West Virginia Invoice Template for Consulting Services: A Comprehensive Guide Keywords: West Virginia, invoice template, consulting services, detailed description Introduction: Welcome to the detailed description of the West Virginia Invoice Template for Consulting Services. In this guide, we will explore the features, benefits, and various types of invoice templates available specifically for consulting services in the state of West Virginia. Whether you are an independent consultant, a consultancy firm, or a client seeking consulting services, having a professionally designed and legally compliant invoice template is crucial for maintaining accurate records, streamlining billing processes, and ensuring smooth financial transactions. Features and Benefits: 1. Professional Appearance: The West Virginia Invoice Template for Consulting Services features a sleek and professional design that reflects the credibility and professionalism of your consulting services. 2. Customizable Fields: These templates provide flexibility by allowing you to add, delete, or modify fields to tailor the invoice according to your specific consulting service requirements. 3. Company Logo and Branding: Personalize your invoice by adding your company logo and branding elements, helping you establish a strong brand identity. 4. Clear and Comprehensive Information: The invoice template includes essential details such as the consultant's or consultancy firm's name, address, contact information, client information, project description, fees, payment terms, and due dates. 5. Legal Compliance: The West Virginia Invoice Template for Consulting Services meets the legal requirements set forth by the state, ensuring that your invoices are accurate, valid, and enforceable. Types of West Virginia Invoice Templates for Consulting Services: 1. Standard Invoice Template: This template is suitable for general consulting services with standard billing requirements, such as hourly rates, fixed project fees, or retainer-based services. 2. Time and Expense Invoice Template: Ideal for consultants who need to track both billable hours and reimbursable expenses, this template allows you to itemize all services rendered and associated costs separately. 3. Retainer Invoice Template: Designed for consultants working on a retainer basis, this template enables you to outline the retainer terms, notify clients of the retainer balance, and provide a breakdown of services performed using retainer funds. 4. Progress Invoice Template: Consultants who work on long-term projects with multiple milestones or deliverables can use this template to invoice clients based on project progress. It includes a clear breakdown of the work completed to date along with associated costs. 5. Recurring Invoice Template: If your consulting services involve recurring billing, such as ongoing monthly retainers or subscription-based services, this template automates invoice generation for hassle-free billing cycles. Conclusion: Selecting the appropriate West Virginia Invoice Template for Consulting Services ensures professionalism, accuracy, and adherence to legal requirements in your invoicing process. Whether you opt for a standard, time and expense, retainer, progress, or recurring invoice template, these customizable options will help you streamline your financial transactions, maintain complete records, and foster strong client relationships. Invest in an efficient and industry-compliant invoice template to elevate your consulting services in West Virginia.

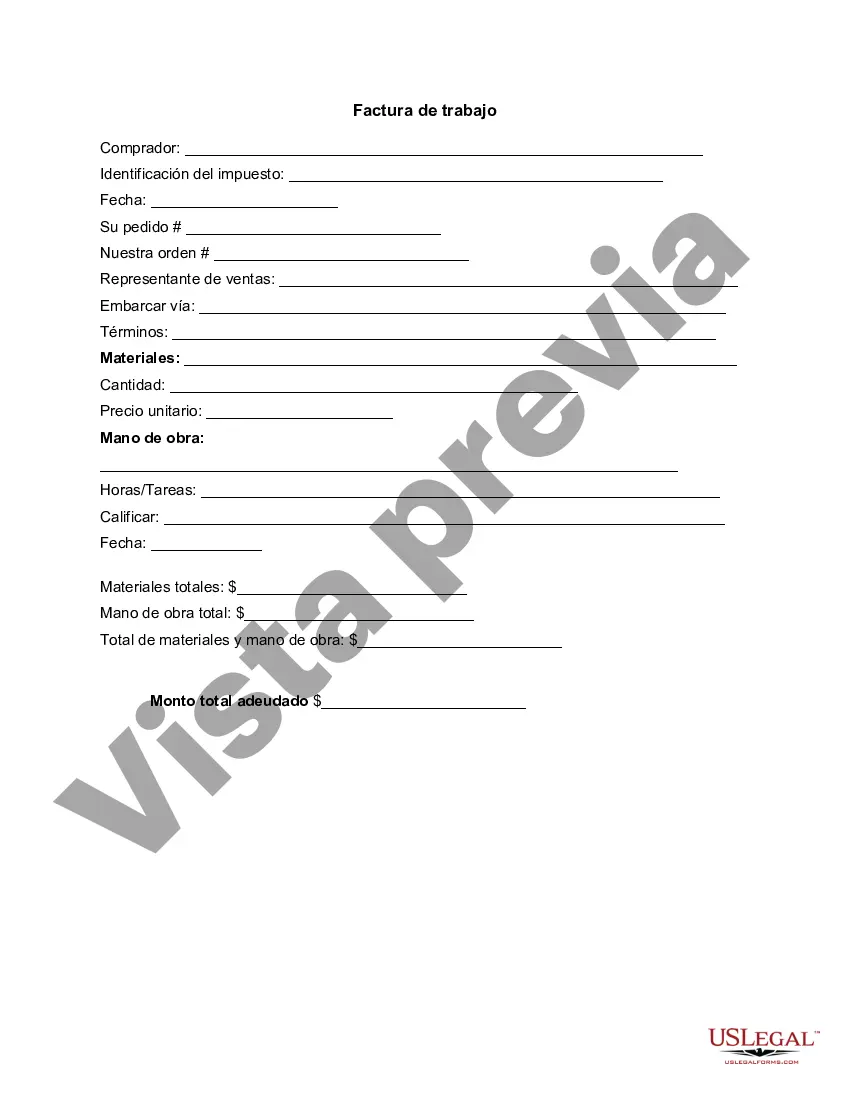

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Plantilla de factura para servicios de consultoría - Invoice Template for Consulting Services

Description

How to fill out West Virginia Plantilla De Factura Para Servicios De Consultoría?

Discovering the right authorized record design could be a battle. Obviously, there are a lot of templates available on the Internet, but how can you discover the authorized kind you require? Take advantage of the US Legal Forms site. The support gives 1000s of templates, for example the West Virginia Invoice Template for Consulting Services, which can be used for enterprise and private needs. All of the forms are checked by professionals and fulfill federal and state needs.

In case you are presently signed up, log in for your account and then click the Acquire option to get the West Virginia Invoice Template for Consulting Services. Make use of your account to check with the authorized forms you might have acquired formerly. Proceed to the My Forms tab of your account and obtain yet another duplicate from the record you require.

In case you are a fresh user of US Legal Forms, allow me to share straightforward instructions that you should adhere to:

- First, ensure you have chosen the right kind to your town/county. It is possible to check out the form making use of the Preview option and browse the form description to guarantee this is basically the right one for you.

- In the event the kind fails to fulfill your expectations, take advantage of the Seach field to obtain the correct kind.

- When you are certain that the form is proper, select the Buy now option to get the kind.

- Select the rates strategy you would like and enter the required information and facts. Create your account and pay money for the transaction making use of your PayPal account or charge card.

- Pick the data file file format and download the authorized record design for your product.

- Comprehensive, change and printing and indication the attained West Virginia Invoice Template for Consulting Services.

US Legal Forms will be the biggest catalogue of authorized forms for which you can find different record templates. Take advantage of the service to download appropriately-produced documents that adhere to condition needs.