West Virginia Sale of Partnership to Corporation

Description

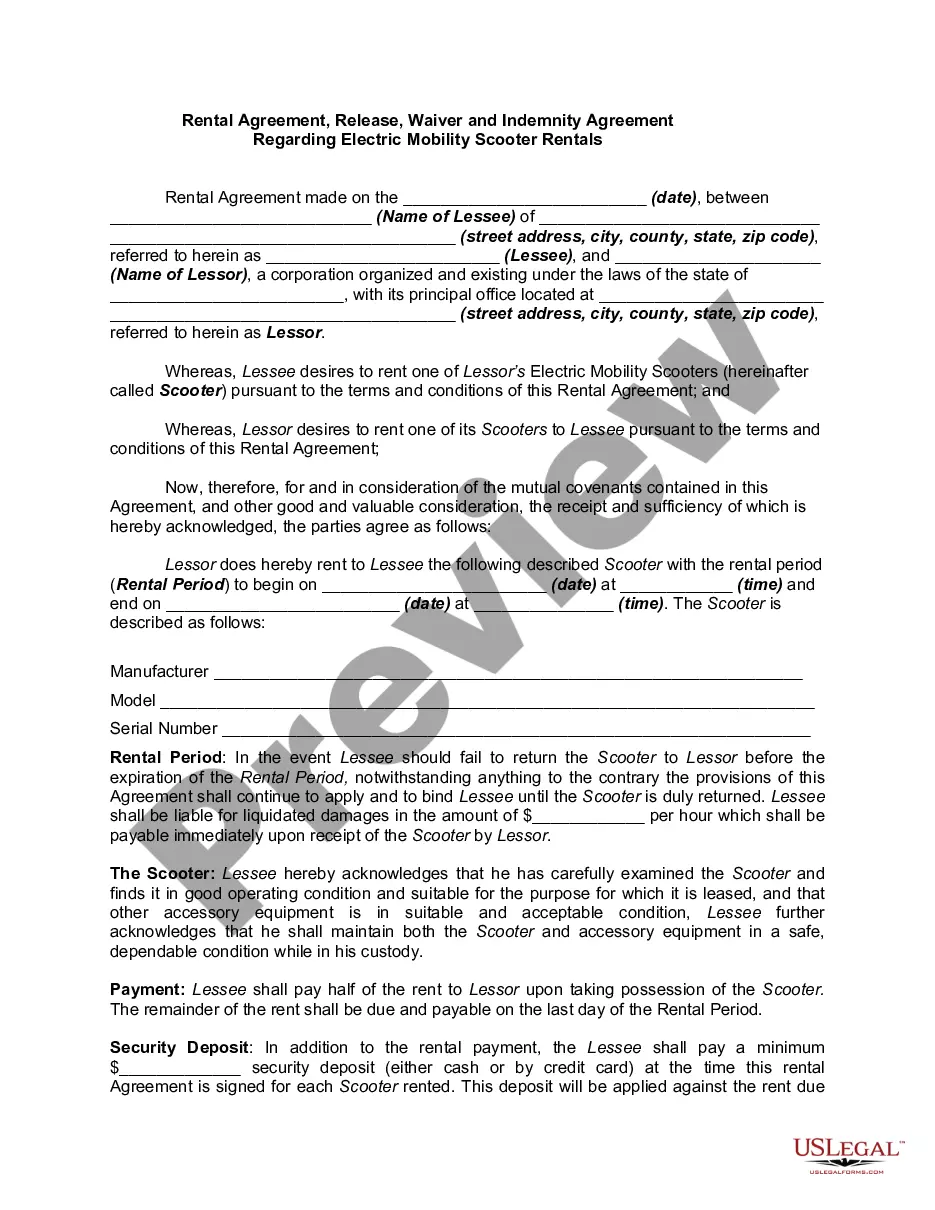

How to fill out Sale Of Partnership To Corporation?

Are you currently in a situation where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of document templates, such as the West Virginia Sale of Partnership to Corporation, which are designed to meet federal and state regulations.

Once you find the correct form, click Get now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and complete the payment with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the West Virginia Sale of Partnership to Corporation template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Review button to check the form.

- Verify the details to make sure you have selected the correct form.

- If the form does not meet your needs, use the Search field to find the appropriate document.

Form popularity

FAQ

Yes, West Virginia does accept federal extensions for partnerships. If you file for a federal extension, it automatically grants you additional time to file your West Virginia partnership return. This can be crucial during the West Virginia Sale of Partnership to Corporation, as it allows for careful planning and compliance. For more information and assistance in managing your partnership’s tax obligations, USLegalForms has helpful resources and templates available.

Yes, West Virginia operates under a single sales factor apportionment rule. This method allocates corporate income based solely on sales within the state, which can be particularly beneficial for businesses looking to make a West Virginia Sale of Partnership to Corporation. Understanding this can help you optimize your tax strategy. For detailed calculations and implications, consider consulting with tax professionals or use USLegalForms for resources.

To dissolve a corporation in West Virginia, you must file Articles of Dissolution with the Secretary of State. This process involves settling any outstanding debts and obligations. After officially filing, you will complete the necessary steps to ensure a smooth transition, particularly if your corporation is involved in the West Virginia Sale of Partnership to Corporation. Utilizing platforms like USLegalForms can streamline this process, providing templates and guidance tailored to your needs.

The nonresident withholding tax rate in West Virginia is typically set at the state's income tax rate. This rate can vary depending on the income level and specific circumstances of the non-resident. As you consider the West Virginia Sale of Partnership to Corporation, staying informed about the nonresident withholding tax can assist you in planning for tax obligations efficiently.

To close a West Virginia sales tax account, you need to file the necessary forms with the West Virginia State Tax Department. It is important to ensure that all sales tax liabilities have been settled before submitting the closure request. Following these steps can streamline your transition if you are considering the West Virginia Sale of Partnership to Corporation, allowing for smoother operations moving forward.

Yes, West Virginia does accept federal extensions for corporations. This allows corporations to extend their tax filing deadline, offering more time to prepare their financial documentation. Understanding these extensions can benefit businesses navigating the complexities of converting from a partnership to a corporation through the West Virginia Sale of Partnership to Corporation.

In West Virginia, the withholding rate for partnerships typically aligns with the state's income tax guidelines. Partnerships must calculate their withholding based on partnership income distributed to partners. Ensuring compliance with these withholding rules is essential when considering the West Virginia Sale of Partnership to Corporation, as it may affect your overall tax strategy.

Yes, a non-resident can be a partner in a partnership in West Virginia. The state does not prohibit non-residents from participating in partnerships. However, it's important to understand how this may impact your tax obligations and potential withholding requirements. For those looking to transition their partnership interests to a corporation, considering the West Virginia Sale of Partnership to Corporation is crucial.

Yes, an S-corporation can be a partner in a partnership, as long as it meets certain IRS requirements. This co-ownership can allow for beneficial tax treatments and strategic business arrangements. If you're contemplating a West Virginia Sale of Partnership to Corporation, understanding how S-corporations fit into the equation can be crucial for a smooth transition.

Closing a business in West Virginia involves several key steps. You need to file articles of dissolution with the Secretary of State and settle all financial obligations. Before filing, make sure to notify any affected parties, including employees and creditors. If your situation includes a West Virginia Sale of Partnership to Corporation, using a resource like US Legal Forms can aid in completing your tasks efficiently.