When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

Title: West Virginia Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties Keywords: West Virginia, letter, credit card company, lower payments, financial difficulties, hardship, debt, struggling, request, monthly payments, interest rates, budget, repayment plan, circumstances, genuine, modify, negotiate, terms, agreement. Description: A West Virginia letter to a credit card company seeking to lower payments due to financial difficulties is a formal communication addressing the financial challenges faced by an individual or business. This letter aims to request the credit card company to consider adjusting the monthly payments in light of the current circumstances and financial hardships encountered by the debtor. This particular letter is of utmost relevance to residents of West Virginia who find themselves struggling to meet their credit card obligations. It provides a framework for expressing the genuine need for payment modifications, mainly focusing on reducing monthly payments or negotiating lower interest rates. A West Virginia letter to a credit card company seeking lower payments due to financial difficulties can be further categorized into specific types based on the debtor's exact situation. Some potential variations include: 1. West Virginia Letter to Credit Card Company Seeking Reduced Monthly Payments: This type of letter specifically focuses on requesting a decrease in the amount of money owed each month. The debtor explains their current financial situation and provides supporting evidence to substantiate their claim for a reduced payment arrangement. 2. West Virginia Letter to Credit Card Company Seeking Lower Interest Rates: In this variation, the primary concern is the high interest rates charged by the credit card company. The debtor highlights the burden of interest charges on their finances and emphasizes the critical need for a revised interest rate plan that aligns with their ability to repay the debt. 3. West Virginia Letter to Credit Card Company Seeking a Customized Repayment Plan: This type of letter addresses borrowers who are unable to maintain the current repayment structure offered by the credit card company. It proposes a more sustainable repayment plan to better suit the debtor's specific financial circumstances. Overall, regardless of the specific type, a West Virginia letter to a credit card company seeking to lower payments due to financial difficulties is a sincere request for the credit card company to modify the repayment terms and provide relief to individuals or businesses under financial strain. The debtor's aim is to negotiate a mutually acceptable agreement that helps them manage their debt effectively while overcoming their financial difficulties.Title: West Virginia Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties Keywords: West Virginia, letter, credit card company, lower payments, financial difficulties, hardship, debt, struggling, request, monthly payments, interest rates, budget, repayment plan, circumstances, genuine, modify, negotiate, terms, agreement. Description: A West Virginia letter to a credit card company seeking to lower payments due to financial difficulties is a formal communication addressing the financial challenges faced by an individual or business. This letter aims to request the credit card company to consider adjusting the monthly payments in light of the current circumstances and financial hardships encountered by the debtor. This particular letter is of utmost relevance to residents of West Virginia who find themselves struggling to meet their credit card obligations. It provides a framework for expressing the genuine need for payment modifications, mainly focusing on reducing monthly payments or negotiating lower interest rates. A West Virginia letter to a credit card company seeking lower payments due to financial difficulties can be further categorized into specific types based on the debtor's exact situation. Some potential variations include: 1. West Virginia Letter to Credit Card Company Seeking Reduced Monthly Payments: This type of letter specifically focuses on requesting a decrease in the amount of money owed each month. The debtor explains their current financial situation and provides supporting evidence to substantiate their claim for a reduced payment arrangement. 2. West Virginia Letter to Credit Card Company Seeking Lower Interest Rates: In this variation, the primary concern is the high interest rates charged by the credit card company. The debtor highlights the burden of interest charges on their finances and emphasizes the critical need for a revised interest rate plan that aligns with their ability to repay the debt. 3. West Virginia Letter to Credit Card Company Seeking a Customized Repayment Plan: This type of letter addresses borrowers who are unable to maintain the current repayment structure offered by the credit card company. It proposes a more sustainable repayment plan to better suit the debtor's specific financial circumstances. Overall, regardless of the specific type, a West Virginia letter to a credit card company seeking to lower payments due to financial difficulties is a sincere request for the credit card company to modify the repayment terms and provide relief to individuals or businesses under financial strain. The debtor's aim is to negotiate a mutually acceptable agreement that helps them manage their debt effectively while overcoming their financial difficulties.

