The West Virginia Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions is a crucial legal document that outlines the process of establishing banking relationships for corporations and designating authorized individuals to act as signatories on their accounts. This resolution ensures that a corporation operates smoothly by providing clear guidelines for choosing a suitable bank and determining account signatories. As per the West Virginia laws, there aren't specific types of resolutions for selecting a bank or account signatories. However, corporations can create variations of this resolution to suit their specific requirements. Here are some relevant keywords and a detailed description of the West Virginia Resolution Selecting Bank for Corporation and Account Signatories — Corporate Resolutions: 1. Corporate banking relationship: This resolution establishes the framework for selecting a bank to fulfill the financial needs of a corporation. It includes the criteria for evaluating potential banking partners, such as reputation, services offered, fees, and proximity to the corporation's location. 2. Account signatories: This resolution identifies the key individuals authorized to sign on behalf of the corporation for various account transactions. It specifies their roles, responsibilities, and the limits of their authority. These signatories may include officers, directors, or other authorized personnel designated by the corporation. 3. Due diligence: The resolution stresses the importance of conducting thorough due diligence when selecting a bank. It emphasizes the need to verify the bank's stability, security measures, and compliance with regulatory requirements. This ensures that the corporation's funds are in safe hands and that the chosen bank aligns with the corporation's financial goals and values. 4. Decision-making process: The resolution outlines the process for evaluating multiple banking options. It may require the corporation to form a committee responsible for conducting research, comparing proposals, and presenting their recommendations to the board of directors. This ensures transparency and accountability in the selection process. 5. Board approval: The resolution mandates that the board of directors reviews and approves the selection of the bank and the designated signatories. This ensures that the board exercises oversight and approves significant decisions related to the corporation's finances. The resolution may specify the number of votes required for approval and the documentation necessary to record the board's decision. 6. Documentation: The resolution requires the corporation to formally document the chosen bank and account signatories through the execution of proper agreements, such as account opening forms, signature cards, and contractual arrangements. This documentation serves as evidence of the corporation's official relationship with the bank and the authorized individuals acting on its behalf. 7. Reporting obligations: The resolution may include provisions for regular reporting to the board of directors and officers regarding the corporation's banking activities. This ensures transparency, accountability, and effective oversight of financial transactions and decisions. Remember that while these keywords provide a general framework for content generation, it's essential to customize the resolution to your corporation's specific needs and comply with any applicable West Virginia laws or regulations.

