West Virginia Sample Letter for Notice of Charge Account Credit Limit Raise

Description

How to fill out Sample Letter For Notice Of Charge Account Credit Limit Raise?

If you wish to obtain, download, or print approved document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Make use of the website's straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal use are categorized by type and locality, or keywords.

Every legal document template you purchase is yours permanently. You have access to every form you have downloaded in your account.

Visit the My documents section and select a form to print or download again. Stay competitive and download, and print the West Virginia Sample Letter for Notice of Charge Account Credit Limit Increase with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to locate the West Virginia Sample Letter for Notice of Charge Account Credit Limit Increase in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to retrieve the West Virginia Sample Letter for Notice of Charge Account Credit Limit Increase.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Confirm you have selected the form for the correct region/state.

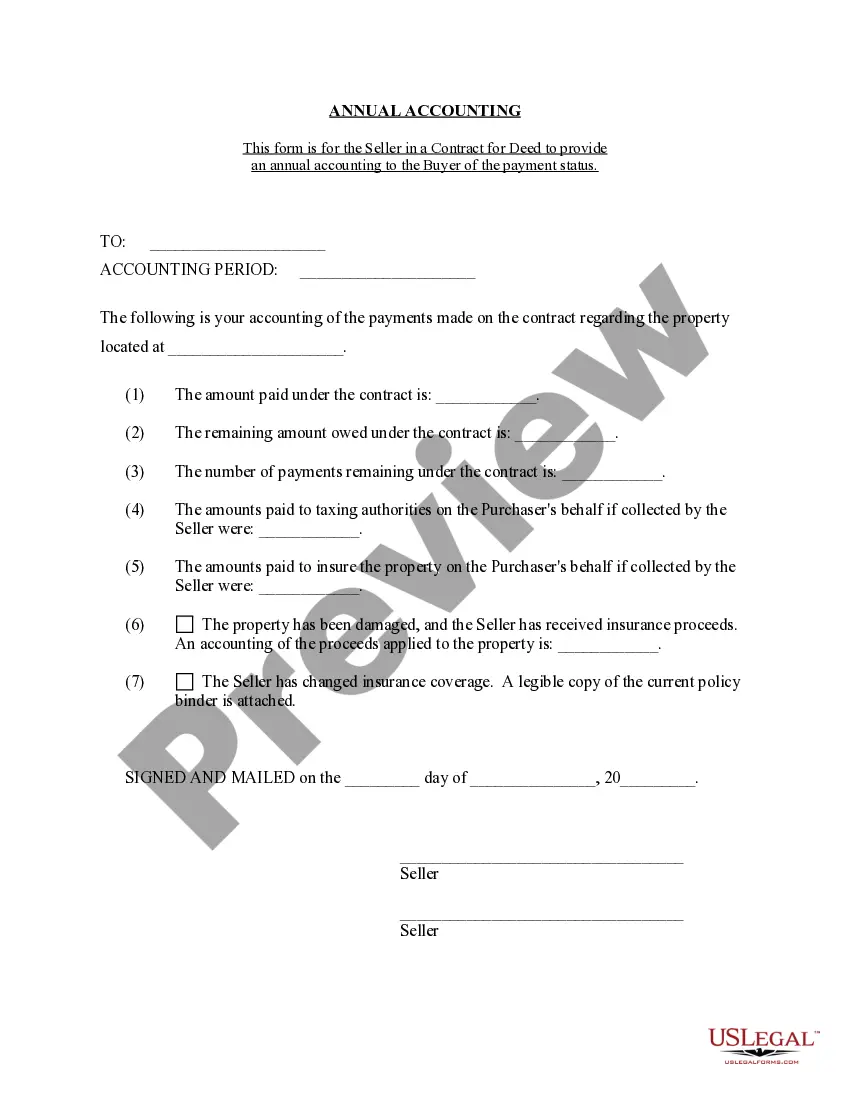

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the required form, click the Purchase now button. Select your preferred payment plan and provide your information to register for an account.

- Step 5. Complete the transaction process. You can use your credit card or PayPal account for payment.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, edit, print, or sign the West Virginia Sample Letter for Notice of Charge Account Credit Limit Increase.

Form popularity

FAQ

Respected Sir/Madam, I like to state that my name is (Name) and, I hold a (name of credit card) credit card with your bank having credit card number (credit card number). I am writing this letter to ask you to kindly increase the limit of my credit card.

I am writing to request an increase of $5,000.00 in my credit limit with Doe. My current limit is insufficient to cover my monthly purchases at your firm. As you know, my credit history with you is spotless. I have always made payments on time, so I do not anticipate problems handling the increased limit.

Respected Sir/ Madam, My name is (Name) and I do hold a cash credit limit in your branch i.e. (Branch Name) bearing account number (Account number). I look forward to your kind and quick support. In case of any queries, you may contact me at (Contact number).

How to Raise Your Credit LimitPay your bills on time.Ask the card company to raise your credit limit.Apply for a new card with a higher limit.Balance transfer.Roll two cards into one.Increase your income.Wait for an Automatic Credit Limit Increase.Increase your Security Deposit.

An automatic credit limit increase is a sign of a consistent payment history. If you've also kept your debt balances low in addition to making on-time payments, then you may have seen your credit score improve over time.

Creditors will review your credit, income and payment history on a regular basis moving forward. If they feel you can afford an increase and refrain from abusing the added spending power, they may automatically grant a credit limit increase without you asking.

It's often automatic, and you may not be notified that it's happening. But it'll improve your credit score as long as all other factors remain the same. That means you shouldn't start spending more or otherwise change your payment habits.

Use Your Card Responsibly Have higher than average credit scores. Make at least the minimum payment every month. Pay on time (or early) every month. Keep their account open for at least six months or preferably much longer.

Increasing your credit limit can lower credit utilization, potentially boosting your credit score. A credit score is an important metric lenders use to determine a borrower's ability to repay. A higher credit limit can also be an efficient way to make large purchases and provide a source of emergency funds.