West Virginia Financing Statement is a legal document that serves as a public record to secure financial interests in lenders and creditors in the state of West Virginia. It is governed by the Uniform Commercial Code (UCC) Article 9. A West Virginia Financing Statement outlines the rights of a creditor or lender against a debtor's personal property or assets in case of default or non-repayment of a loan. By filing this document with the West Virginia Secretary of State's office, creditors ensure their priority position in claiming the assets of a debtor. The keywords relevant to West Virginia Financing Statement include: 1. West Virginia: Referring to the state where the financing statement is filed. 2. Financing Statement: The legal document used to secure financial interests against a debtor's assets. 3. Lenders and Creditors: Individuals or institutions that provide loans or credit to debtors. 4. Uniform Commercial Code (UCC): The set of laws that regulate commercial transactions, including the filing of financing statements, in the United States. 5. Article 9: A specific section of the UCC that governs secured transactions and the creation and filing of financing statements. There are no specific types of West Virginia Financing Statements; however, variations may arise depending on the nature of the transaction or the type of collateral involved. Common variations may include: 1. General Financing Statement: The most common type, which encompasses a wide range of collateral and grants a blanket security interest. 2. Specific Financing Statement: Filed to secure a debt against specific assets or collateral, providing a more focused security interest. 3. Fixture Financing Statement: This type involves fixtures, which are personal properties attached to real estate, such as machinery or appliances. These filings ensure the lender's interest in fixtures if the debtor defaults or transfers the property. It is important for lenders and creditors to file a West Virginia Financing Statement accurately and in a timely manner. This document helps protect their financial interests and ensures they have a legal claim in case the debtor fails to repay the loan as agreed.

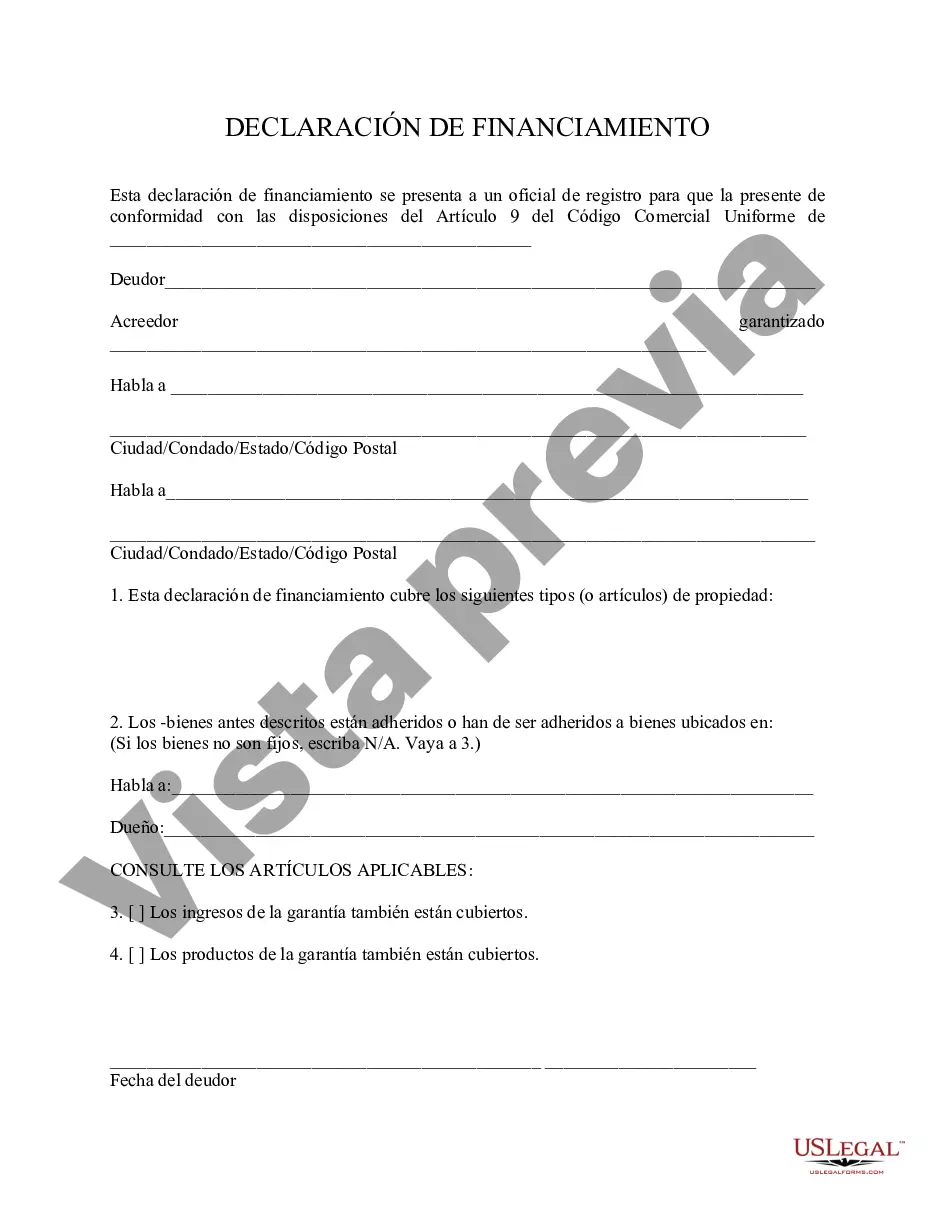

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Declaración de Financiamiento - Financing Statement

Description

How to fill out West Virginia Declaración De Financiamiento?

You can spend several hours on the web attempting to find the authorized papers design that meets the federal and state needs you will need. US Legal Forms gives a huge number of authorized forms which can be examined by professionals. You can actually download or printing the West Virginia Financing Statement from your assistance.

If you currently have a US Legal Forms profile, you may log in and then click the Obtain option. Following that, you may comprehensive, edit, printing, or signal the West Virginia Financing Statement. Every authorized papers design you buy is your own for a long time. To get an additional duplicate for any obtained form, check out the My Forms tab and then click the corresponding option.

If you use the US Legal Forms web site the first time, keep to the straightforward guidelines beneath:

- Initial, be sure that you have selected the right papers design to the state/metropolis of your choice. Browse the form outline to ensure you have picked out the proper form. If available, make use of the Preview option to look throughout the papers design at the same time.

- If you wish to locate an additional edition of the form, make use of the Search area to discover the design that meets your requirements and needs.

- After you have identified the design you need, click Acquire now to carry on.

- Select the prices prepare you need, enter your accreditations, and register for an account on US Legal Forms.

- Comprehensive the transaction. You may use your credit card or PayPal profile to purchase the authorized form.

- Select the format of the papers and download it for your system.

- Make alterations for your papers if possible. You can comprehensive, edit and signal and printing West Virginia Financing Statement.

Obtain and printing a huge number of papers themes utilizing the US Legal Forms website, which provides the greatest variety of authorized forms. Use professional and express-particular themes to deal with your small business or specific needs.