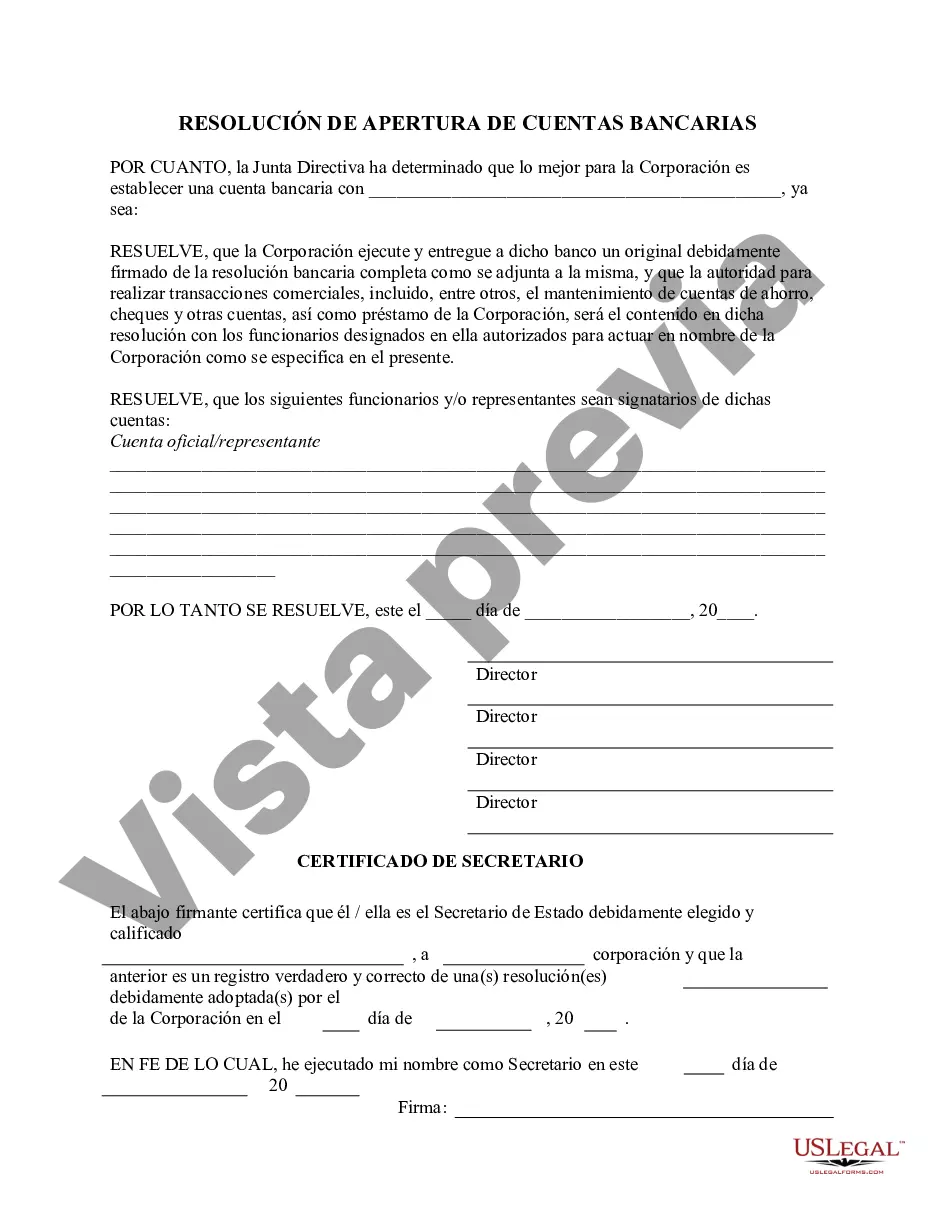

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Resolución de Selección de Banco para Sociedades Anónimas y Signatarios de Cuentas - Resoluciones Corporativas - Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions

Description

How to fill out West Virginia Resolución De Selección De Banco Para Sociedades Anónimas Y Signatarios De Cuentas - Resoluciones Corporativas?

If you need to total, down load, or produce authorized papers web templates, use US Legal Forms, the most important variety of authorized kinds, that can be found on-line. Utilize the site`s basic and handy search to obtain the paperwork you will need. Various web templates for enterprise and person functions are sorted by classes and suggests, or keywords and phrases. Use US Legal Forms to obtain the West Virginia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions in a few mouse clicks.

When you are currently a US Legal Forms customer, log in to your profile and then click the Acquire button to obtain the West Virginia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions. You can even gain access to kinds you formerly downloaded in the My Forms tab of the profile.

If you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for that appropriate city/region.

- Step 2. Make use of the Preview method to check out the form`s information. Don`t forget to read the description.

- Step 3. When you are unhappy together with the type, take advantage of the Lookup field near the top of the monitor to get other versions of your authorized type web template.

- Step 4. Once you have found the shape you will need, go through the Purchase now button. Choose the rates plan you favor and put your accreditations to register to have an profile.

- Step 5. Approach the deal. You should use your credit card or PayPal profile to complete the deal.

- Step 6. Select the formatting of your authorized type and down load it on your product.

- Step 7. Comprehensive, edit and produce or sign the West Virginia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions.

Every single authorized papers web template you buy is your own property permanently. You possess acces to every single type you downloaded within your acccount. Click the My Forms section and choose a type to produce or down load once more.

Compete and down load, and produce the West Virginia Resolution Selecting Bank for Corporation and Account Signatories - Corporate Resolutions with US Legal Forms. There are millions of professional and state-certain kinds you can use for your enterprise or person demands.