West Virginia Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

How to fill out Private Annuity Agreement With Payments To Last For Life Of Annuitant?

You can dedicate numerous hours online striving to locate the valid document template that satisfies the local and national standards you require.

US Legal Forms provides thousands of valid templates that are assessed by experts.

It is easy to obtain or print the West Virginia Private Annuity Agreement with Payments to Last for Life of Annuitant from the service.

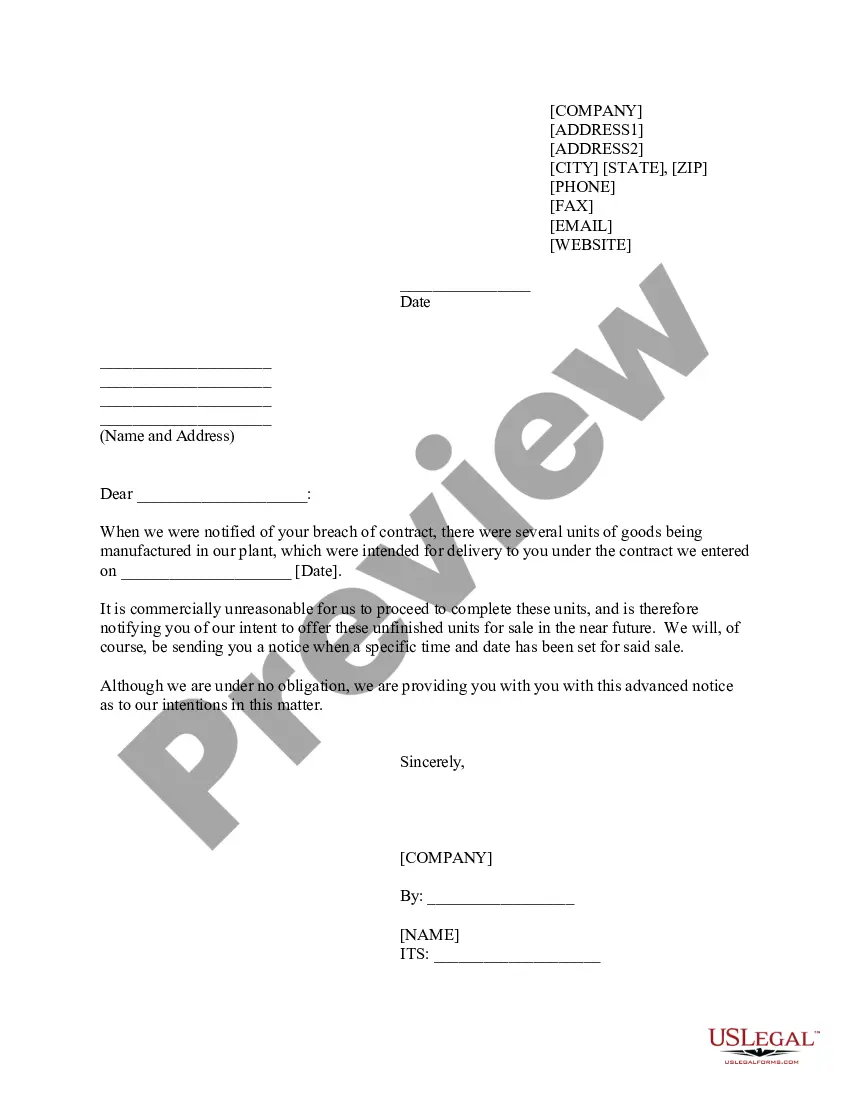

If available, utilize the Review button to view the document template at the same time.

- If you already possess a US Legal Forms account, you can Log In and hit the Download button.

- Subsequently, you can fill out, modify, print, or sign the West Virginia Private Annuity Agreement with Payments to Last for Life of Annuitant.

- Each valid document template you acquire is yours permanently.

- To get another copy of the purchased document, go to the My documents section and press the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple guidelines provided below.

- First, ensure you have selected the correct document template for your region/city of choice.

- Check the document description to confirm you have chosen the correct form.

Form popularity

FAQ

A private annuity, like the West Virginia Private Annuity Agreement with Payments to Last for Life of Annuitant, can have unique tax treatments. Typically, payments received by the annuitant may be partially taxable based on the contribution to the annuity. Understanding the tax implications helps you maximize your financial strategy and reduce potential liabilities. Consulting with financial experts can provide tailored insights to navigate these complexities effectively.

When the annuitant passes away, the tax implications depend on the type of annuity and the payout arrangement. Generally, a West Virginia Private Annuity Agreement with Payments to Last for Life of Annuitant may lead to tax considerations for the beneficiary. The remaining value of the annuity can be subject to income tax, and it is essential to consult a tax advisor to understand your specific situation. Proper planning ensures your loved ones are informed and prepared.

The option known as a life annuity offers payments to last for the entire lifetime of the annuitant. By choosing a West Virginia Private Annuity Agreement with Payments to Last for Life of Annuitant, you ensure a steady income for as long as you live. This option provides peace of mind, knowing you will not outlive your resources. It is an excellent choice for those seeking financial stability in their retirement years.

After the death of the annuitant, what happens to the annuity payments depends on the specific terms of the agreement. In many cases, a West Virginia Private Annuity Agreement with Payments to Last for Life of Annuitant may not provide benefits to heirs after the annuitant's death. However, some agreements include options for beneficiaries to receive a portion of the payments or a one-time payout. It is essential to review the agreement details to understand your options and any potential legacy planning.

A longevity annuity contract provides guaranteed income for the life of the annuitant, starting at a future date. This type of contract ensures that you will receive payments even if you live beyond your life expectancy. Within the context of a West Virginia Private Annuity Agreement with Payments to Last for Life of Annuitant, this structure protects you against the risk of outliving your savings. It offers a reliable income stream that can support your long-term financial stability.

The biggest disadvantage of an annuity, such as the West Virginia Private Annuity Agreement with Payments to Last for Life of Annuitant, is the lack of liquidity. Once you invest in an annuity, accessing those funds can be challenging, particularly in emergencies. Additionally, fees and penalties may apply if you decide to withdraw funds before the specified terms. Understanding these aspects can help you make informed decisions.

The annuity that stops payment when the annuitant passes away is typically identified as a straight life annuity. This type guarantees payments until the death of the annuitant, after which no further disbursements are made. Understanding these distinctions can help you make informed decisions about your retirement funding, particularly with a West Virginia Private Annuity Agreement with Payments to Last for Life of Annuitant.

Payments stop at the annuitant's death in what is known as a life annuity option. This arrangement ensures that the annuitant receives regular payments throughout their lifetime but does not extend these payments to beneficiaries after their death. Choosing a West Virginia Private Annuity Agreement with Payments to Last for Life of Annuitant can offer peace of mind for retirees while structuring their finances.

An annuity settlement arrangement that stops payments upon the death of the annuitant is often termed a life-only annuity. This format is designed to provide lifetime income only to the annuitant, with payments ceasing when they pass away. A West Virginia Private Annuity Agreement with Payments to Last for Life of Annuitant is an example of such an arrangement, catering to those who want secure income without long-term beneficiary payouts.

The taxation of private annuities on the death of the annuitant can be complex. Generally, the IRS requires that any remaining payments or the value of the annuity may be included in the estate of the deceased. Seeking guidance from financial and tax professionals can clarify how this applies within the context of a West Virginia Private Annuity Agreement with Payments to Last for Life of Annuitant, ensuring compliance and optimizing benefits.