West Virginia Deferred Compensation Agreement - Short Form

Description

How to fill out Deferred Compensation Agreement - Short Form?

You can spend hours online searching for the legal document template that satisfies the federal and state requirements you will need.

US Legal Forms provides a vast selection of legal documents that are examined by experts.

You can effortlessly download or print the West Virginia Deferred Compensation Agreement - Short Form from our services.

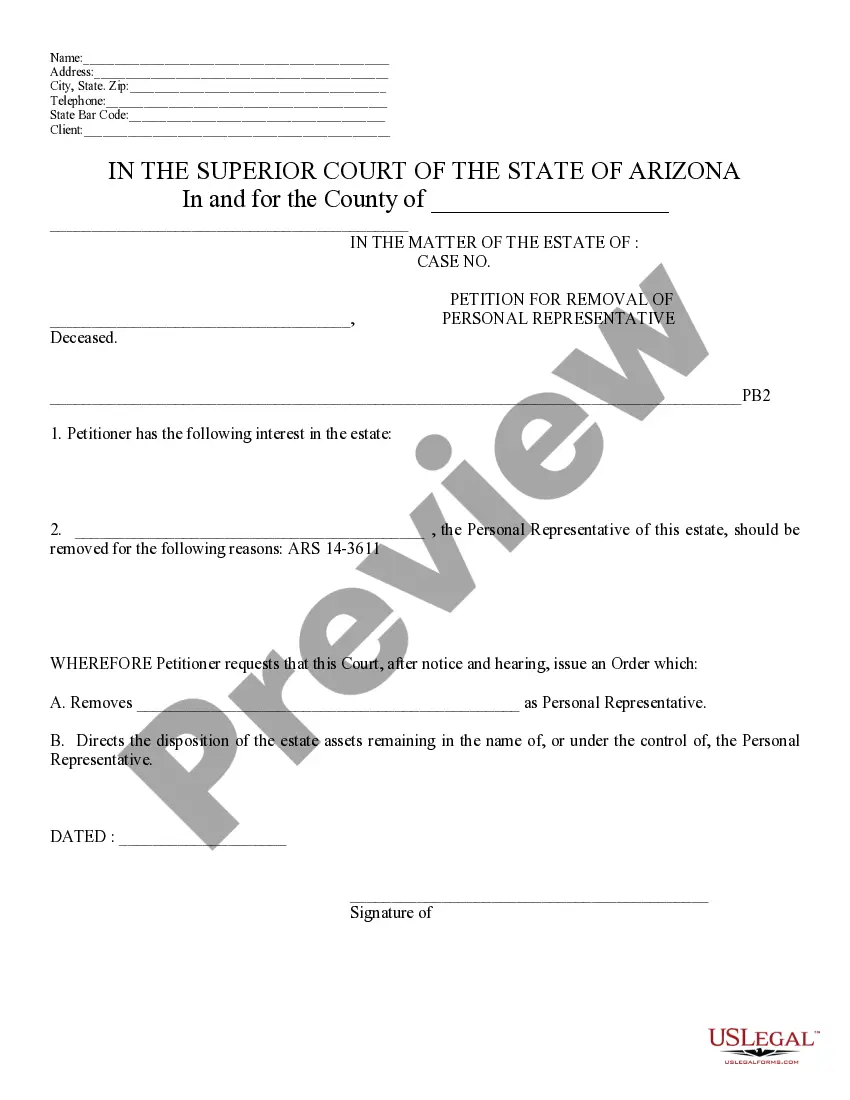

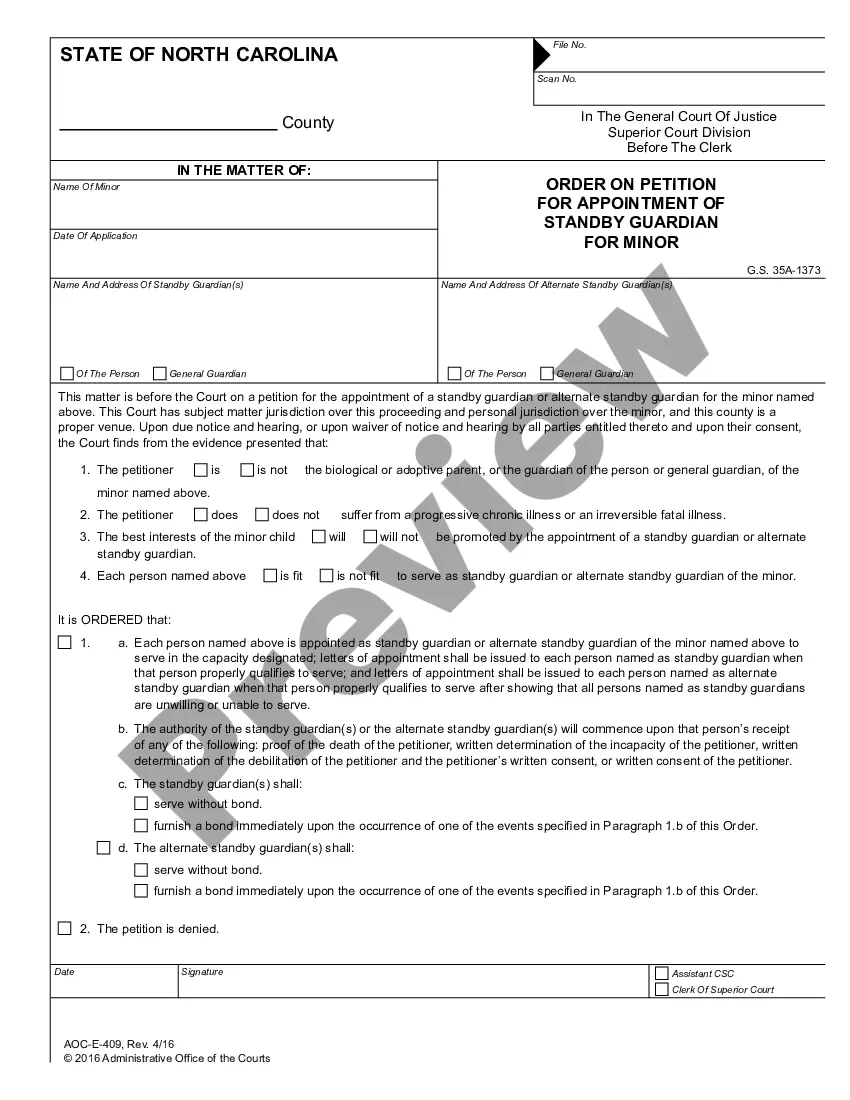

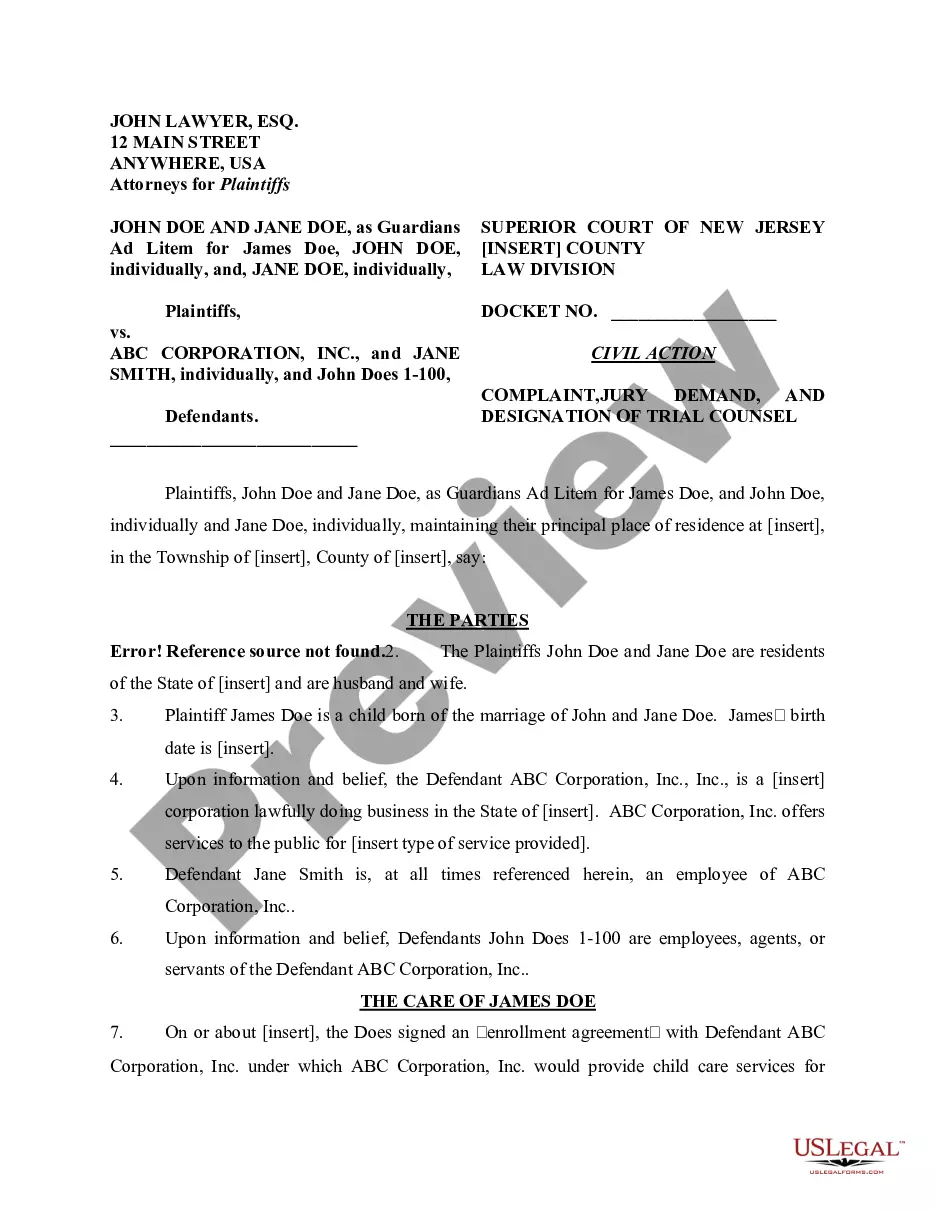

If available, use the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can sign in and click on the Obtain button.

- Subsequently, you can complete, modify, print, or sign the West Virginia Deferred Compensation Agreement - Short Form.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of any purchased form, visit the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city you are interested in.

- Refer to the form description to make sure you have selected the appropriate form.

Form popularity

FAQ

