A West Virginia Simple Promissory Note for Vehicle Purchase is a legally binding document that outlines the terms and conditions of a loan made between a lender and a borrower for the purchase of a vehicle. This agreement serves as evidence of the loan and includes essential information such as the loan amount, repayment terms, interest rate, and collateral details to protect both parties involved. In West Virginia, there are a few different types of Simple Promissory Notes for Vehicle Purchase, each tailored to meet specific needs. Here are some variations commonly used: 1. Fixed-Term Promissory Note: This type of promissory note includes a fixed term over which the loan must be repaid, typically with equal monthly installments. This ensures a structured repayment plan for the borrower and clarifies the expected payment schedule for both parties. 2. Balloon Payment Promissory Note: In this arrangement, the borrower agrees to make smaller monthly payments throughout the loan term, with a large final payment due at the end known as a balloon payment. This option may be suitable for borrowers who anticipate a large sum of money or increased income towards the end of the loan term. 3. Collateral Revolving Promissory Note: Used when the lender requires collateral, such as the vehicle being financed, to secure the loan. This note emphasizes the lender's right to repossess the collateral in the event of default, ensuring added protection for the lender's investment. 4. Variable Interest Rate Promissory Note: This type of promissory note has an interest rate that fluctuates over time based on a pre-determined index or benchmark. This option allows for potential interest rate decreases or increases based on market conditions and can result in varying monthly payments. When drafting a West Virginia Simple Promissory Note for Vehicle Purchase, it is essential to include comprehensive details about the parties involved, vehicle description, repayment terms, late payment penalties, and provisions for default. Both the lender and borrower must carefully review the agreement, ensuring that it accurately represents their respective interests to foster a transparent and trustworthy transaction. It is advisable to consult an attorney or use a pre-drafted template to create a legally sound promissory note, as laws and regulations may vary, and professional guidance can help protect each party's rights and interests.

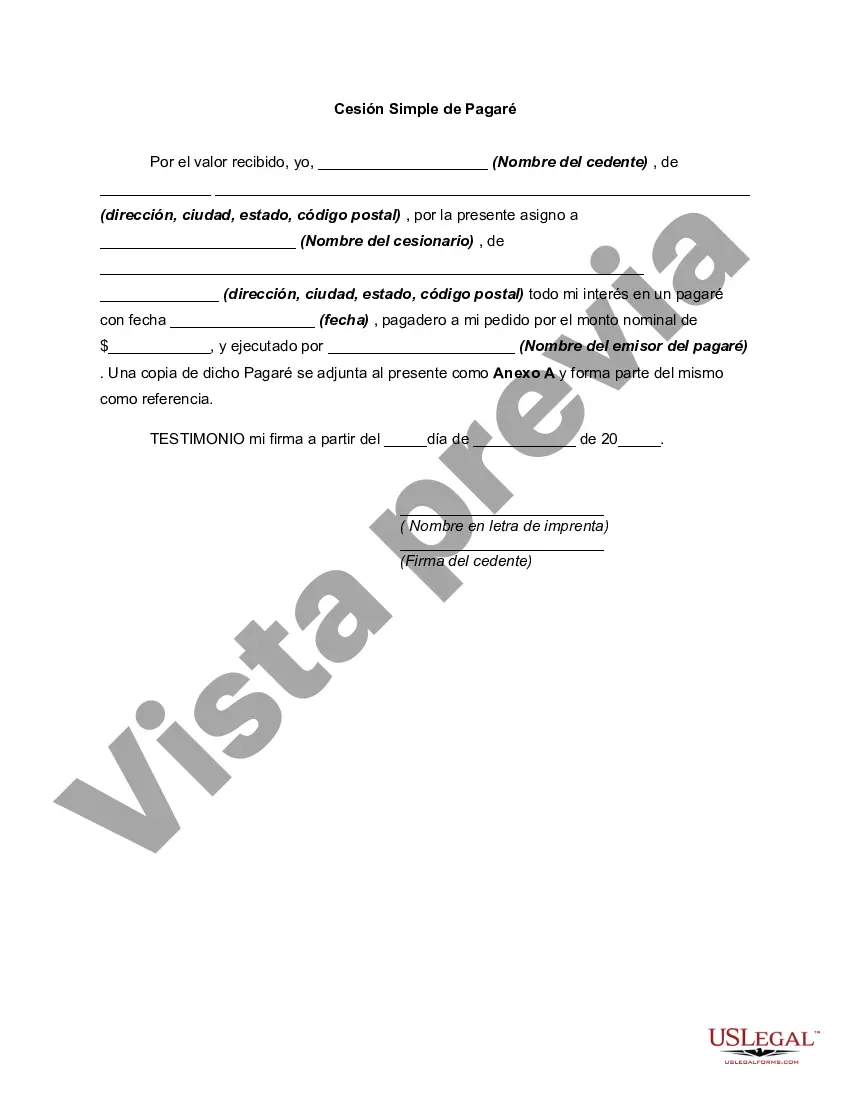

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Pagaré Simple para Compra de Vehículo - Simple Promissory Note for Vehicle Purchase

Description

How to fill out West Virginia Pagaré Simple Para Compra De Vehículo?

You can commit hrs on-line looking for the legal papers format that suits the state and federal specifications you require. US Legal Forms gives 1000s of legal kinds which can be analyzed by specialists. You can easily download or print out the West Virginia Simple Promissory Note for Vehicle Purchase from our services.

If you currently have a US Legal Forms profile, you may log in and then click the Down load switch. After that, you may comprehensive, change, print out, or sign the West Virginia Simple Promissory Note for Vehicle Purchase. Each and every legal papers format you get is your own forever. To acquire an additional duplicate of the purchased type, visit the My Forms tab and then click the related switch.

If you use the US Legal Forms internet site initially, follow the basic directions under:

- Initial, be sure that you have chosen the correct papers format for your state/town of your choosing. See the type description to make sure you have chosen the correct type. If offered, take advantage of the Preview switch to check with the papers format also.

- If you wish to find an additional model of the type, take advantage of the Lookup discipline to obtain the format that suits you and specifications.

- When you have discovered the format you want, simply click Purchase now to proceed.

- Choose the rates plan you want, enter your references, and sign up for a free account on US Legal Forms.

- Complete the transaction. You should use your charge card or PayPal profile to pay for the legal type.

- Choose the formatting of the papers and download it to your product.

- Make modifications to your papers if possible. You can comprehensive, change and sign and print out West Virginia Simple Promissory Note for Vehicle Purchase.

Down load and print out 1000s of papers layouts using the US Legal Forms Internet site, that provides the largest assortment of legal kinds. Use specialist and state-particular layouts to deal with your company or individual needs.