West Virginia Pot Testamentary Trust is a legal arrangement established in West Virginia, specifically for individuals who wish to ensure that their assets — including any lawful investments, marijuana-related businesses, or profits derived from the cannabis industry — are managed and distributed according to their wishes after their death. This type of trust is of particular significance in West Virginia due to the state's regulations around cannabis cultivation, sale, and consumption. Keywords: West Virginia, Pot Testamentary Trust, assets, marijuana-related businesses, cannabis industry, regulations. There are several types of West Virginia Pot Testamentary Trust, each serving a specific purpose: 1. Revocable West Virginia Pot Testamentary Trust: This type of trust allows the granter (the person establishing the trust) to make changes or revoke the trust during their lifetime. It provides flexibility and control, enabling adjustments in beneficiaries, distribution terms, or asset allocation related to the marijuana industry. 2. Irrevocable West Virginia Pot Testamentary Trust: In this trust, the granter relinquishes control over the trust assets and terms, usually for tax or asset protection purposes. Once established, the granter cannot modify or revoke the trust. It ensures that the assets associated with the cannabis industry are managed and distributed according to the granter's wishes without any interference. 3. Special Needs West Virginia Pot Testamentary Trust: This type of trust is tailored to protect the interests of beneficiaries with special needs or disabilities. It allows for the ongoing financial support of such beneficiaries while preserving their eligibility for government benefits. The trust assets, including those derived from the marijuana industry, are managed by a trustee for the beneficiary's benefit. 4. Charitable West Virginia Pot Testamentary Trust: A charitable trust is established to benefit one or more charitable organizations or causes. As the granter, you can direct a portion or the entirety of the trust's assets to support charitable activities or initiatives related to the marijuana industry, such as funding research, educational programs, or advocacy efforts. 5. Generation-Skipping West Virginia Pot Testamentary Trust: This specialized trust allows you to pass on assets associated with the cannabis industry to your grandchildren or subsequent generations, bypassing your immediate children as beneficiaries. It can help minimize estate taxes and provide long-term financial support for future generations involved in the marijuana sector. By establishing a West Virginia Pot Testamentary Trust, individuals can have peace of mind knowing that their assets related to the cannabis industry will be managed, protected, and distributed in accordance with their desires, whether that involves supporting loved ones, causes, or future generations. Keywords: Revocable trust, Irrevocable trust, Special needs trust, Charitable trust, Generation-skipping trust, West Virginia Pot Testamentary Trust.