A 457(b) plan is offered through your employer, and contributions are taken from your paycheck on a pre-tax basis, which lowers your taxable income. Unlike a 401(k) or 403(b), if you leave a job or retire before age 59½ and need to withdraw your retirement funds from a 457(b), you won't pay a 10% tax penalty.

A deferred compensation plan is another name for a 457(b) retirement plan, or 457 plan for short. Deferred compensation plans are designed for state and municipal workers, as well as employees of some tax-exempt organizations.

You can take the distribution in a lump sum or regular installments, paying tax when you receive the income. You can also arrange to withdraw some of it when you anticipate a need, such as paying for your kids' college tuition. While the IRS has few restrictions, your employer will probably have their own rules.

Deferred compensation plans are funded informally. There is essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

DEFINITION. A 457(b) plan is an employer-sponsored, tax-favored retirement savings account. With this type of plan, you can contribute pre-tax dollars from your paycheck, and that money won't be taxed until you withdraw the money, usually for retirement.

If you participate in a deferred compensation plan, you can contribute a portion of your salary to a retirement account. That money and any earnings you accumulate are not taxed until you withdraw them.

Qualified deferred compensation plans are pension plans governed by the Employee Retirement Income Security Act (ERISA), including 401(k) plans and 403(b) plans. A company that has such a plan in place must offer it to all employees, though not to independent contractors.

PEBSCO is the largest, most experienced administrator of deferred compensation plans in the United States, serving over 2,500 government bodies with over 320,000 participants. In the State of Illinois PEBSCO administers plans for 65 jurisdictions.

457 plans are IRS-sanctioned, tax-advantaged employee retirement plans. They are offered by state, local government, and some nonprofit employers. Participants are allowed to contribute up to 100% of their salary, provided it does not exceed the applicable dollar limit for the year.

457 plans are IRS-sanctioned, tax-advantaged employee retirement plans. They are offered by state, local government, and some nonprofit employers. Participants are allowed to contribute up to 100% of their salary, provided it does not exceed the applicable dollar limit for the year.