The West Virginia Revenue Sharing Agreement is a legal arrangement that governs the distribution of income derived from the licensing and customization of software within the state. This agreement outlines the sharing mechanism for revenue generated through software licensing and custom modification activities, ensuring fair distribution among parties involved. Under the West Virginia Revenue Sharing Agreement, two main types can be identified: 1. Standard Revenue Sharing Agreement: This type of agreement is commonly used when multiple parties collaborate in the development and licensing of software. It establishes the terms and conditions for revenue allocation based on predetermined percentages or other agreed-upon factors. The parties involved, including software developers, customizers, and licensors, negotiate the terms to determine how income will be shared. 2. Customized Revenue Sharing Agreement: This type of agreement is tailored to specific circumstances, often seen in situations where a company or organization licenses pre-existing software and seeks custom modifications to meet their unique requirements. The customized agreement outlines the revenue-sharing arrangements for the licensing of the original software as well as any subsequent income generated through customization services. Key elements commonly addressed within the West Virginia Revenue Sharing Agreement include: 1. Definitions: This section establishes the key terms used throughout the agreement, such as "software," "licensing," "customization," and "revenue." Clear definitions ensure a common understanding among parties involved. 2. Revenue Allocation: This specifies how revenue will be distributed among the participating parties. This can be a fixed percentage, a tiered structure, or based on specific sales or usage metrics. 3. Reporting and Timelines: The agreement sets out the frequency and method for reporting revenue, typically requiring regular statements to track income generated from software licensing and customization activities. 4. Payment Mechanism: This section explains how revenue will be paid to the respective parties, including details such as payment frequency, method (e.g., wire transfer, checks), and any applicable transaction fees. 5. Intellectual Property Rights: The agreement defines ownership and rights associated with the software, ensuring clarity regarding licensed software, customized modifications, and any intellectual property developed throughout the process. 6. Termination and Dispute Resolution: This addresses the conditions under which the agreement can be terminated, as well as the mechanism to resolve any disputes that may arise during its implementation. By establishing a West Virginia Revenue Sharing Agreement specific to income from software licensing and custom modification, all parties involved can have a clear understanding of their rights, responsibilities, and how revenue will be shared.

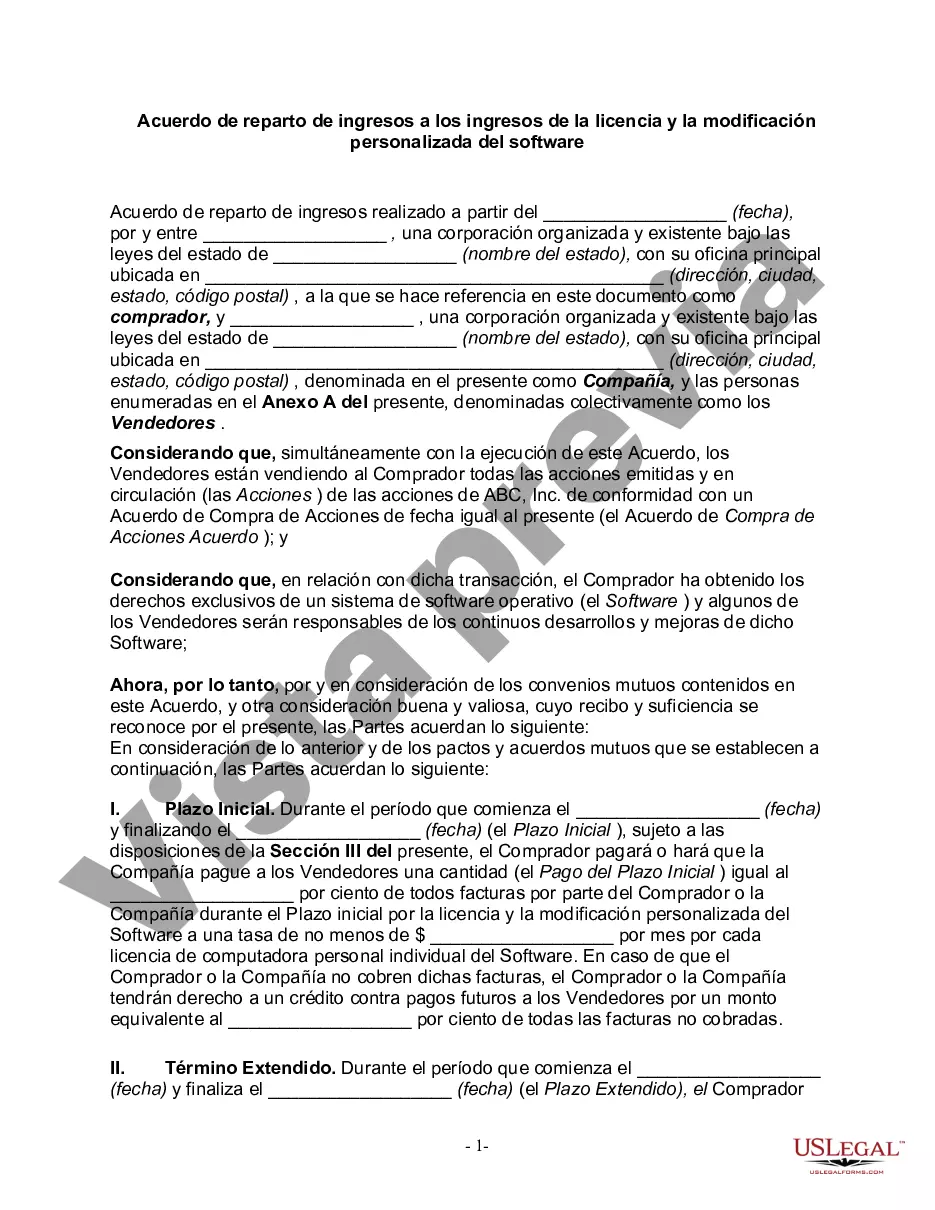

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Acuerdo de reparto de ingresos a los ingresos de la licencia y la modificación personalizada del software - Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software

Description

How to fill out West Virginia Acuerdo De Reparto De Ingresos A Los Ingresos De La Licencia Y La Modificación Personalizada Del Software?

If you want to comprehensive, down load, or printing legal file templates, use US Legal Forms, the greatest collection of legal varieties, which can be found on-line. Utilize the site`s basic and handy research to get the files you want. Different templates for company and personal reasons are sorted by types and claims, or keywords and phrases. Use US Legal Forms to get the West Virginia Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software in a number of click throughs.

If you are presently a US Legal Forms consumer, log in to the account and click the Down load option to get the West Virginia Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software. You can also accessibility varieties you previously acquired from the My Forms tab of your respective account.

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape to the right area/nation.

- Step 2. Take advantage of the Review choice to look through the form`s articles. Never forget about to read the information.

- Step 3. If you are not satisfied with all the type, utilize the Look for area towards the top of the monitor to discover other types from the legal type web template.

- Step 4. Once you have discovered the shape you want, go through the Acquire now option. Opt for the costs strategy you like and add your accreditations to register on an account.

- Step 5. Approach the deal. You can use your credit card or PayPal account to finish the deal.

- Step 6. Pick the formatting from the legal type and down load it on the product.

- Step 7. Full, revise and printing or indicator the West Virginia Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software.

Every single legal file web template you get is yours forever. You may have acces to each and every type you acquired within your acccount. Click on the My Forms section and select a type to printing or down load once more.

Contend and down load, and printing the West Virginia Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software with US Legal Forms. There are thousands of specialist and express-certain varieties you may use to your company or personal requires.