A West Virginia Simple Promissory Note for School is a legally binding document that outlines the terms and conditions of a loan agreement. It is a written promise between two parties, typically a lender and a borrower, where the borrower agrees to repay a specific amount of money borrowed for educational purposes. In the state of West Virginia, there are a few different types of simple promissory notes for school, each designed to cater to specific needs and requirements. These may include: 1. West Virginia Private Student Loan Promissory Note: This type of promissory note is used when a private lender provides financial assistance to a student for education-related expenses. It specifies the loan amount, interest rate, repayment terms, and any additional conditions agreed upon between the borrower and lender. 2. West Virginia Parent PLUS Loan Promissory Note: This promissory note is used by parents or legal guardians who wish to borrow money to cover their child's education expenses. It is specific to the Federal Parent Loan for Undergraduate Students (PLUS) program and outlines the terms and conditions of the loan, including interest rates and repayment options. 3. West Virginia College Loan Promissory Note: This promissory note is utilized when a college or university directly provides financial aid or loans to students. It includes the details of the loan, such as the loan amount, repayment terms, and any applicable interest rates. The content of a West Virginia Simple Promissory Note for School generally includes the following key components: 1. Parties involved: Clearly states the names and contact information of the lender(s) and borrower(s). 2. Loan amount: Specifies the exact amount borrowed for educational purposes. 3. Interest rate: Outlines the interest rate charged on the loan and how it will be calculated. 4. Repayment terms: Describes the repayment schedule, including the frequency and duration of payments, and any applicable grace periods. 5. Late payment penalties: States the consequences or penalties for late or missed payments. 6. Default terms: Discusses what happens if the borrower fails to repay the loan as agreed upon, including potential legal actions the lender may take. 7. Signatures: Requires the signatures of both parties, indicating their agreement and understanding of the terms stated in the promissory note. It is important to note that a West Virginia Simple Promissory Note for School should be carefully reviewed and understood by both parties before signing to ensure compliance with West Virginia state laws and regulations.

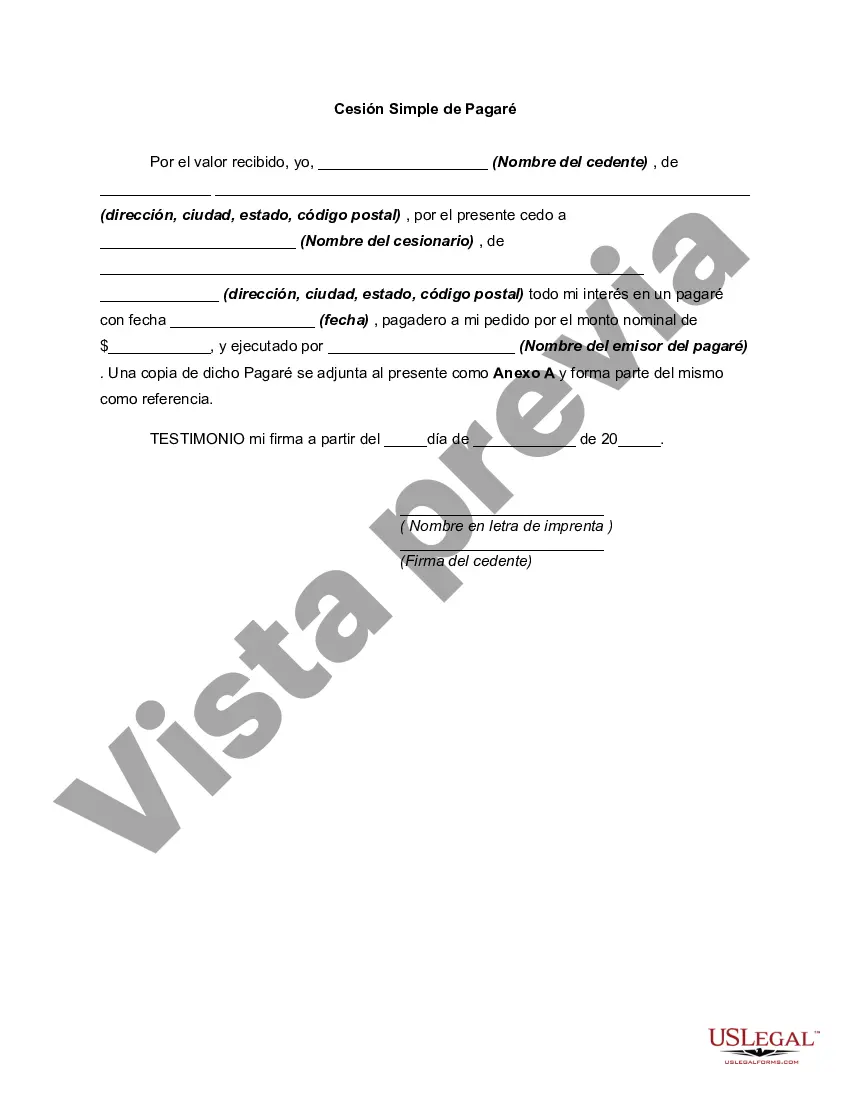

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Pagaré simple para la escuela - Simple Promissory Note for School

Description

How to fill out West Virginia Pagaré Simple Para La Escuela?

US Legal Forms - among the largest libraries of legitimate kinds in the USA - gives a wide range of legitimate file templates you can download or produce. Making use of the internet site, you can find 1000s of kinds for business and individual purposes, sorted by groups, suggests, or key phrases.You can get the most up-to-date variations of kinds such as the West Virginia Simple Promissory Note for School within minutes.

If you already have a monthly subscription, log in and download West Virginia Simple Promissory Note for School from the US Legal Forms catalogue. The Acquire button will show up on every develop you perspective. You gain access to all earlier acquired kinds in the My Forms tab of your respective accounts.

In order to use US Legal Forms the very first time, here are easy directions to help you started:

- Make sure you have picked out the proper develop for your personal area/state. Go through the Review button to check the form`s information. See the develop information to ensure that you have selected the appropriate develop.

- If the develop doesn`t satisfy your needs, make use of the Lookup field near the top of the monitor to obtain the one which does.

- Should you be content with the shape, confirm your choice by clicking the Acquire now button. Then, select the rates strategy you favor and provide your accreditations to sign up for an accounts.

- Process the purchase. Use your credit card or PayPal accounts to finish the purchase.

- Select the format and download the shape in your product.

- Make alterations. Complete, modify and produce and signal the acquired West Virginia Simple Promissory Note for School.

Each web template you included in your money does not have an expiration date and is also yours permanently. So, in order to download or produce another copy, just proceed to the My Forms portion and then click in the develop you want.

Gain access to the West Virginia Simple Promissory Note for School with US Legal Forms, probably the most considerable catalogue of legitimate file templates. Use 1000s of professional and express-certain templates that meet your business or individual demands and needs.