Title: Exploring the West Virginia Simple Promissory Note for Family Loan Description: In this article, we will delve into the details of the West Virginia Simple Promissory Note for Family Loan, shedding light on its purpose, components, and legal significance. A simple promissory note serves as a legal document that outlines the terms and conditions of a loan between family members within the state of West Virginia. It acts as a written agreement, providing clarity and ensuring accountability for both the lender and borrower. Keywords: West Virginia, simple promissory note, family loan, terms and conditions, legal document, loan agreement Types of West Virginia Simple Promissory Note for Family Loan: 1. West Virginia Simple Promissory Note for Lump Sum Loan: This type of promissory note is used when the loan amount is provided as a single lump sum, and the borrower is expected to repay the principal along with any agreed-upon interest within specified timeframes. 2. West Virginia Simple Promissory Note for Installment Loan: This type of promissory note is employed when the loan is divided into regular installments over a predetermined period. The borrower agrees to repay the principal and interest in equal or varying amounts within the agreed-upon schedule. 3. West Virginia Simple Promissory Note with Collateral: This variation includes an additional provision where the borrower offers collateral, such as property or assets, to secure the loan. If the borrower fails to repay the loan as per the agreed terms, the lender may have recourse to the collateral as a means of compensation. 4. West Virginia Simple Promissory Note with Interest: This type of promissory note stipulates that the borrower will pay a predetermined rate of interest in addition to the borrowed principal. The note specifies the interest rate applied and the method of calculating the interest. 5. West Virginia Simple Promissory Note with Flexible Repayment Terms: This promissory note allows the lender and borrower to customize the repayment schedule, including grace periods, balloon payments, or any other special arrangements that suit their unique circumstances. Remember, it is crucial to consult with an attorney or legal professional to ensure the West Virginia Simple Promissory Note for Family Loan adheres to all applicable laws and regulations in the state, providing legal protection for both parties involved. By understanding the various types of West Virginia Simple Promissory Note for Family Loan, individuals can make informed decisions regarding borrowing or lending within the familial context while safeguarding relationships and fostering financial trust.

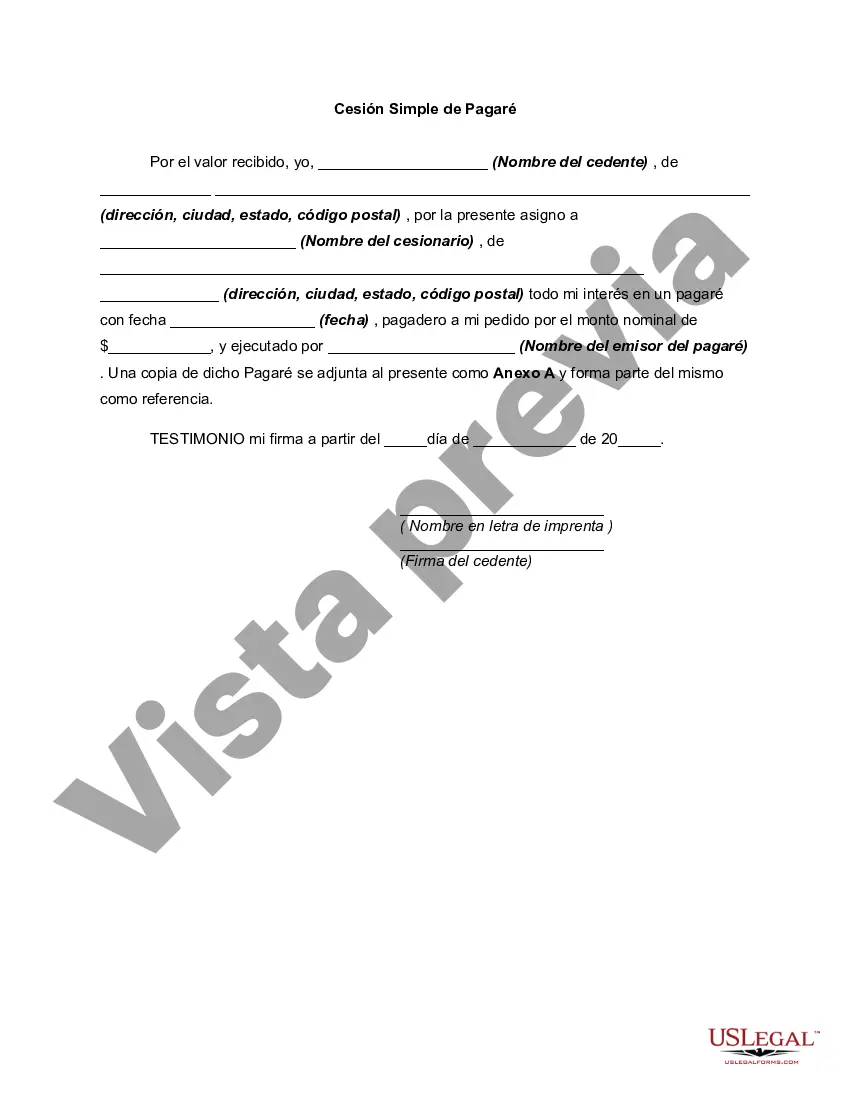

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out West Virginia Pagaré Simple Para Préstamo Familiar?

Are you currently in a place in which you need to have files for both business or individual uses just about every day time? There are a variety of legitimate file web templates available online, but locating ones you can rely on is not easy. US Legal Forms gives a large number of type web templates, like the West Virginia Simple Promissory Note for Family Loan, that happen to be created to satisfy federal and state needs.

If you are presently informed about US Legal Forms internet site and also have an account, just log in. Following that, you may download the West Virginia Simple Promissory Note for Family Loan design.

If you do not have an bank account and want to start using US Legal Forms, follow these steps:

- Obtain the type you need and make sure it is to the appropriate metropolis/county.

- Take advantage of the Review key to review the shape.

- Look at the outline to ensure that you have selected the right type.

- In case the type is not what you`re looking for, take advantage of the Search discipline to find the type that meets your needs and needs.

- When you get the appropriate type, just click Purchase now.

- Opt for the costs prepare you would like, fill in the specified details to generate your money, and pay money for an order with your PayPal or charge card.

- Pick a hassle-free data file file format and download your backup.

Find all the file web templates you possess purchased in the My Forms food list. You can aquire a more backup of West Virginia Simple Promissory Note for Family Loan anytime, if necessary. Just select the essential type to download or produce the file design.

Use US Legal Forms, one of the most extensive variety of legitimate types, in order to save time and steer clear of blunders. The services gives expertly created legitimate file web templates that you can use for a selection of uses. Make an account on US Legal Forms and initiate producing your life easier.