This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

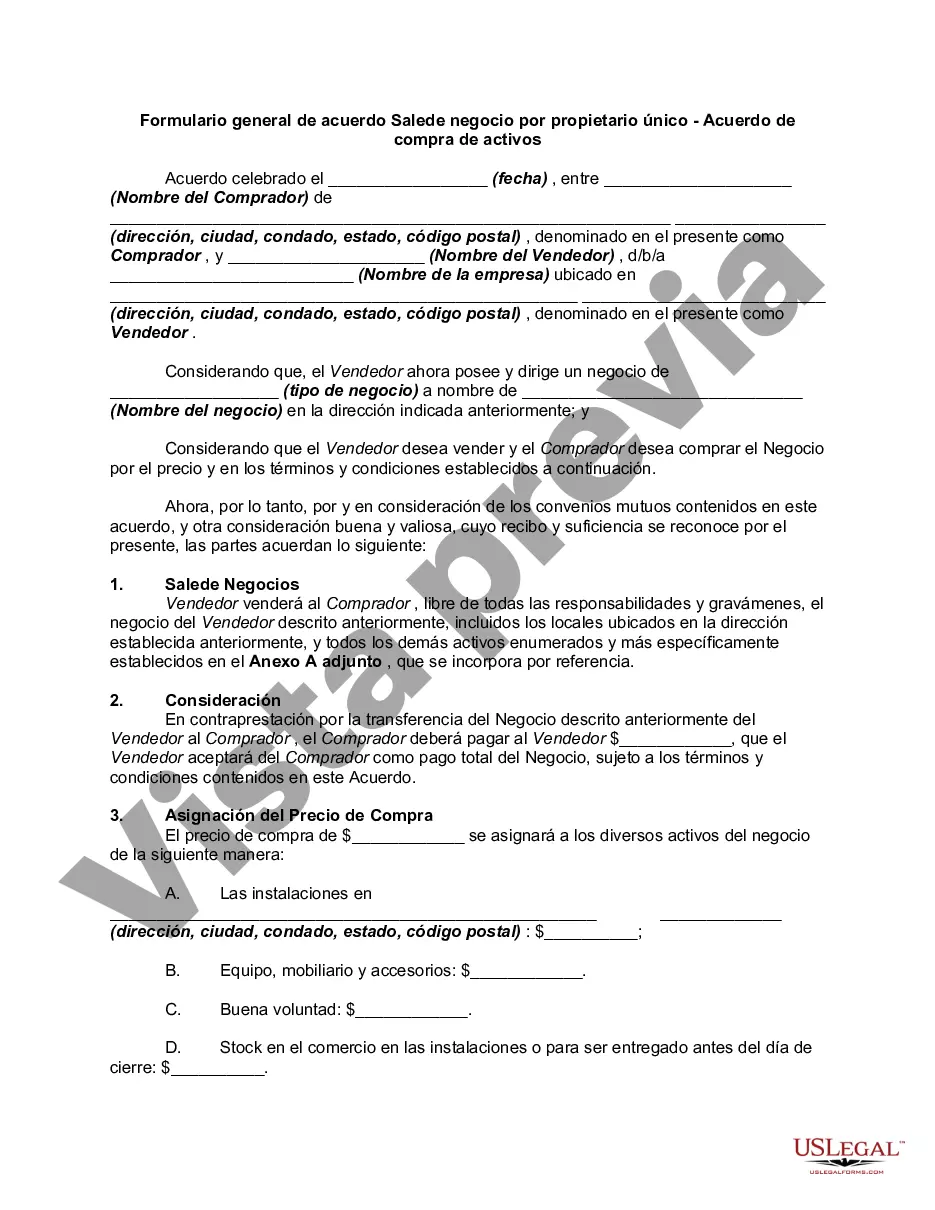

West Virginia General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document used when a sole proprietor in West Virginia decides to sell their business as an asset purchase. This agreement outlines the terms and conditions of the sale, protecting the rights and interests of both the seller and the buyer. The West Virginia General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement contains various provisions related to the sale, including the purchase price, payment terms, assets included in the sale, liabilities assumed by the buyer, warranties, representations, and indemnification clauses. It also addresses any potential contingencies, such as financing or inspections, and lays out the timelines for completing the transaction. Keywords: West Virginia, General Form, Agreement, Sale of Business, Sole Proprietor, Asset Purchase Agreement, legal document, terms and conditions, seller, buyer, purchase price, payment terms, assets, liabilities, warranties, representations, indemnification, contingencies, financing, inspections, transaction. Different types of West Virginia General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement may include specific variations based on the nature of the business being sold, such as: 1. Retail Business Asset Purchase Agreement: This type of agreement is specifically tailored for the sale of a retail business, including details about inventory, leases or rental agreements for retail space, and any specific licenses or permits necessary for operating the business. 2. Service-Based Business Asset Purchase Agreement: Service-based businesses, such as consulting firms, salons, or professional practices, may require a specialized agreement that addresses the transfer of client contracts, intellectual property rights, or non-compete clauses specific to the industry. 3. Manufacturing Business Asset Purchase Agreement: For businesses involved in manufacturing or production, this agreement may cover machinery and equipment, raw materials, patents or trademarks, and any regulatory compliance issues specific to the industry. By incorporating the relevant keywords and variations into the description, it ensures that the generated content provides useful and accurate information about the West Virginia General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement and its potential types based on different business scenarios.West Virginia General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement is a legal document used when a sole proprietor in West Virginia decides to sell their business as an asset purchase. This agreement outlines the terms and conditions of the sale, protecting the rights and interests of both the seller and the buyer. The West Virginia General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement contains various provisions related to the sale, including the purchase price, payment terms, assets included in the sale, liabilities assumed by the buyer, warranties, representations, and indemnification clauses. It also addresses any potential contingencies, such as financing or inspections, and lays out the timelines for completing the transaction. Keywords: West Virginia, General Form, Agreement, Sale of Business, Sole Proprietor, Asset Purchase Agreement, legal document, terms and conditions, seller, buyer, purchase price, payment terms, assets, liabilities, warranties, representations, indemnification, contingencies, financing, inspections, transaction. Different types of West Virginia General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement may include specific variations based on the nature of the business being sold, such as: 1. Retail Business Asset Purchase Agreement: This type of agreement is specifically tailored for the sale of a retail business, including details about inventory, leases or rental agreements for retail space, and any specific licenses or permits necessary for operating the business. 2. Service-Based Business Asset Purchase Agreement: Service-based businesses, such as consulting firms, salons, or professional practices, may require a specialized agreement that addresses the transfer of client contracts, intellectual property rights, or non-compete clauses specific to the industry. 3. Manufacturing Business Asset Purchase Agreement: For businesses involved in manufacturing or production, this agreement may cover machinery and equipment, raw materials, patents or trademarks, and any regulatory compliance issues specific to the industry. By incorporating the relevant keywords and variations into the description, it ensures that the generated content provides useful and accurate information about the West Virginia General Form of Agreement for Sale of Business by Sole Proprietor — Asset Purchase Agreement and its potential types based on different business scenarios.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.