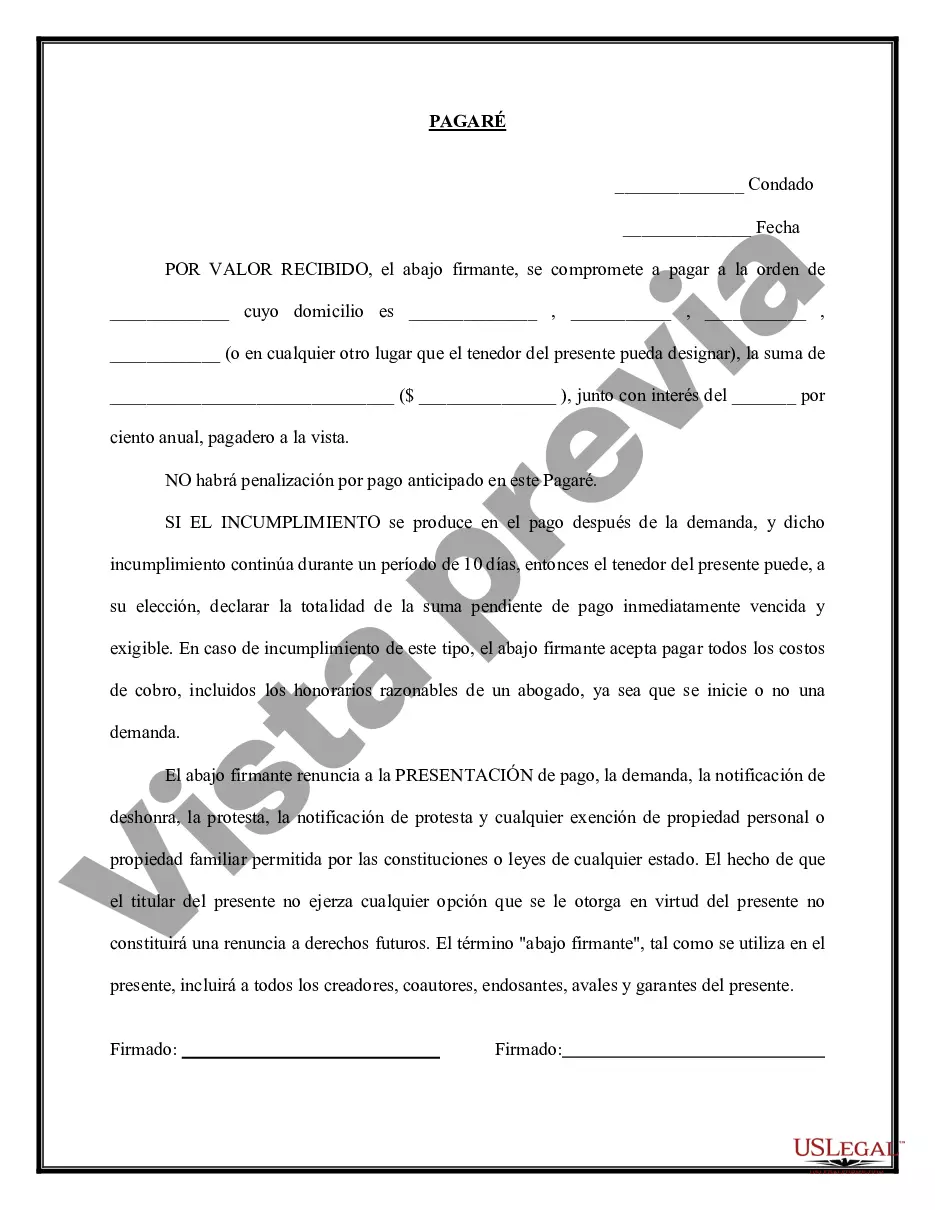

A West Virginia Promissory Note — Payable on Demand is a legal document used within the state of West Virginia to outline the terms of a loan agreement. This type of promissory note establishes an enforceable commitment between a lender and a borrower, specifying the repayment terms and conditions. It is important to understand the various types of West Virginia Promissory Note — Payable on Demand, as they differ based on specific situations. One type of West Virginia Promissory Note — Payable on Demand is the Secured Promissory Note. This note includes a collateral clause, wherein the borrower offers a specific asset as security for the loan. The lender can seize the collateral in case the borrower defaults on the note, providing an additional layer of protection for the lender. This type of note is commonly used when a substantial loan is involved. Another type is the Unsecured Promissory Note, which does not require any collateral from the borrower. It solely relies on the borrower's promise to repay the loan according to the agreed-upon terms. This type of note is commonly used for smaller loans or when the borrower has a good credit history. Additionally, the West Virginia Promissory Note — Payable on Demand can be categorized as a Demand Promissory Note. It means the lender has the right to request immediate repayment of the loan at any time they desire. This type of note offers flexibility to the lender but could potentially put pressure on the borrower regarding repayment. Furthermore, a Fixed-Term Promissory Note is another category of the West Virginia Promissory Note — Payable on Demand. This note outlines specific repayment terms, including a fixed amount to be repaid regularly over a defined period. Such notes are often used for larger loans with extended repayment durations. To draft a West Virginia Promissory Note — Payable on Demand, it is crucial to include key details. These may include the names and contact information of both the lender and borrower, the loan amount, the interest rate (if applicable), the repayment schedule, any late payment penalties, and the consequences of default. In conclusion, a West Virginia Promissory Note — Payable on Demand is a legally binding agreement used to establish the terms of a loan. It is vital to understand the different types available, such as the Secured Promissory Note, Unsecured Promissory Note, Demand Promissory Note, and Fixed-Term Promissory Note. Creating a comprehensive promissory note helps protect the rights and responsibilities of both the lender and borrower in West Virginia.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Pagaré - Pagadero a la vista - Promissory Note - Payable on Demand

Description

How to fill out West Virginia Pagaré - Pagadero A La Vista?

