The articles of amendment shall be executed by the corporation by an officer of the corporation.

West Virginia Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation

Description

How to fill out Articles Of Amendment To The Articles Of Incorporation Of Church Non-Profit Corporation?

Are you in a situation where you frequently require documents for either organizational or particular purposes? There are numerous legitimate document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of form templates, including the West Virginia Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation, which are designed to meet both federal and state criteria.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the West Virginia Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation template.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents list. You can download an additional copy of the West Virginia Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation whenever necessary; just click on the relevant form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service offers correctly drafted legal document templates for various purposes. Create an account on US Legal Forms and start making your life a bit simpler.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Choose the form you need and ensure it corresponds to the correct area/state.

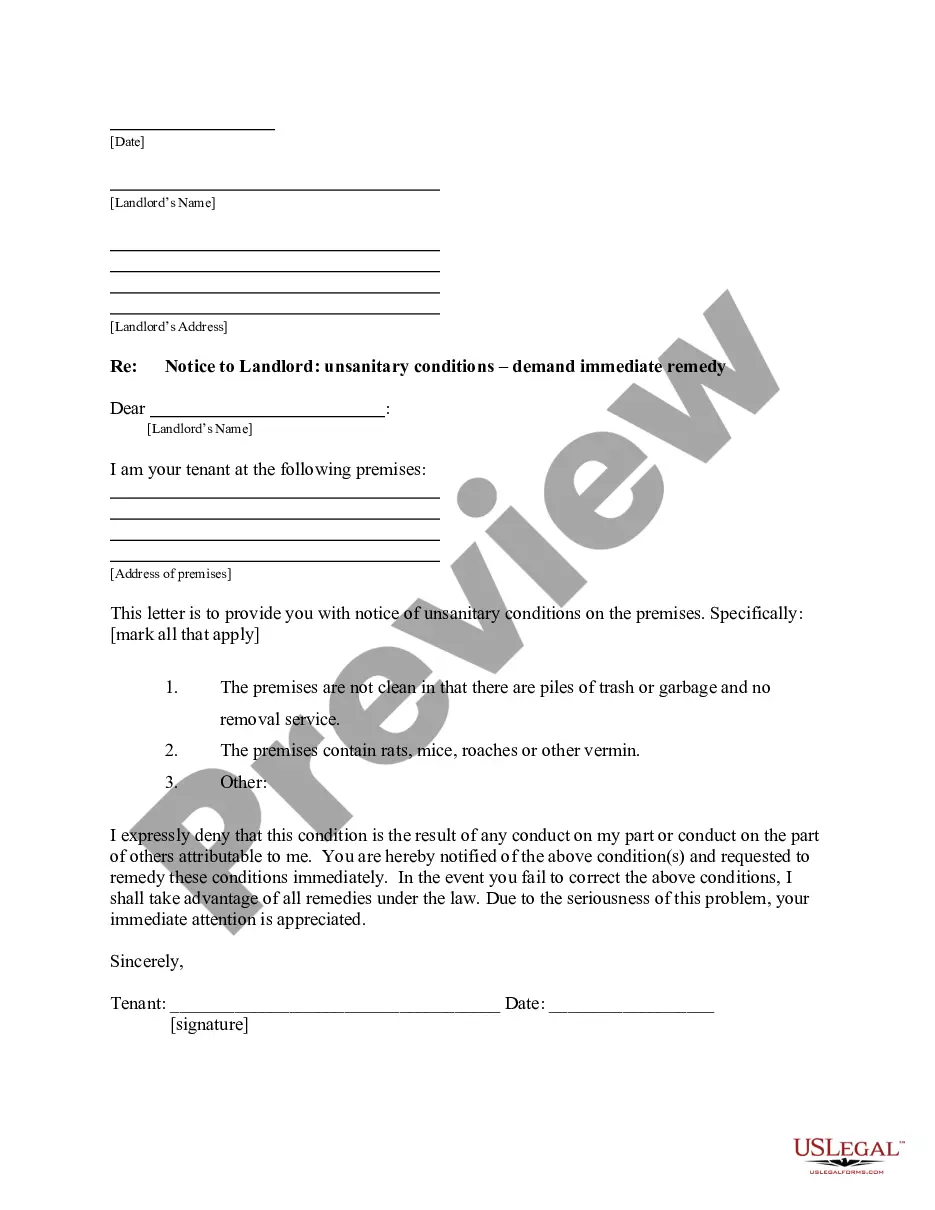

- Use the Review button to examine the form.

- Read the summary to confirm you have selected the correct form.

- If the form isn't what you're looking for, utilize the Search field to find the form that meets your requirements.

- Once you locate the appropriate form, click Buy now.

- Select the pricing plan you want, provide the required information to create your account, and complete the order using your PayPal or credit card.

Form popularity

FAQ

Filling out the certificate of amendment to the articles of organization for your West Virginia Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation involves several steps. First, gather your original articles of incorporation and ensure you have the correct amendment information ready. Carefully fill in the required fields on the certificate, double-check your details, and prepare to submit it as per state regulations. If you're unsure, consider using platforms like US Legal Forms to guide you through the process.

Articles of Amendment are filed when your business needs to add to, change or otherwise update the information you originally provided in your Articles of Incorporation or Articles of Organization.

Changing articles of incorporation often means changing things like agent names, the businesses operating name, addresses, and stock information. The most common reason that businesses change the articles of incorporation is to change members' information.

Depending on the state in which the business is incorporated, unanimous agreement from all the shareholders may be required to change the articles of incorporation. Most states have changed this older, common law rule, and now only require a majority of shareholders to agree to change the articles of incorporation.

Furthermore, the names of the incorporators, the first set of directors and subscribers, the initial treasurer, their original subscription and the place and date of execution of the first Articles of Incorporation cannot be amended.

Amendment of Articles of Incorporation. The amendments shall take effect upon their approval by the Securities and Exchange Commission or from the date of filing with the said Commission if not acted upon within six (6) months from the date of filing for a cause not attributable to the corporation.

How to Incorporate in West VirginiaForm CD-1: West Virginia Articles of Incorporation.Bylaws.IRS Form SS-4: Obtain an EIN.Form 2553: S-Corp Election, if desired.Form WV/BUS-APP: West Virginia Office of Business Registration.

Any corporation may for legitimate corporate purpose or purposes amend its articles of incorporation by a majority vote of its board of directors or trustees and the vote or written assent of two-thirds of its members if it be a non-stock corporation, or if it be a stock corporation, by the vote or written assent of

Articles of Amendment are filed when your business needs to add to, change or otherwise update the information you originally provided in your Articles of Incorporation or Articles of Organization.

Use Virginia Form SCC710N, Articles of Amendment Changing the Name of a Virginia Stock Corporation by Unanimous Consent of the Shareholders. Complete and file this form strictly for amending the name of your Virginia Corporation. File it by mail or in person.