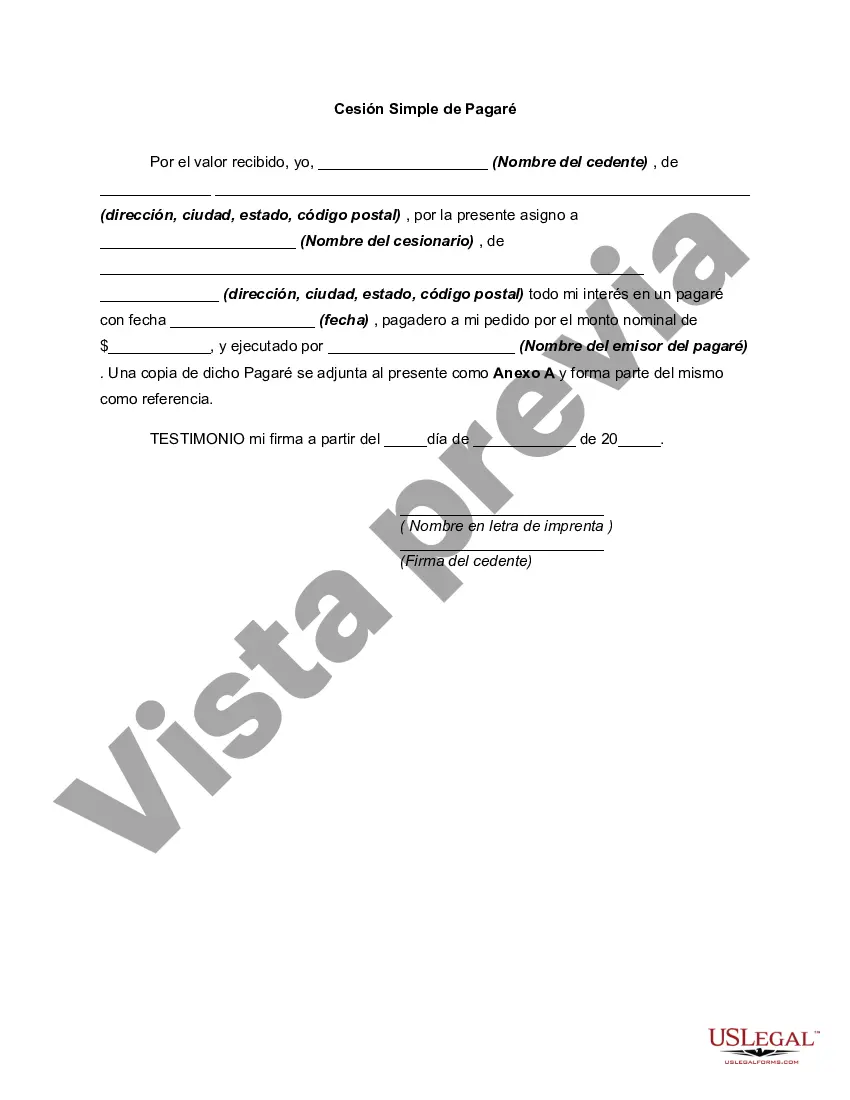

A West Virginia Simple Promissory Note for Personal Loan is a legally binding document used to formalize a loan agreement between two parties. This type of promissory note outlines the terms and conditions, including the repayment schedule and interest rate, for a personal loan in West Virginia. It serves as a written record of the borrower's promise to repay the loaned amount to the lender, creating security and clarity for both parties involved. Key components of a West Virginia Simple Promissory Note for Personal Loan include: 1. Loan amount: The principal amount borrowed by the borrower from the lender. 2. Interest rate: The agreed-upon interest rate that the borrower will pay on the loan. 3. Repayment schedule: The timeline and frequency of loan repayments, whether it is in installments, monthly, quarterly, etc. 4. Late fees: Any additional fees or penalties imposed on the borrower if repayments are not made on time. 5. Collateral: Mention of any collateral provided by the borrower to secure the loan, such as real estate, vehicles, or valuable assets. 6. Default consequences: The actions the lender can take if the borrower fails to repay the loan according to the agreed terms, including legal recourse or collection efforts. West Virginia Simple Promissory Note for Personal Loan may differ based on their specific purpose or variations in terms and conditions. Some possible types include: 1. Fixed-Rate Promissory Note: An agreement where the interest rate remains constant throughout the loan term. 2. Variable-Rate Promissory Note: An agreement where the interest rate fluctuates based on a predetermined index or market conditions. 3. Secured Promissory Note: A loan that includes collateral provided by the borrower, establishing extra security for the lender. 4. Unsecured Promissory Note: A loan agreement without any collateral, relying solely on the borrower's creditworthiness and reputation. 5. Installment Promissory Note: A loan repaid in regular payments over a specific period, including both principal and interest. It is crucial to consult legal professionals or seek expert advice when drafting or signing any West Virginia Simple Promissory Note for Personal Loan, as state laws may vary and require specific terms and conditions to be met for the document's validity and enforceability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Pagaré Simple para Préstamo Personal - Simple Promissory Note for Personal Loan

Description

How to fill out West Virginia Pagaré Simple Para Préstamo Personal?

If you have to complete, acquire, or print out legal papers templates, use US Legal Forms, the biggest collection of legal varieties, that can be found on-line. Utilize the site`s basic and handy research to find the paperwork you need. A variety of templates for enterprise and specific purposes are sorted by categories and states, or search phrases. Use US Legal Forms to find the West Virginia Simple Promissory Note for Personal Loan within a number of clicks.

When you are currently a US Legal Forms customer, log in in your account and click on the Acquire switch to have the West Virginia Simple Promissory Note for Personal Loan. You can even entry varieties you in the past delivered electronically in the My Forms tab of your account.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape to the appropriate area/nation.

- Step 2. Take advantage of the Preview option to look over the form`s content. Never forget to learn the explanation.

- Step 3. When you are not happy with all the type, utilize the Research area on top of the monitor to locate other types in the legal type format.

- Step 4. After you have discovered the shape you need, select the Purchase now switch. Choose the rates plan you choose and put your credentials to register on an account.

- Step 5. Process the purchase. You can utilize your Мisa or Ьastercard or PayPal account to accomplish the purchase.

- Step 6. Pick the structure in the legal type and acquire it on the system.

- Step 7. Complete, edit and print out or sign the West Virginia Simple Promissory Note for Personal Loan.

Every single legal papers format you acquire is your own property permanently. You possess acces to each and every type you delivered electronically within your acccount. Click on the My Forms section and choose a type to print out or acquire again.

Be competitive and acquire, and print out the West Virginia Simple Promissory Note for Personal Loan with US Legal Forms. There are thousands of expert and condition-distinct varieties you can use for your enterprise or specific requirements.