This form involves the sale of a small business. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The West Virginia Agreement of Purchase and Sale of Business — Short Form is a legally binding document that outlines the terms and conditions of buying or selling a business in West Virginia. This agreement serves as a contract between the buyer and the seller, ensuring both parties understand their rights, responsibilities, and expectations. The Agreement of Purchase and Sale of Business — Short Form typically includes essential information such as the purchase price, payment terms, assets and liabilities included in the sale, and any conditions or contingencies that must be met before the sale is finalized. This document aims to provide clarity and protection to both the buyer and the seller throughout the entire transaction process. There may be variation in the Agreement of Purchase and Sale of Business — Short Form depending on the specific nature of the business being bought or sold. Some common types of businesses that utilize this agreement include restaurants, retail stores, service providers, manufacturing companies, and professional practices. The West Virginia Agreement of Purchase and Sale of Business — Short Form covers essential details such as the precise description of the business being sold, including its name, location, and key assets. It also includes provisions relating to inventory, customer lists, contracts, equipment, intellectual property, and permits. Additional components that may be included in this agreement are representations and warranties made by the seller, specifying that the business is being sold in good faith, without any undisclosed liabilities or legal issues. It may also outline the seller's obligation to assist in the transition process and provide necessary information or support for a smooth handover. Furthermore, the document generally addresses the allocation of costs, including any adjustments for inventory, prorated taxes, or outstanding debts. It may also detail how any disputes will be resolved, potentially through mediation or arbitration. In conclusion, the West Virginia Agreement of Purchase and Sale of Business — Short Form is a crucial legal contract that facilitates the buying and selling of businesses in West Virginia. By outlining the rights and responsibilities of both parties involved, this agreement ensures a fair and transparent transaction. Whether it's a restaurant, retail store, or professional practice, this agreement serves as a necessary tool for protecting the interests of all parties involved in the business sale.The West Virginia Agreement of Purchase and Sale of Business — Short Form is a legally binding document that outlines the terms and conditions of buying or selling a business in West Virginia. This agreement serves as a contract between the buyer and the seller, ensuring both parties understand their rights, responsibilities, and expectations. The Agreement of Purchase and Sale of Business — Short Form typically includes essential information such as the purchase price, payment terms, assets and liabilities included in the sale, and any conditions or contingencies that must be met before the sale is finalized. This document aims to provide clarity and protection to both the buyer and the seller throughout the entire transaction process. There may be variation in the Agreement of Purchase and Sale of Business — Short Form depending on the specific nature of the business being bought or sold. Some common types of businesses that utilize this agreement include restaurants, retail stores, service providers, manufacturing companies, and professional practices. The West Virginia Agreement of Purchase and Sale of Business — Short Form covers essential details such as the precise description of the business being sold, including its name, location, and key assets. It also includes provisions relating to inventory, customer lists, contracts, equipment, intellectual property, and permits. Additional components that may be included in this agreement are representations and warranties made by the seller, specifying that the business is being sold in good faith, without any undisclosed liabilities or legal issues. It may also outline the seller's obligation to assist in the transition process and provide necessary information or support for a smooth handover. Furthermore, the document generally addresses the allocation of costs, including any adjustments for inventory, prorated taxes, or outstanding debts. It may also detail how any disputes will be resolved, potentially through mediation or arbitration. In conclusion, the West Virginia Agreement of Purchase and Sale of Business — Short Form is a crucial legal contract that facilitates the buying and selling of businesses in West Virginia. By outlining the rights and responsibilities of both parties involved, this agreement ensures a fair and transparent transaction. Whether it's a restaurant, retail store, or professional practice, this agreement serves as a necessary tool for protecting the interests of all parties involved in the business sale.

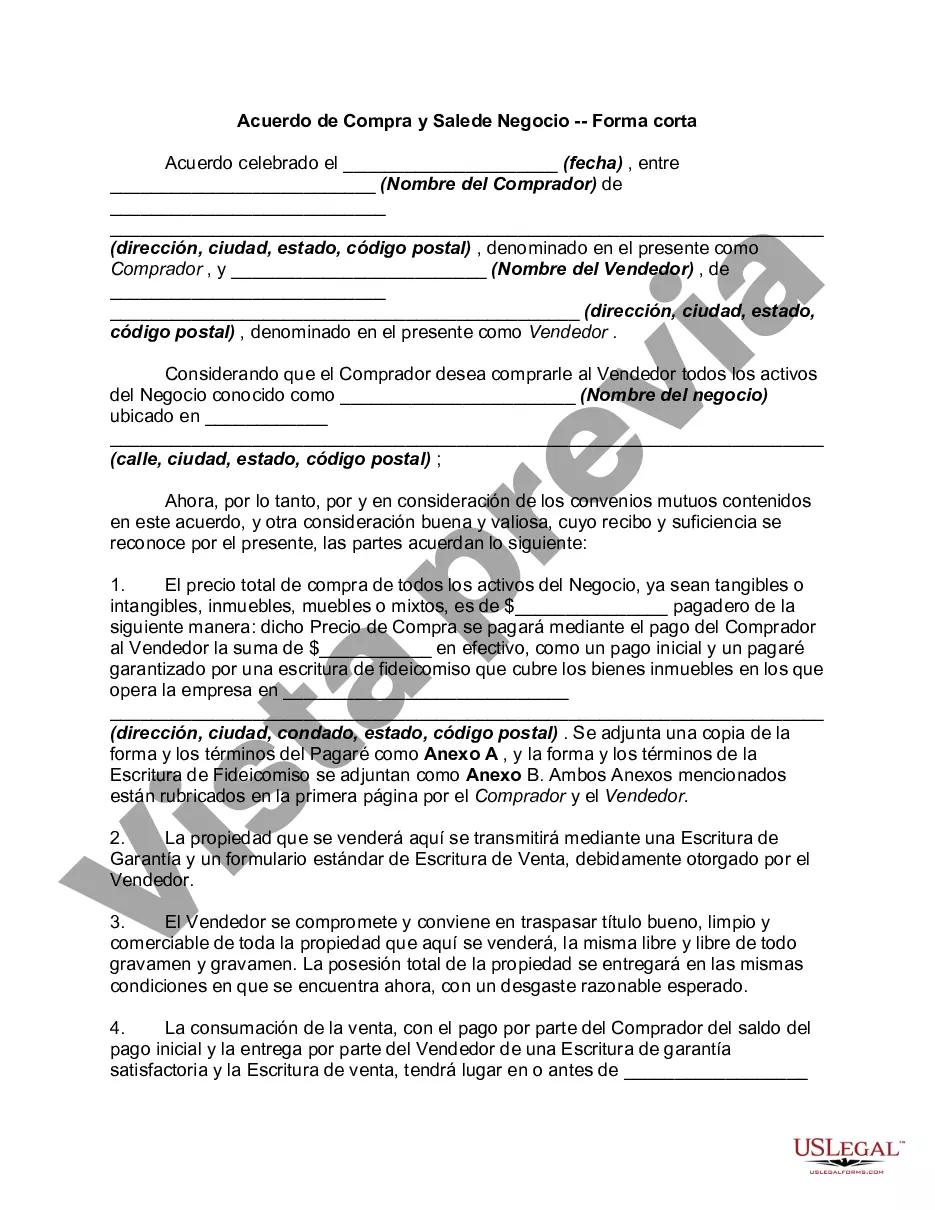

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.