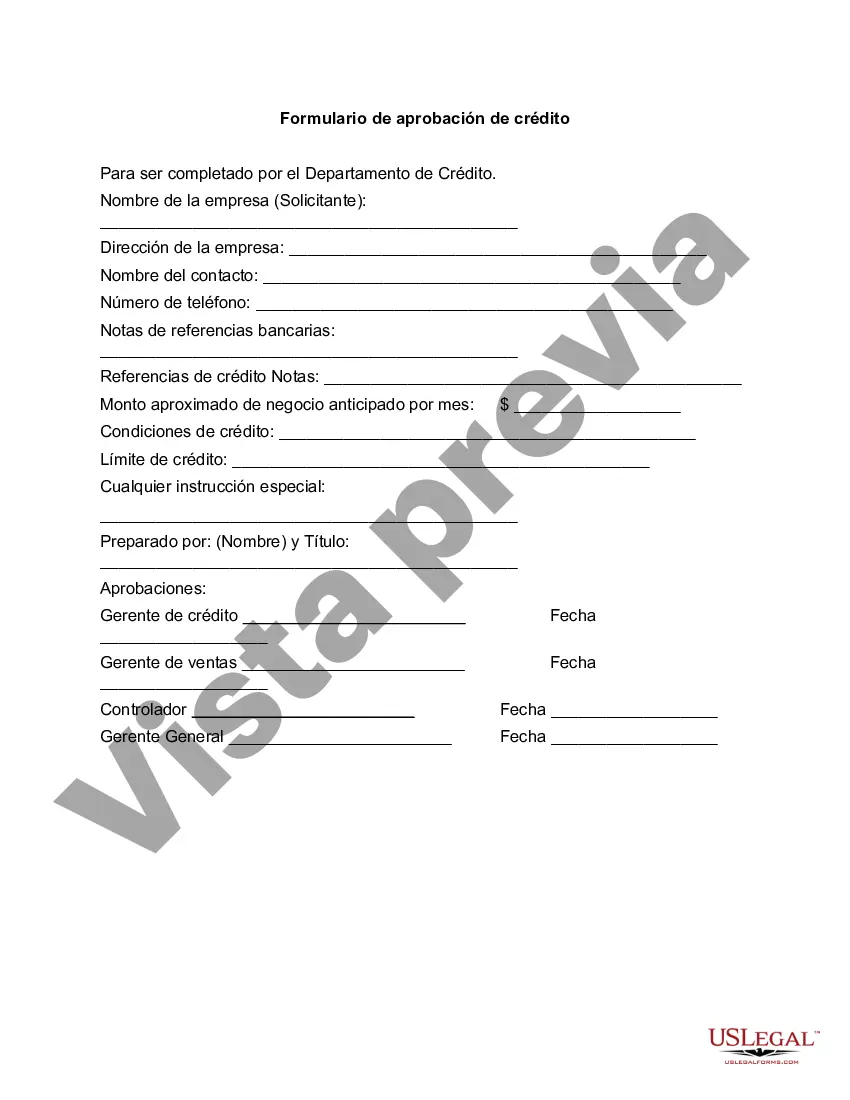

The West Virginia Credit Approval Form is a document utilized in the state of West Virginia to assess an individual's creditworthiness for various purposes such as obtaining loans, credit cards, or other credit-related matters. This form plays a crucial role in determining whether an individual qualifies for credit and helps lenders make informed decisions regarding granting or denying credit requests. Some relevant keywords associated with the West Virginia Credit Approval Form include: 1. Credit Assessment: This form assists in evaluating an individual's financial standing by considering factors such as income, employment history, outstanding debts, and credit history. 2. Loan Application: The form is often required when applying for loans from banks, credit unions, or other lending institutions within West Virginia. 3. Credit Card Application: Some credit card providers may require applicants to complete the West Virginia Credit Approval Form to assess their creditworthiness before issuing a credit card. 4. Financial Stability: The form helps lenders determine whether an individual has the financial stability and ability to repay the credit they are seeking. 5. Credit Worthiness: This document enables lenders to gauge an individual's creditworthiness, considering their credit score, payment history, and existing credit obligations. 6. Borrower Information: The form typically requests personal details of the applicant, including their name, address, contact information, Social Security number, and employment details. 7. Co-Signer: In some instances, the West Virginia Credit Approval Form may offer the option for a co-signer to guarantee the repayment of the credit in case the primary borrower defaults. 8. Revolving Credit: The form may also cater to applications for revolving credit, such as credit lines or credit accounts with flexible spending limits. 9. Mortgage Application: For individuals seeking mortgage loans in West Virginia, this form may cover aspects relevant to home financing applications. 10. Credit Limit: If the credit approval is granted, the form may specify the approved credit limit, allowing the borrower to understand their borrowing capacity. It is worth noting that while the core purpose and structure of the West Virginia Credit Approval Form remain consistent, there may be slight variations depending on the specific credit type or lender requirements. Therefore, individuals should always refer to the specific form provided by their chosen lender or credit issuer.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Virginia Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out West Virginia Formulario De Aprobación De Crédito?

Are you presently within a placement where you require paperwork for either enterprise or personal functions almost every time? There are a lot of lawful papers templates available online, but discovering ones you can rely on isn`t effortless. US Legal Forms gives a huge number of develop templates, like the West Virginia Credit Approval Form, that are published to fulfill state and federal needs.

When you are presently acquainted with US Legal Forms website and have an account, basically log in. Next, it is possible to download the West Virginia Credit Approval Form design.

Should you not offer an profile and would like to begin using US Legal Forms, abide by these steps:

- Obtain the develop you need and ensure it is for your right metropolis/region.

- Use the Review key to check the shape.

- Browse the description to ensure that you have chosen the appropriate develop.

- When the develop isn`t what you`re trying to find, take advantage of the Lookup field to obtain the develop that meets your requirements and needs.

- When you find the right develop, just click Acquire now.

- Opt for the prices strategy you need, complete the required info to generate your money, and buy your order making use of your PayPal or bank card.

- Choose a hassle-free document structure and download your duplicate.

Get each of the papers templates you possess purchased in the My Forms food list. You can aquire a further duplicate of West Virginia Credit Approval Form at any time, if needed. Just go through the required develop to download or produce the papers design.

Use US Legal Forms, one of the most considerable selection of lawful types, in order to save time and avoid errors. The service gives expertly made lawful papers templates that you can use for a selection of functions. Make an account on US Legal Forms and begin generating your daily life a little easier.