enhance the perceived value of their shares. Increasing the par value can also be beneficial when planning to issue additional shares or during a stock split. 2. Decrease in Par Value: Conversely, this type of amendment refers to reducing the nominal value of each share of common stock. A decrease in par value might be pursued to increase the number of outstanding shares, facilitate stock dividend distributions, or align the company's valuation with its market performance. Lowering the par value can also make shares more affordable to potential investors. When implementing a Wisconsin Amendment of common stock par value, corporations are required to comply with the relevant state laws and regulations. They must file the appropriate documentation, such as an amended article of incorporation or a certificate of amendment, with the Wisconsin Department of Financial Institutions. It is crucial for corporations to consider the potential implications of such amendments, as they may impact shareholders' rights, contribute to changes in ownership percentages, influence stock prices, or affect the corporation's financial statements. Therefore, companies often consult legal and financial professionals to ensure compliance and make informed decisions when adopting an amendment of common stock par value in Wisconsin.

Wisconsin Amendment of common stock par value

Description

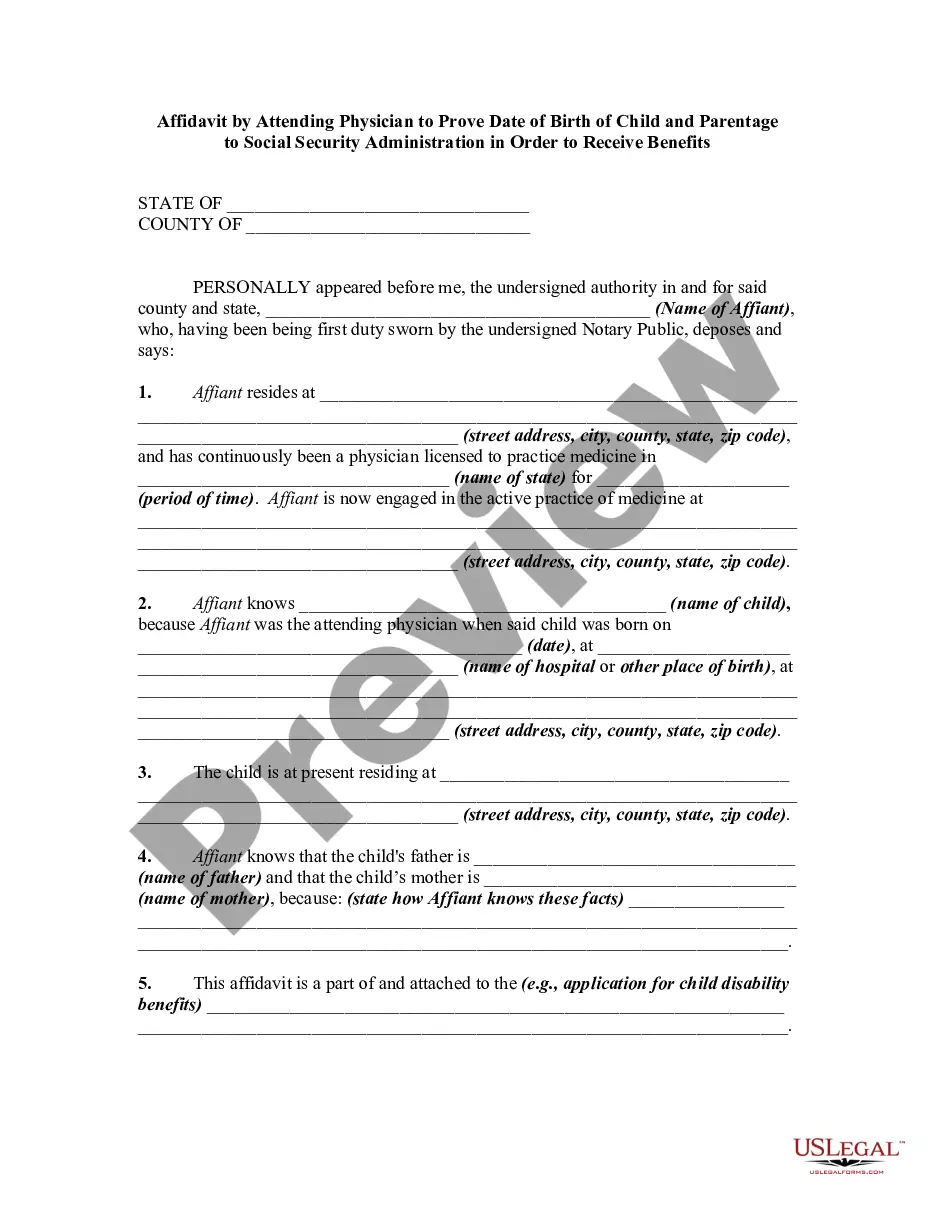

How to fill out Amendment Of Common Stock Par Value?

Choosing the right legal papers design can be a struggle. Of course, there are a lot of templates available on the Internet, but how would you obtain the legal form you want? Make use of the US Legal Forms web site. The support gives 1000s of templates, including the Wisconsin Amendment of common stock par value, that you can use for business and personal needs. All the forms are checked by pros and meet up with state and federal specifications.

In case you are already registered, log in to your accounts and click on the Down load key to have the Wisconsin Amendment of common stock par value. Make use of your accounts to appear with the legal forms you may have purchased formerly. Go to the My Forms tab of the accounts and get an additional backup of the papers you want.

In case you are a new customer of US Legal Forms, listed below are basic directions that you can comply with:

- First, make certain you have chosen the proper form for the area/area. You can check out the shape making use of the Review key and study the shape description to make sure this is basically the right one for you.

- In case the form is not going to meet up with your requirements, take advantage of the Seach field to discover the right form.

