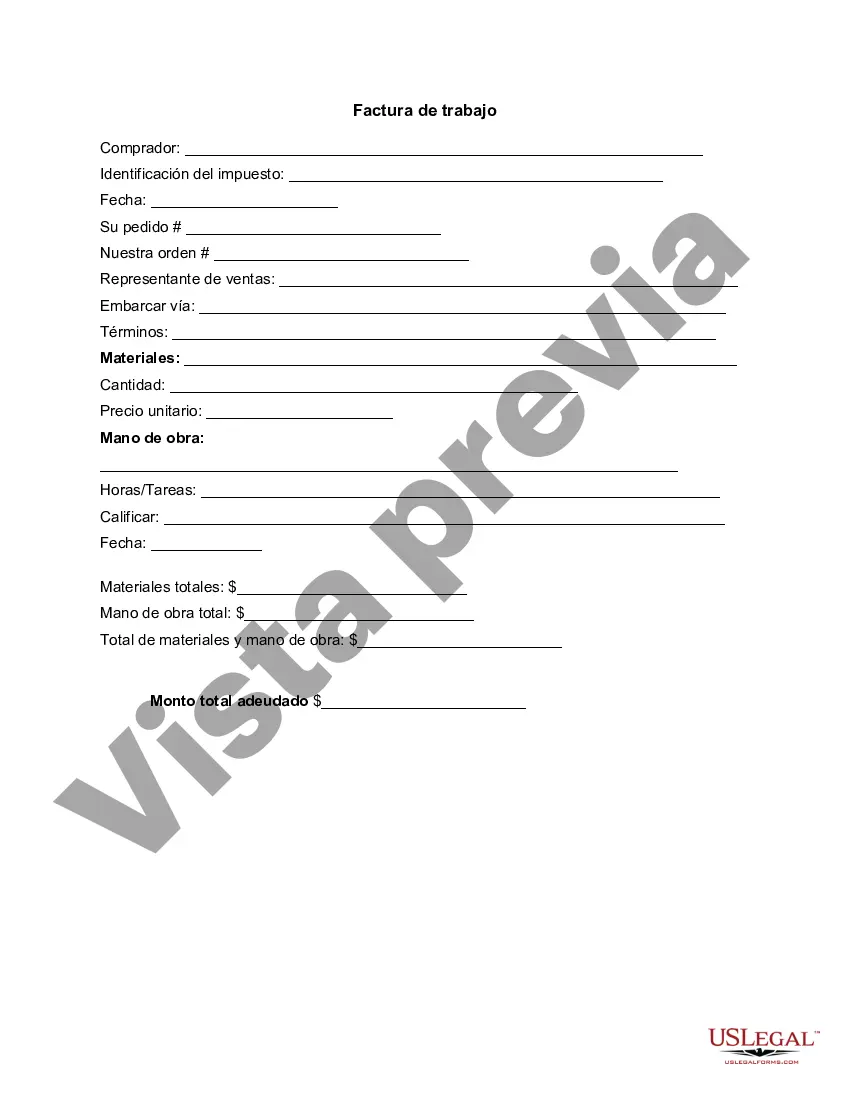

West Virginia Invoice Template for Bakers: A Comprehensive Guide Introduction: In the world of baking, maintaining organized financial records is crucial for any baker's success. By using an invoice template specifically designed for bakers in West Virginia, you can streamline your billing process, track sales, and ensure timely payments from your customers. This article aims to provide a detailed description of what a West Virginia Invoice Template for bakers entails, along with different types of templates available. Key Features of West Virginia Invoice Template for Bakers: 1. Professional Layout: The West Virginia Invoice Template for bakers incorporates a professional layout that reflects your business branding while appearing crisp and visually appealing. 2. Contact Information: The template includes space to enter your name, address, contact details, and the recipient's contact information. Having clearly mentioned contact information ensures effective communication and minimizes any potential errors. 3. Invoice Number and Date: Each invoice generated from this template will have a unique invoice number and the date of issuance. This helps with easy identification, reference, and bookkeeping. 4. Itemized List: The template presents a section where you can create an itemized list of the baked goods or services offered, including their description, quantity, price per unit, and the total amount for each line item. This breakdown allows for transparent billing and facilitates understanding for both you and your customers. 5. Customizable Tax Calculation: West Virginia has specific tax regulations for bakeries. The template enables you to include applicable taxes on your invoices and automatically calculates the total amount due, including taxes, making your invoicing process convenient and accurate. 6. Payment Terms: Clearly outlining your payment terms, such as due dates and accepted payment methods, is essential. The West Virginia Invoice Template for bakers offers a dedicated section to specify these details, ensuring a straightforward payment process. 7. Notes and Additional Comments: In some cases, you may need to provide additional information or notes to your customers. This template includes space where you can write personalized messages, special instructions, or any other relevant details. Types of West Virginia Invoice Templates for Bakers: 1. Basic Invoice Template: This type of template covers the fundamental invoicing needs for bakers in West Virginia. It includes all the key features mentioned above. 2. Customizable Invoice Template: This variation allows you to customize the template based on your unique business requirements, such as incorporating your bakery logo, choosing font styles, and adjusting colors to match your branding. 3. Tax-Compliant Invoice Template: For bakeries that need to adhere to West Virginia's specific taxation regulations, this template includes fields to record and calculate applicable taxes accurately. 4. Multi-Currency Invoice Template: Suitable for bakers who engage in international transactions or serve customers from different countries, this template allows you to display multiple currencies and convert prices accordingly. Conclusion: Using a West Virginia Invoice Template for bakers simplifies your invoicing process, assists in tracking payments, and ensures professional communication with your customers. Whether you opt for a basic template or a tax-compliant variation, choosing an appropriate invoice template enhances your bakery's financial management and ultimately contributes to your business's success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Plantilla de factura para panadero - Invoice Template for Baker

Description

How to fill out West Virginia Plantilla De Factura Para Panadero?

If you wish to total, down load, or printing legitimate papers themes, use US Legal Forms, the largest selection of legitimate kinds, that can be found on the Internet. Utilize the site`s basic and practical lookup to get the files you want. Various themes for organization and person uses are sorted by groups and states, or search phrases. Use US Legal Forms to get the West Virginia Invoice Template for Baker in just a couple of mouse clicks.

When you are already a US Legal Forms consumer, log in for your account and click the Obtain button to find the West Virginia Invoice Template for Baker. You can even accessibility kinds you earlier downloaded from the My Forms tab of the account.

If you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have chosen the form for that right area/nation.

- Step 2. Make use of the Preview option to look through the form`s content. Don`t forget about to see the description.

- Step 3. When you are not satisfied together with the form, take advantage of the Look for industry at the top of the screen to find other versions in the legitimate form web template.

- Step 4. When you have identified the form you want, go through the Purchase now button. Choose the rates program you favor and add your credentials to register to have an account.

- Step 5. Approach the transaction. You should use your bank card or PayPal account to accomplish the transaction.

- Step 6. Choose the format in the legitimate form and down load it on your own system.

- Step 7. Comprehensive, modify and printing or indicator the West Virginia Invoice Template for Baker.

Every legitimate papers web template you acquire is yours forever. You may have acces to every single form you downloaded with your acccount. Select the My Forms area and choose a form to printing or down load once again.

Compete and down load, and printing the West Virginia Invoice Template for Baker with US Legal Forms. There are thousands of skilled and state-specific kinds you can utilize for the organization or person requirements.