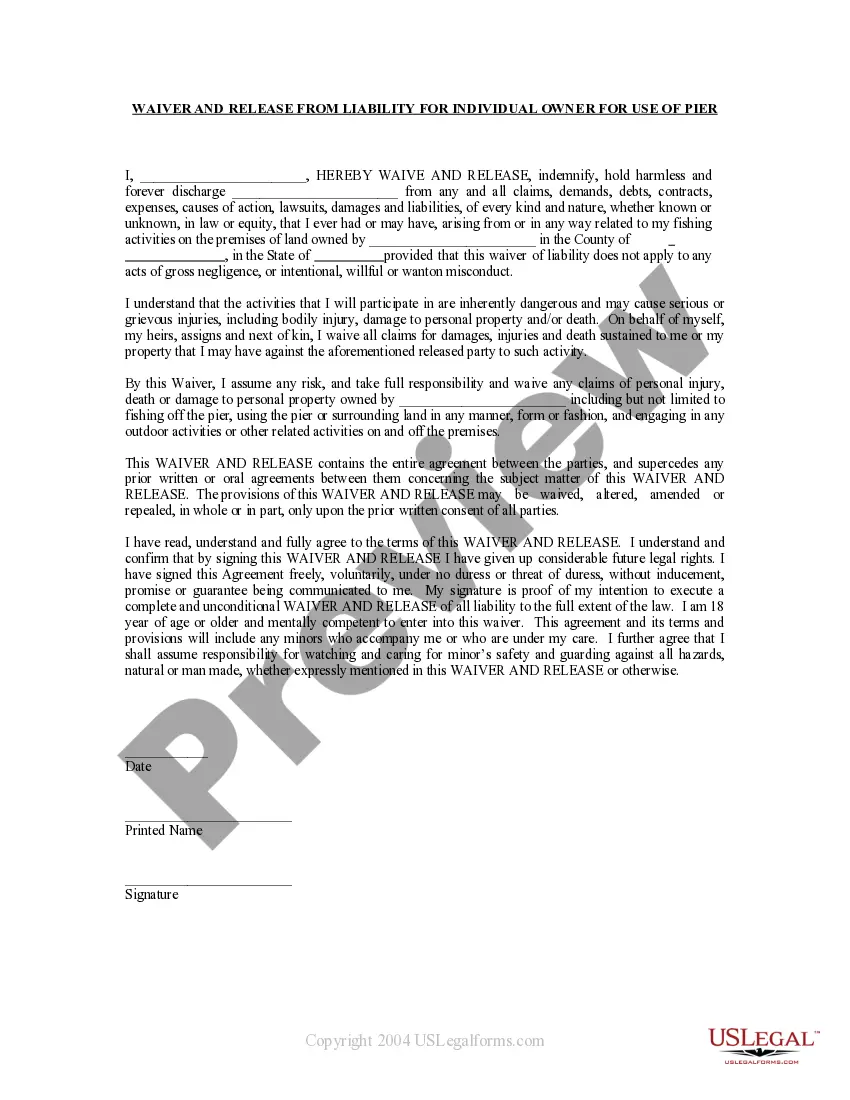

Have you been inside a situation where you need paperwork for either company or specific functions nearly every working day? There are tons of legitimate papers templates available online, but locating kinds you can rely isn`t simple. US Legal Forms offers 1000s of form templates, just like the West Virginia Promissory Note - Payable on Demand, which can be created in order to meet federal and state demands.

In case you are currently acquainted with US Legal Forms site and have your account, simply log in. Following that, it is possible to obtain the West Virginia Promissory Note - Payable on Demand template.

If you do not offer an bank account and would like to start using US Legal Forms, follow these steps:

- Discover the form you require and make sure it is for that correct area/state.

- Take advantage of the Preview switch to analyze the form.

- Read the explanation to actually have selected the right form.

- When the form isn`t what you are trying to find, take advantage of the Search field to find the form that suits you and demands.

- Once you obtain the correct form, click on Get now.

- Opt for the pricing strategy you would like, fill in the necessary details to generate your bank account, and pay for your order with your PayPal or bank card.

- Select a hassle-free data file formatting and obtain your copy.

Get all of the papers templates you have purchased in the My Forms menu. You can obtain a more copy of West Virginia Promissory Note - Payable on Demand any time, if required. Just click on the required form to obtain or printing the papers template.

Use US Legal Forms, by far the most comprehensive collection of legitimate varieties, to save lots of efforts and stay away from blunders. The services offers professionally created legitimate papers templates that can be used for an array of functions. Create your account on US Legal Forms and initiate creating your daily life easier.