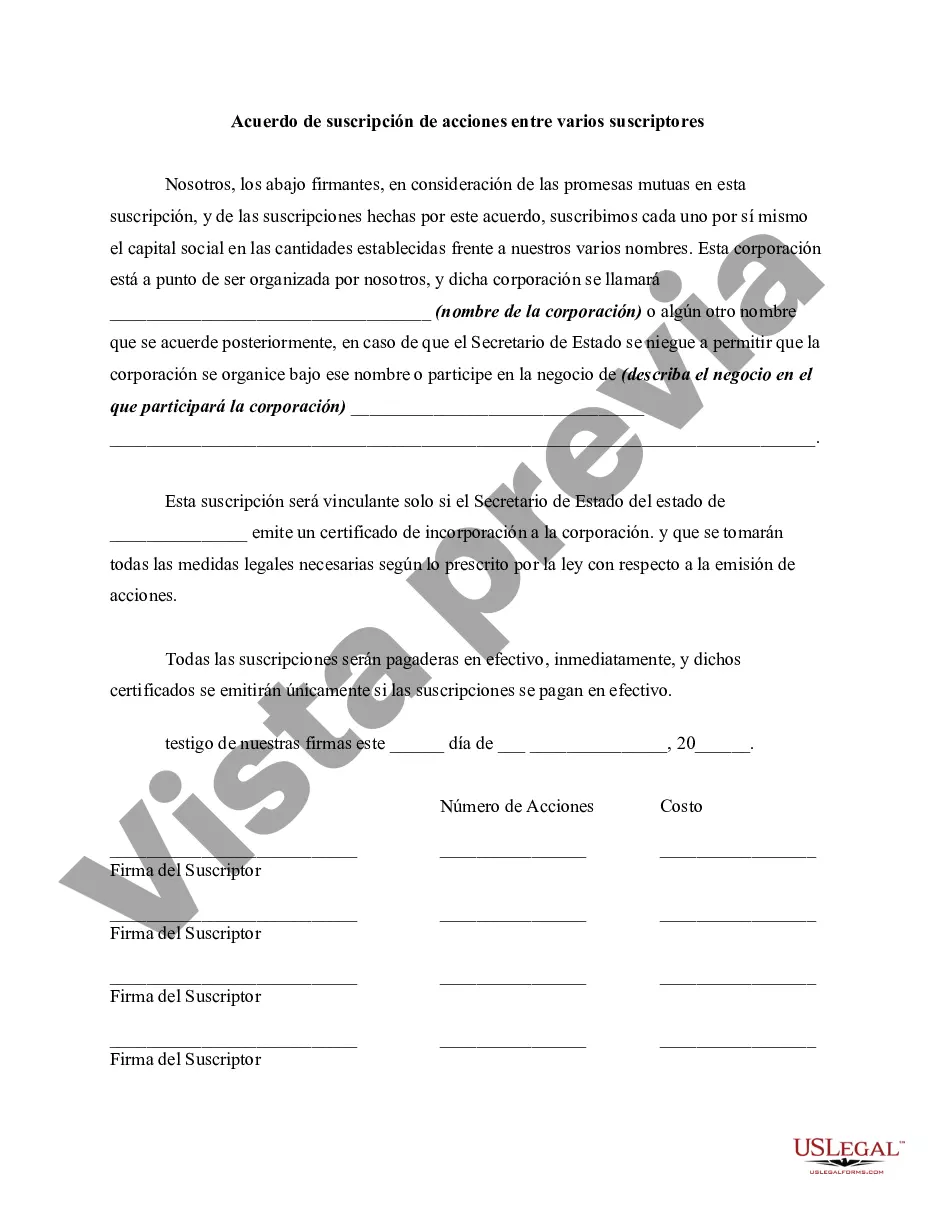

A stock subscription is an agreement to purchase, at a stated price, a stated number of shares of stock of a corporation which is to be formed. Unless some restriction appears in the enabling statute or in the articles or certificate of incorporation, any natural person, and any corporation with the appropriate power, may be a subscriber to corporate stock. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A West Virginia Stock Subscription Agreement Among Several Subscribers is a legally binding contract that outlines the terms and conditions of the purchase and sale of company stock between multiple subscribers in the state of West Virginia. This agreement is essential when a company wishes to raise capital by offering shares of its stock to investors. This agreement typically includes important information such as the names and addresses of the subscribers, the number of shares being purchased, the purchase price per share, and the payment terms. It will also outline the rights and obligations of both the company and the subscribers. Different types of West Virginia Stock Subscription Agreements Among Several Subscribers may include: 1. Common Stock Subscription Agreement: This type of agreement is the most common and involves the purchase of ordinary shares in the company. Common stockholders generally have voting rights in the company's affairs and are entitled to dividends if declared. 2. Preferred Stock Subscription Agreement: This agreement is specific to the purchase and sale of preferred stock. Preferred stockholders have certain preferences over common stockholders, such as priority in receiving dividends and liquidation preferences. 3. Convertible Stock Subscription Agreement: This type of agreement allows subscribers to convert their preferred or common stock into another class of stock at a designated time or under specific circumstances. It offers flexibility to investors who may wish to convert their shares to take advantage of potential future benefits. 4. Restricted Stock Subscription Agreement: This agreement pertains to the purchase of restricted stock, which has certain restrictions on transferability or sale. Typically, these restrictions are imposed to ensure that the subscriber holds the stock for a specified period or meets specific conditions before selling or transferring the shares. These agreements are crucial in protecting the rights and interests of both the company and the subscribers. It ensures clear communication and minimizes the risk of misunderstandings or disputes regarding the stock purchase.A West Virginia Stock Subscription Agreement Among Several Subscribers is a legally binding contract that outlines the terms and conditions of the purchase and sale of company stock between multiple subscribers in the state of West Virginia. This agreement is essential when a company wishes to raise capital by offering shares of its stock to investors. This agreement typically includes important information such as the names and addresses of the subscribers, the number of shares being purchased, the purchase price per share, and the payment terms. It will also outline the rights and obligations of both the company and the subscribers. Different types of West Virginia Stock Subscription Agreements Among Several Subscribers may include: 1. Common Stock Subscription Agreement: This type of agreement is the most common and involves the purchase of ordinary shares in the company. Common stockholders generally have voting rights in the company's affairs and are entitled to dividends if declared. 2. Preferred Stock Subscription Agreement: This agreement is specific to the purchase and sale of preferred stock. Preferred stockholders have certain preferences over common stockholders, such as priority in receiving dividends and liquidation preferences. 3. Convertible Stock Subscription Agreement: This type of agreement allows subscribers to convert their preferred or common stock into another class of stock at a designated time or under specific circumstances. It offers flexibility to investors who may wish to convert their shares to take advantage of potential future benefits. 4. Restricted Stock Subscription Agreement: This agreement pertains to the purchase of restricted stock, which has certain restrictions on transferability or sale. Typically, these restrictions are imposed to ensure that the subscriber holds the stock for a specified period or meets specific conditions before selling or transferring the shares. These agreements are crucial in protecting the rights and interests of both the company and the subscribers. It ensures clear communication and minimizes the risk of misunderstandings or disputes regarding the stock purchase.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.