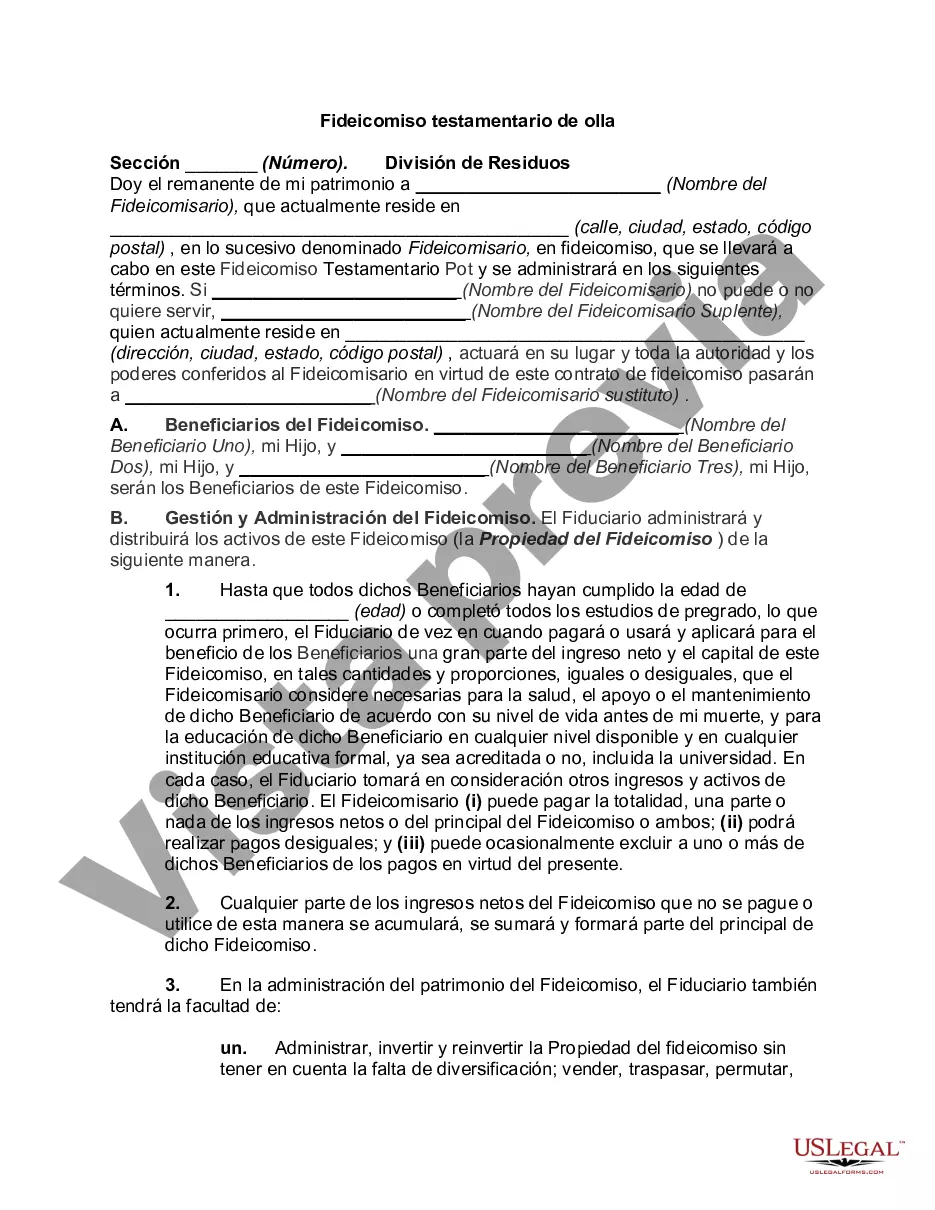

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Fideicomiso testamentario de olla - Pot Testamentary Trust

Description

How to fill out West Virginia Fideicomiso Testamentario De Olla?

US Legal Forms - one of many largest libraries of lawful forms in America - gives a wide range of lawful papers layouts it is possible to download or produce. Making use of the website, you may get 1000s of forms for company and personal uses, categorized by categories, says, or key phrases.You can find the latest versions of forms such as the West Virginia Pot Testamentary Trust within minutes.

If you already possess a registration, log in and download West Virginia Pot Testamentary Trust from the US Legal Forms library. The Acquire switch will show up on every single type you look at. You have access to all earlier delivered electronically forms from the My Forms tab of the profile.

In order to use US Legal Forms the very first time, here are simple guidelines to obtain began:

- Be sure to have picked the proper type for your town/area. Click the Preview switch to analyze the form`s articles. Read the type outline to ensure that you have selected the right type.

- If the type doesn`t fit your requirements, make use of the Search area near the top of the display to obtain the one that does.

- If you are happy with the form, confirm your choice by simply clicking the Purchase now switch. Then, opt for the costs prepare you like and supply your credentials to sign up to have an profile.

- Method the purchase. Utilize your bank card or PayPal profile to accomplish the purchase.

- Pick the file format and download the form in your system.

- Make modifications. Fill out, change and produce and signal the delivered electronically West Virginia Pot Testamentary Trust.

Each template you included in your bank account does not have an expiry day and it is your own forever. So, if you wish to download or produce an additional version, just go to the My Forms portion and click on on the type you will need.

Obtain access to the West Virginia Pot Testamentary Trust with US Legal Forms, by far the most considerable library of lawful papers layouts. Use 1000s of professional and state-certain layouts that meet your company or personal requires and requirements.