- When you are certain that the shape would work, go through the Acquire now key to have the form.

- Pick the prices prepare you desire and enter in the necessary info. Build your accounts and pay for your order with your PayPal accounts or bank card.

- Select the file format and download the legal papers design to your system.

- Total, revise and print out and indicator the received Wisconsin Amendment of common stock par value.

US Legal Forms is the greatest library of legal forms for which you can discover different papers templates. Make use of the service to download professionally-made files that comply with status specifications.

Form popularity

FAQ

To make amendments to your Wisconsin articles of incorporation, you can file Wisconsin Form 4, Articles of Amendment ? Stock, for-Profit Corporation to the Wisconsin Department of Financial Institutions (DFI).

To make amendments to your Wisconsin articles of incorporation, you can file Wisconsin Form 4, Articles of Amendment ? Stock, for-Profit Corporation to the Wisconsin Department of Financial Institutions (DFI). The form is optional; you may draft your own Articles of Amendment.

How do I create Articles of Incorporation? Step 1: State where the corporation is incorporating. ... Step 2: Provide details about the person filing the Articles of Incorporation. ... Step 3: State the corporation's name, purpose and duration. ... Step 4: Include details about the registered agent and office.

Articles of Incorporation refers to the highest governing document in a corporation. It is also known known as the corporate charter. The Articles of Incorporation generally include the purpose of the corporation, the type and number of shares, and the process of electing a board of directors.

One of the benefits of incorporating a company in Delaware is the flexibility of the corporate structure. With stock amendments, you can increase or decrease the number of shares your Delaware company has authorized; you can also add or remove classes of stock and/or modify the par value of the stock.

Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split). A stock split is exactly what it sounds like: a division of shares.

You'll need to file Articles of Organization to start your Wisconsin LLC. You can submit your articles online or by mail. Paper filings cost $170 and online submissions are $130. Expediting costs an additional $25.

To start a corporation in Wisconsin, you must file Articles of Incorporation with the Wisconsin Department of Financial Institutions. You can file the document online or by mail. The Articles of Incorporation cost $100 to file. Once filed with the state, this document formally creates your Wisconsin corporation.