Title: West Virginia Sample Letter for Request for Free Credit Report Allowed by Federal Law Introduction: In the US, citizens have the right to request a free copy of their credit report annually under the Fair Credit Reporting Act (FCRA). This law ensures that individuals can access their credit information to monitor their financial health. In West Virginia, residents can take advantage of this federal law by submitting a formal request for their credit report. This article provides a detailed description of what West Virginia residents should include in their sample letter for requesting a free credit report. [Keywords: West Virginia, sample letter, request, free credit report, federal law] Main Content: I. Importance of Requesting a Free Credit Report: — Highlight the significance of reviewing credit reports regularly — Outline how credit reports impact financial decisions, loan applications, and interest rates — Emphasize that a free credit report can help identify errors, fraudulent activities, or potential identity theft II. Formatting the West Virginia Sample Letter: — Start with a formal introduction, including the recipient's details — Clearly state the purpose of the letter — requesting a free credireportor— - Include personal identification information to ensure accurate results — Mention that the request is being made in accordance with the Fair Credit Reporting Act III. Essential Components of the West Virginia Sample Letter: — Convey the need for a comprehensive credit report from all major credit reporting agencies — Briefly mention any recent financial events or concerns that prompted the request — Express gratitude for providing the credit report within the legally required timeframe IV. Sample West Virginia Letters for Requesting Credit Reports: a) Standard Request Letter: — This type of letter requests a free credit report without any specific reason or concern mentioned. b) Dispute Letter: — This type of letter is used when an individual has identified errors or discrepancies on their credit report. — Encourage individuals to provide evidence to support their dispute claims. c) Identity Theft Letter: — This type of letter is used if a person suspects or has become a victim of identity theft. — Request an immediate credit report and emphasize the need to correct any fraudulent activities. Conclusion: Requesting a free credit report in West Virginia is an effective way to stay informed about one's financial history and prevent potential problems. By utilizing the provided sample letters, residents can exercise their rights granted by the Fair Credit Reporting Act. Regularly monitoring credit reports is crucial for maintaining financial stability and safeguarding against fraud. [Keywords: West Virginia, sample letter, request, free credit report, federal law, standard request letter, dispute letter, identity theft letter]

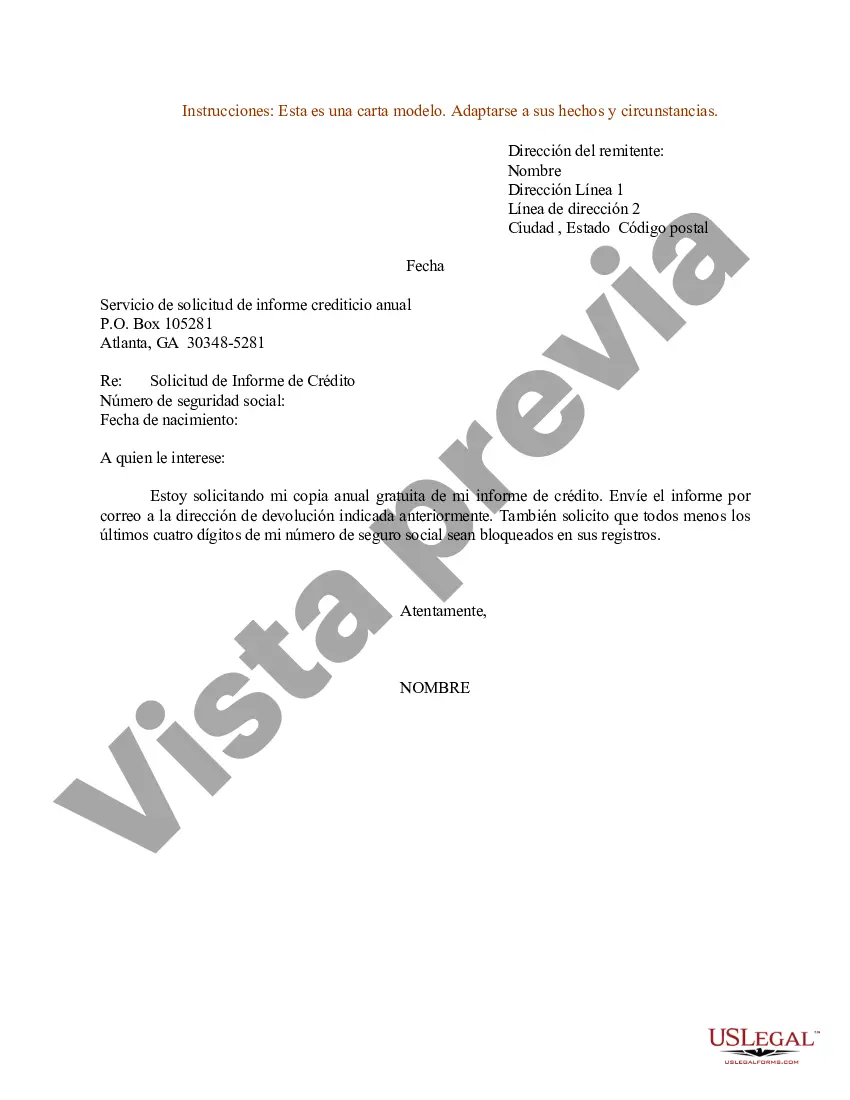

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Ejemplo de carta de solicitud de informe de crédito gratuito permitido por la ley federal - Sample Letter for Request for Free Credit Report Allowed by Federal Law

Description

How to fill out West Virginia Ejemplo De Carta De Solicitud De Informe De Crédito Gratuito Permitido Por La Ley Federal?

If you want to complete, acquire, or print lawful record themes, use US Legal Forms, the most important assortment of lawful varieties, which can be found on the web. Make use of the site`s simple and easy convenient research to get the paperwork you want. Numerous themes for enterprise and person uses are categorized by groups and states, or keywords. Use US Legal Forms to get the West Virginia Sample Letter for Request for Free Credit Report Allowed by Federal Law with a handful of mouse clicks.

When you are previously a US Legal Forms client, log in to the account and then click the Obtain button to have the West Virginia Sample Letter for Request for Free Credit Report Allowed by Federal Law. You can also accessibility varieties you earlier delivered electronically within the My Forms tab of your account.

If you work with US Legal Forms initially, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for that right town/country.

- Step 2. Take advantage of the Preview option to look over the form`s content material. Don`t forget about to read the outline.

- Step 3. When you are unhappy together with the form, take advantage of the Search area near the top of the display screen to discover other versions of the lawful form template.

- Step 4. When you have discovered the form you want, select the Buy now button. Opt for the rates strategy you prefer and include your references to sign up for an account.

- Step 5. Approach the purchase. You should use your Мisa or Ьastercard or PayPal account to accomplish the purchase.

- Step 6. Pick the file format of the lawful form and acquire it in your device.

- Step 7. Comprehensive, change and print or indicator the West Virginia Sample Letter for Request for Free Credit Report Allowed by Federal Law.

Every single lawful record template you get is your own forever. You possess acces to each and every form you delivered electronically inside your acccount. Select the My Forms segment and choose a form to print or acquire yet again.

Contend and acquire, and print the West Virginia Sample Letter for Request for Free Credit Report Allowed by Federal Law with US Legal Forms. There are millions of professional and state-certain varieties you can utilize to your enterprise or person demands.