West Virginia Installment Promissory Note with Bank Deposit as Collateral is a legally binding document that outlines the terms and conditions agreed upon by the borrower and the lender in West Virginia for a loan transaction. This type of promissory note is unique because it involves using a bank deposit as collateral. The West Virginia Installment Promissory Note with Bank Deposit as Collateral provides a detailed description of the loan agreement, including the loan amount, repayment terms, interest rate, and other crucial details. It serves as evidence of the borrower's promise to repay the loan, along with the agreement to use the bank deposit as security for the lender. This promissory note is primarily used when a borrower wants to secure a loan using their bank deposit as collateral. By utilizing this type of collateral, lenders can minimize their risk and potentially offer more favorable terms such as lower interest rates or longer repayment periods. There are a few different variations of the West Virginia Installment Promissory Note with Bank Deposit as Collateral, such as: 1. Fixed Interest Rate Promissory Note: This variation establishes a fixed interest rate for the loan, ensuring a consistent payment amount throughout the loan term. Borrowers benefit from knowing their exact payment obligations, while lenders enjoy the stability of predictable interest income. 2. Adjustable Interest Rate Promissory Note: With this type, the interest rate can fluctuate based on an agreed-upon benchmark, such as the prime rate. This variation offers the potential for lower initial interest rates, but borrowers must be prepared for potential rate increases in the future. 3. Balloon Payment Promissory Note: In this case, the borrower agrees to make smaller regular installment payments for a set period, after which a final lump sum payment (balloon payment) is due. This option can be useful for borrowers who anticipate a higher income or cash flow at the end of the loan term. Overall, the West Virginia Installment Promissory Note with Bank Deposit as Collateral provides a framework that protects both the borrower and the lender in a loan transaction. It ensures transparency, clarity, and establishes legal obligations for both parties involved.

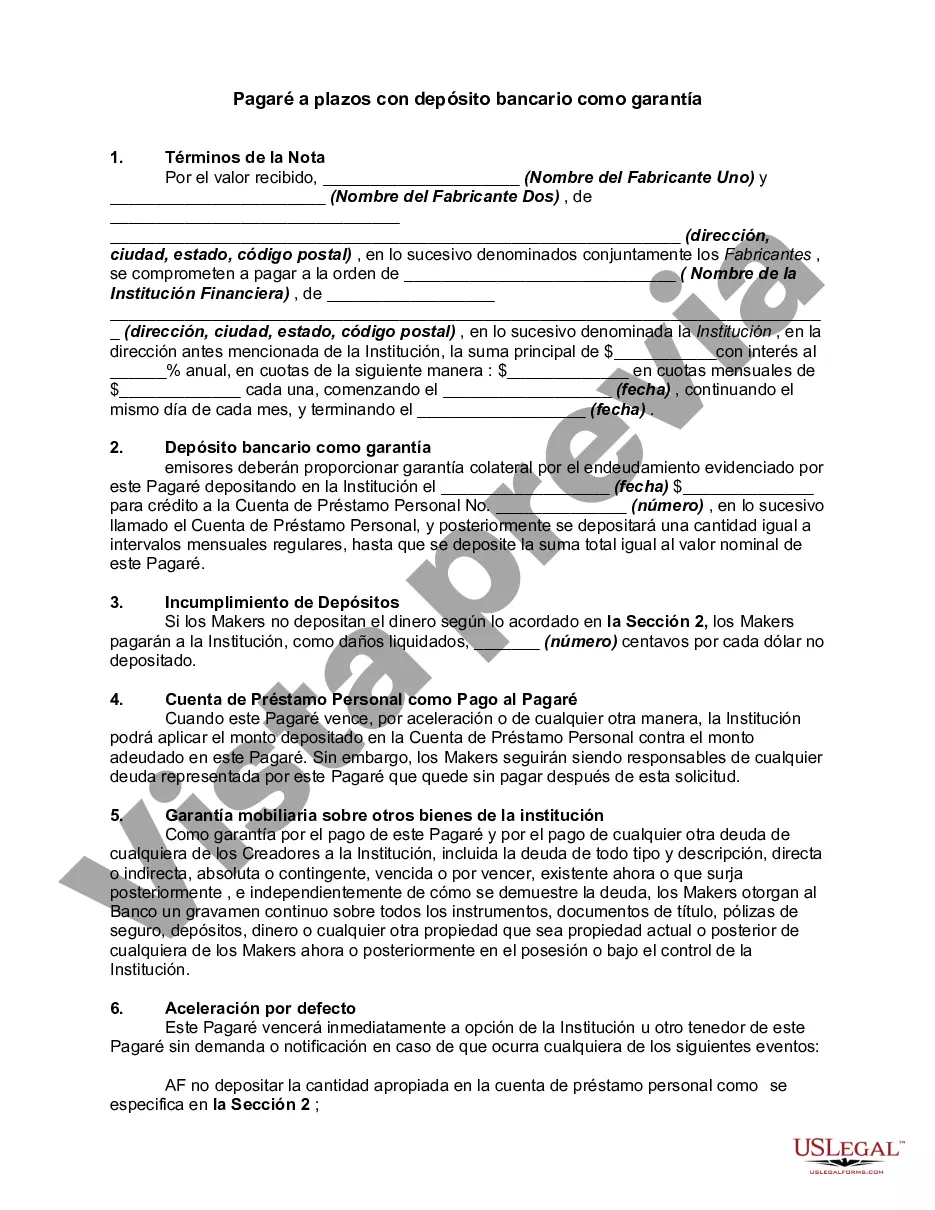

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Pagaré a plazos con depósito bancario como garantía - Installment Promissory Note with Bank Deposit as Collateral

Description

How to fill out West Virginia Pagaré A Plazos Con Depósito Bancario Como Garantía?

Are you in the situation that you require papers for possibly company or individual reasons almost every time? There are plenty of legitimate record web templates available online, but finding kinds you can rely on is not simple. US Legal Forms offers 1000s of kind web templates, like the West Virginia Installment Promissory Note with Bank Deposit as Collateral, which can be written in order to meet state and federal demands.

If you are currently knowledgeable about US Legal Forms site and have an account, just log in. Following that, you are able to download the West Virginia Installment Promissory Note with Bank Deposit as Collateral web template.

If you do not come with an account and wish to begin to use US Legal Forms, abide by these steps:

- Find the kind you want and ensure it is for that proper area/region.

- Make use of the Preview key to check the shape.

- Read the outline to ensure that you have selected the appropriate kind.

- In the event the kind is not what you`re seeking, utilize the Lookup area to obtain the kind that suits you and demands.

- Whenever you get the proper kind, simply click Acquire now.

- Pick the costs plan you need, complete the necessary information to make your account, and pay money for your order with your PayPal or credit card.

- Decide on a practical data file formatting and download your duplicate.

Get all of the record web templates you possess purchased in the My Forms menu. You can obtain a further duplicate of West Virginia Installment Promissory Note with Bank Deposit as Collateral anytime, if needed. Just click the needed kind to download or print out the record web template.

Use US Legal Forms, the most considerable collection of legitimate types, to save lots of time as well as avoid blunders. The service offers professionally made legitimate record web templates which can be used for a range of reasons. Make an account on US Legal Forms and begin generating your way of life a little easier.