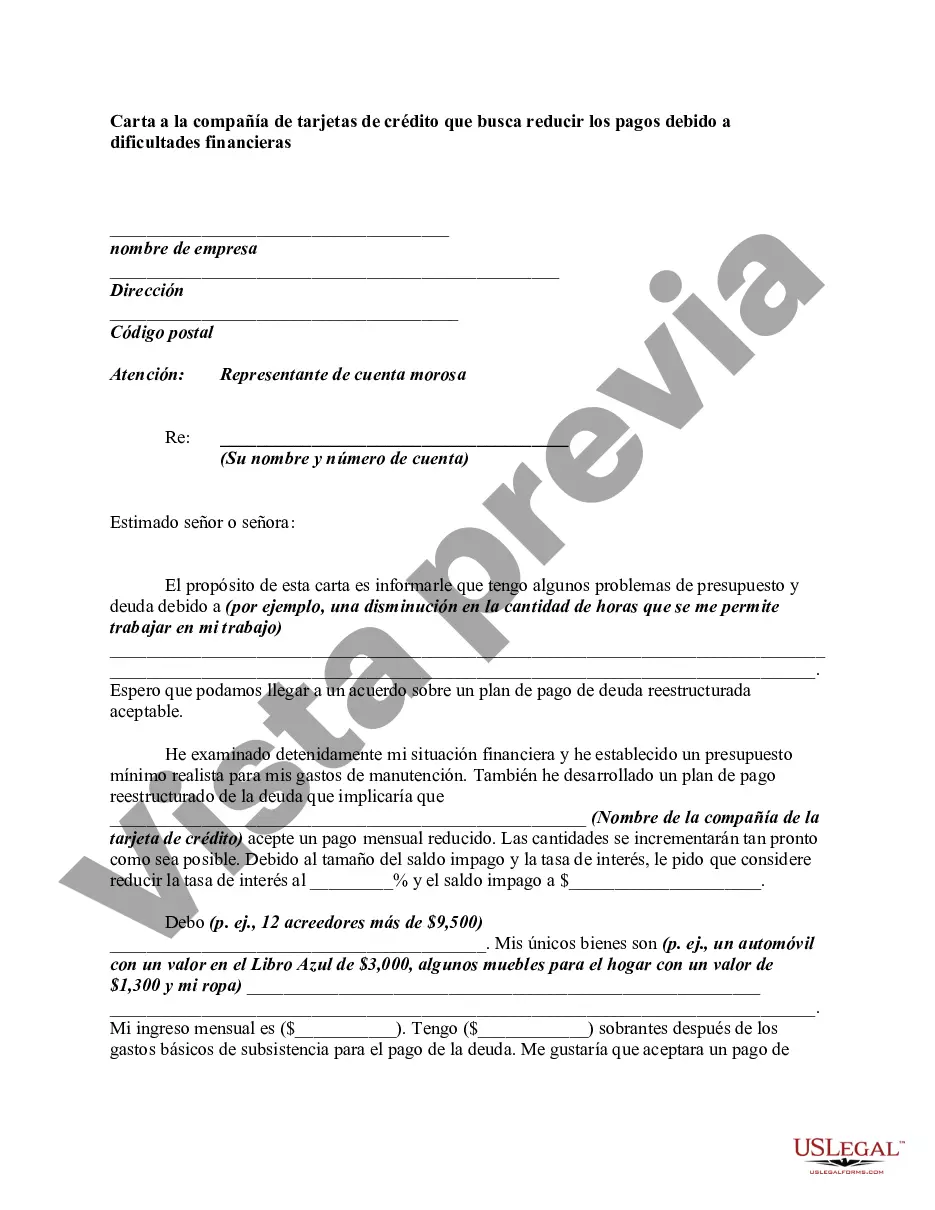

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.